In this article we discuss all you need to know about filing tax forms on behalf of contractors you pay that provide services to your vacation rental business.

There is a table of contents below here that provides a quick link to any subject area where you need help.

An update worth noting:

For contractor income it is best to use 1099-NEC instead of 1099-MISC. The 1099-NEC is new for tax filing year 2020. If you paid contractors previously using 1099-MISC, we suggest moving to the new 1099-NEC. The 1099-NEC makes your filing very specific about the type of payment (in this case, contractor income or other service income you paid). Otherwise, the forms are essentially similar except for the types of payments where each apply.

To file using form 1099-NEC, use this link:

https://www.vacationlord.com/how-to-file-form-1099-nec-for-contractors-you-employ/

Table of Contents

First, Do I Need to File Form For My Contractor?

The very first decision to make is to decide if you need to file tax forms for any of the contractors you employ. The answer depends upon the amount and frequency of service the contractor provides. Here are some simple tests to decide if you need to file forms:

- You paid more than $600 of wages to a contractor in a single year.

- The payments you made were made to a person and not a company.

- The payments were for services the person provided, labor not equipment or supplies.

Let’s go through these in more detail.

The minimum amount required to file the form is $600/year. If you paid more than $2,200/year, be sure to file the form. There is a key reason why $2,200 is important, as a sort of magic number. At this income level, the IRS expects that Social Security and Medicare (so called FICA) taxes to be paid. When you file the appropriate forms, note that the recipient (and not you, the real estate owner) are responsible for paying these FICA taxes.

The key decision here for these tests is to capture payments made to individuals that work in a capacity using their labor over a time period. If the person who provided service works for a company and payments were made in the company’s name, do not file forms.

Also, don’t consider big service jobs. Let’s say you replaced your HVAC system for $4,000. Even though you the job was more than $600, it is most likely you paid a company not a person. Do not file forms.

The most common example that might come up when renting real estate, is cleaning services. If you paid a person more than $600 per year to clean your property, then it is likely you will need to file forms.

Next, Is My Contractor An Employee?

Many states over time have been cracking down on businesses that employ people as contractors instead of classifying them as employees. The most recent example is the so called California legislation called AB5. Under AB5, there are a set of tests to determine how to classify the worker.

The most important test under AB5 is to ask a simple question: is the worker in the same business as the business that employs her?

If your business is just renting real estate, the answer is most likely no. The IRS has Publication 15 that goes into more detail about how to classify employees.

The contractors you employ for renting real estate will belong into categories such as cleaners, maintenance, property management. For any of these contractors to be classified as your employees, you would need to have a substantial amount of services provided. If your real estate business grow to such an extent, it will become evident.

What Forms To File

If you have gotten this far, then you may have decided that you will need to file the appropriate forms. When you file forms to declare income for your contractors, this becomes a case that is bigger than your own tax return. This is because you need to send your contractor a copy of the 1099-MISC. The contractor will file their copy on their tax return. You will need to file yours on your tax return. So, these two forms need to be completed:

