Table of Contents

Occupancy Tax Collection and Remittance in the State of New Jersey

As of October 1, 2018, New Jersey has applied Sales Tax and the State Occupancy Fee on charges associated with the rental of transient accommodations. In practice, what this means that landlords who rent out rooms transiently on online marketplaces for less than 90 days owe taxes.

In the original bill, it was worded such that landlords who rent directly (either on their own or with the aide of referral marketplaces/websites) were subject to the tax. Also, if you rented the property through a licensed realtor, you were also exempt from the tax.

A subsequent follow up bill was passed in 2019 (A4814) that repealed the tax on landlords who rent properties on their own (outside of online marketplaces). The exemption only applies if you rent 1 or 2 homes.

These are the exceptions that may apply to you:

- The rental period is 90 days or more.

- The rental was obtained through a licensed Realtor.

- The landlord rents 1 or 2 properties.

A detailed document describing all the state rules can be found here.

Statewide Tax Rate

The following taxes need to be collected. These two taxes are consistent with what hotels are charged as well.

- Occupancy Fee: 5%

- Sales Tax: 6.625%

- Total: 11.625%

In almost all cases, the two taxes above apply. The law allows some municipalities to modify the state rates.

City Special Rates

The state legislation provides the ability of some local municipalities to charge their own transient taxes. Municipalities may amend or adopt an ordinance to impose the following additional taxes on charges for transient accommodations:

- Municipal Occupancy Tax, Sports and Entertainment Facility Tax (Millville)

- Atlantic City Luxury Tax (Atlantic City)

- Atlantic City Promotion Fee (Atlantic City)

- Cape May County Tourism Tax and Assessment (Cape May County)

- Hotel Occupancy Tax (Elizabeth, Newark, and Jersey City).

If you property is located among the jurisdictions mentioned above, then local taxes could be coming your way in the future. As of March 2019, only one municipality has moved to amend their own ordinances (Elizabeth). This is the jurisdiction that has adopted their own accommodations taxes.

Elizabeth – Special Tax Rate

The following taxes need to be collected according to these rates.

- State Occupancy Fee – 1%

- Sales Tax – 6.625%

- Elizabeth Occupancy Tax – 6%

- Total: 13.625%

As a result of charging its own occupancy tax, the state occupancy tax rate gets reduced to 1%. The effect of this ordinance is that the tax rate for Elizabeth is 2% higher than the rest of the state.

Do I Need To Pay?

Most landlords are not required to pay the tax unless they rent more than 2 properties. Also, rentals obtained from a licensed real estate agent are exempt. If you use any online service that charges payments on your behalf you are good. These companies are required to charge and submit the payments on your behalf. These services include companies such as Airbnb and Booking.com.

Exempt Rental Activity – Do not submit taxes

Licensed Real Estate AgentAirbnb/VRBOBooking.comOther sites that charge guest on your behalfLandlord rents directly or by referral

The most common reason why you would need to file and pay the taxes is if you rent more than 2 properties.

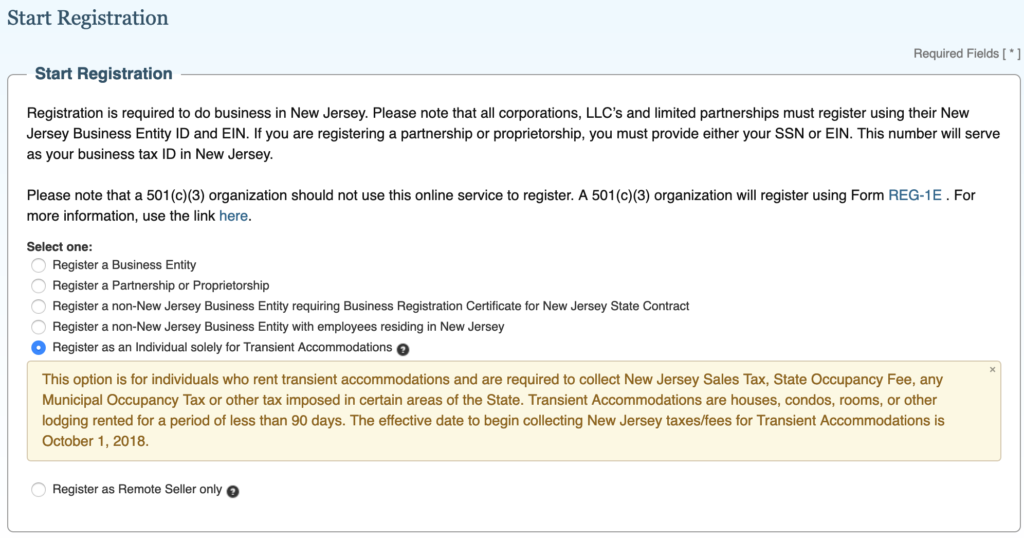

How Do I Register My Property?

You can register your property at the New Jersey state website that provides for business registration. Note that even if your local municipality has chosen to charge its own taxes (as mentioned above), you would still send the money to the state. The state takes care of the distribution of the money to the city on your behalf. This is more convenient than other states that may require county or city level registration.

Use the link below:

State of New Jersey Business Registration

Also, good news you don’t actually need to have a partnership, LLC or other business entity to use this site. There is an entry specifically designated for homeowners as listed show here.

How Do I Pay?

There is a state website where you can submit your payments:

Hotel and Motel State Tax Login

Before you can submit your payments, register your property as explained above. The state will provide paperwork to you that confirms your registration along with an account PIN.