Summary

- Third Party marketers (Airbnb, Homeaway) will likely never send you a 1099-MISC.

- It is your responsibility to self report your income.

- We review how to do this correctly on your tax return.

There are more marketing channels than ever to sell and rent your vacation rental property. There are newer businesses such as Airbnb, FlipKey, and Homeaway, which are apps that manage your listings and market them to a global audience. These new apps work well to get you customers that can fill in those gaps in your schedule that may have been harder to rent.

Before Online Sites Came Into Being

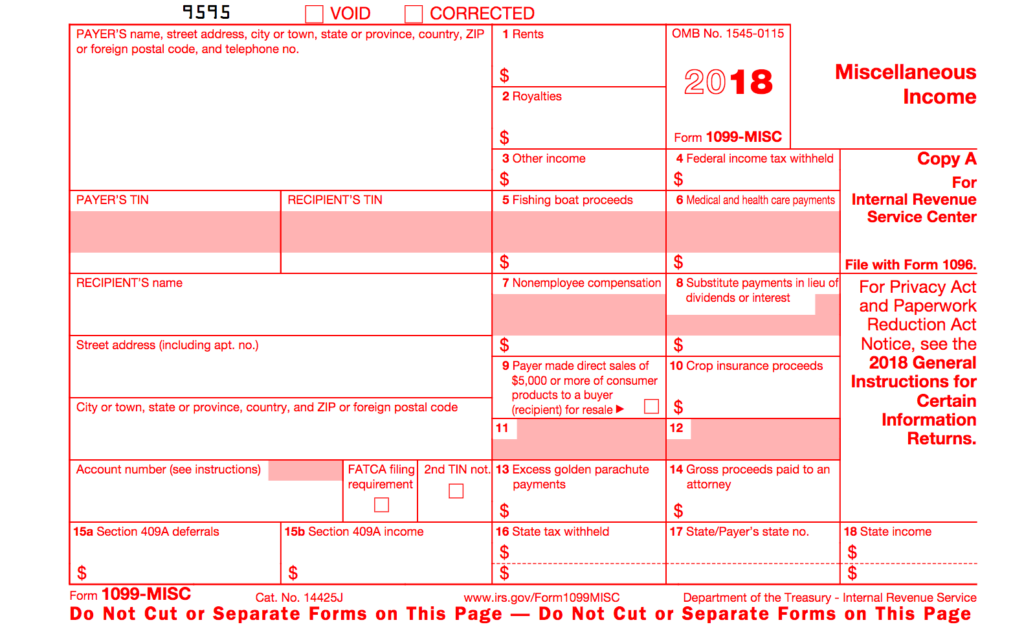

Before all these new marketing choices, there were a few methods you likely used to rent your vacation property. These include self promotion in newspaper/magazine advertisements, a sign on the house with a phone number, or third parties (such as Realtors). When you need to tabulate all your rental income you simply combined all the income your received. The income would come from your own guests plus any income you received from third parties. The third parties very likely sent you a tax form called a 1099-MISC. This form documented all the rent they collected on your behalf. Here is what the form looks like below:

In our experience, it didn’t matter how much or how little rent you collected from third parties, they would send out 1099s at the end of the year.

Why You Won’t Get A 1099

With the advent of newer property marketing technologies that collect rent on your behalf, you may never get a 1099-MISC. The many technology companies that have moved into the rental space are pretty aggressive and early on didn’t issue 1099s for everyone. Even though the regulations on this have been clarified, in most cases you still won’t get a 1099 unless you have enough rental activity.

The federal tax regulation was updated in 2012. Here is the law below:

Beginning in January 2012, payment settlement entities (PSEs) are required by the Housing Assistance Tax Act of 2008 to report on Form 1099-K the following transactions:

- All payments made in settlement of payment card transactions (e.g.,credit card) if:

- Gross payments to a participating payee exceed $20,000.

- There are more than 200 transactions with the participating payee.

The real sticking point here is the 200 transactions requirement. Unless you have more than one property it is unlikely you will ever reach this threshold. So, in the majority of cases, these third party sites will not report your income to the IRS using the standard 1099 forms.

How To Calculate Your Rental Income

The amount of income that is applicable to your tax return is different from the money that actually was put into your pocket. The difference is that your total income for tax return purposes includes the commissions, which must be separately accounted for (even if you never saw the money).

This is very common, third parties who send you 1099-MISC forms report total gross rent (Box 1), which includes the commissions. This makes sense because your guest actually paid the total rent charged which includes any commissions that were deducted by the third party.