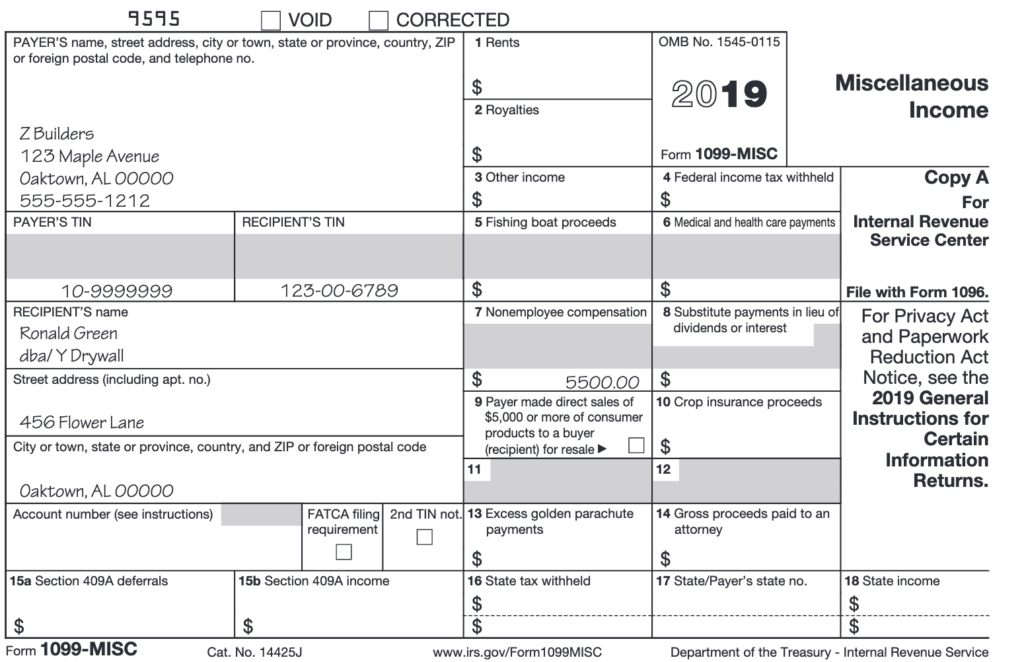

- 1099-MISC, Copy A — Lists Income You Paid to Contractor – File on your return.

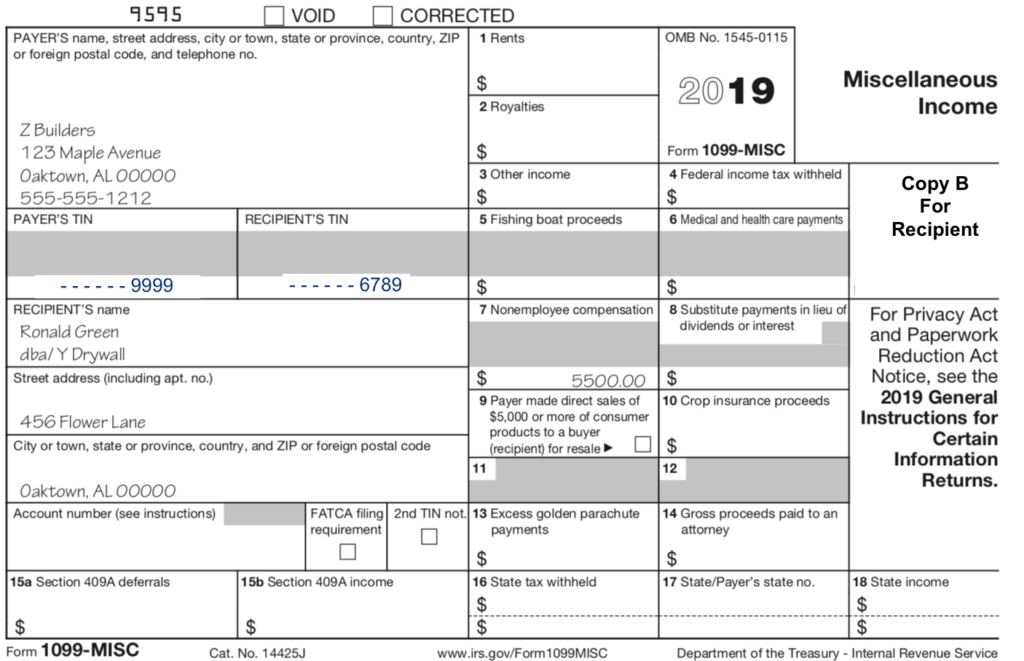

- 1099-MISC, Copy B — Lists Income You Paid to Contractor – Send to Contractor.

Sample Forms Filled Out

The following sample is taken directly from the IRS 1099-MISC Instructions.

Example Contractor:

Z-Builders is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y-Drywall. During the year, Z-Builders pays Mr. Green $5,500. Z-Builders must file Form 1099-MISC because they paid Mr. Green $600 or more in the course of their trade or business, and Mr. Green is not a corporation.

The following is the form that Z-Builders files on their own tax return:

The following is the form that Ronald Green files on his own tax return. Note that the TINs have been obscured to prevent identity theft and maintain privacy. The accepted convention from the IRS is to keep the last four digits of the TIN:

A Few Words About Security/Privacy

When you send out a 1099-MISC to a contractor, it is appropriate to take a few measures to insure that the privacy of the person is kept. A 1099-MISC form has enough information in it that identity theft is a real concern. In order to keep the information secure and private, use the following measures.

- When filling out the form to the recipient, obscure the first 5 digits of the Taxpayer Identification Numbers (TINs). Note in the sample form provided above, this number have been obscured.

- When sending the form, encrypt the file. If you have a PC or Mac, ZIP utilities can add password encryption to your file before you send it. Then, communicate the password to unencrypt the file in a separate communication.

1 Comment

Pingback: How To File Form 1099-NEC For Contractors You Employ - VacationLord