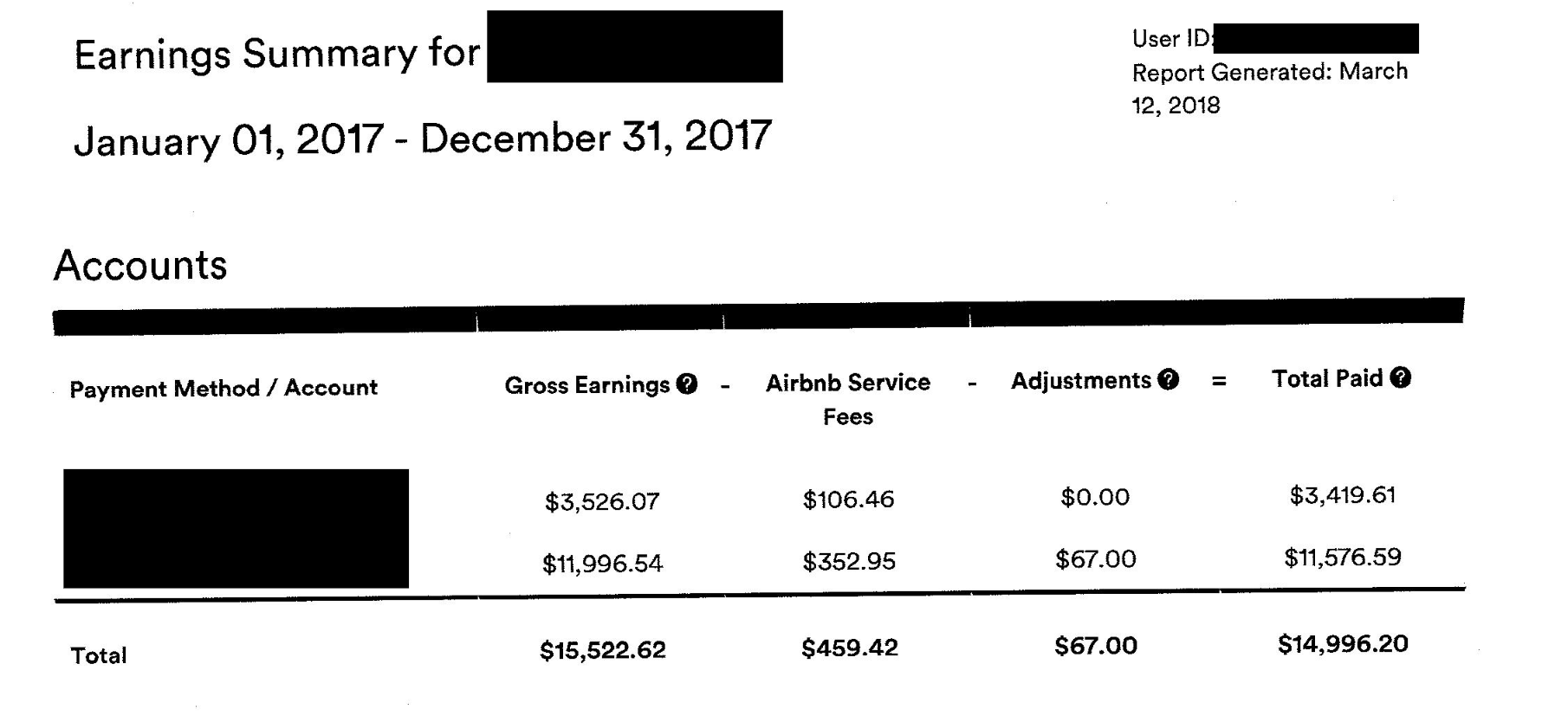

Here is a sample entry from Airbnb:

Using the sample above, the amount that you report on your tax return is the Gross Earnings, which in this case was $15,522. The Service Fees and Adjustments also need to be reported as deductions against income which we will talk about in the next section. The total amount of management fees in this case is $526.

How To Report Gross Income and Commissions

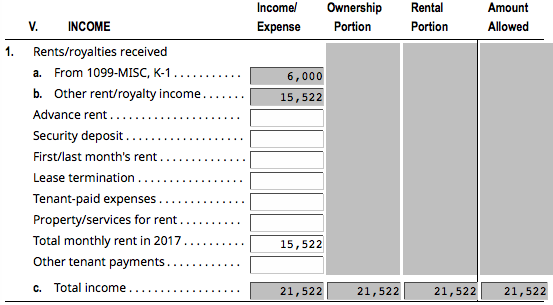

When filing your rental income on your tax return, you would either use the Rental and Royalties worksheet (more common), or if you are running the rental as part of a business, Form 8825. In either case the same method would be used to report the financials. Here is a sample worksheet from the Schedule C, Rentals and Royalties. This uses the Airbnb earnings in the sample above and adds it to other reported earnings that were provided on a 1099-MISC.

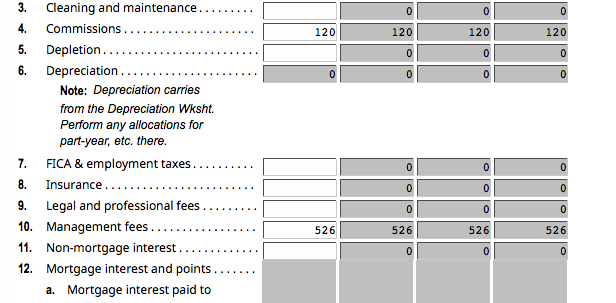

Also on the Airbnb earnings summary were service fees and adjustments. These are to be subtracted as expenses in the next section of the worksheet. Here is how it looks, assuming that the commissions reported on the 1099-MISC were $120.

Summary

When reporting your rental income, the key number you want to focus on is gross rents. If your third party reports your rental income on a 1099, the gross rents number is what will need to match up on your tax return. If you paid any commissions or management fees, these expenses would be itemized further down in the expense itemization worksheet.