Ok, You just decided to rent a room in your personal property. Great! If you are renting the property as a side income you will need to file tax returns. File the property and its financials at the Federal level. You may also need to file at the State/Local level as well.

In this post, we talk about everything you need to assemble to prepare for the tax return. Even if you are seeking the help from a CPA or other tax professional, this guide will be useful. The CPA needs this financial information to prepare your tax return.

If you are looking for specific information use this guide to click your way to the appropriate section. This article is targeted to those filers who are using Schedule E on their U.S Federal tax return.

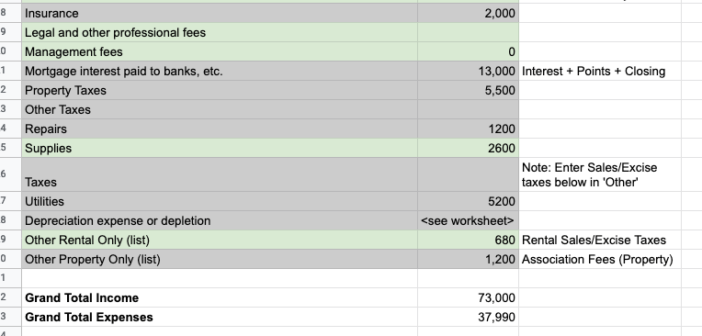

Attached below is the spreadsheet that is used to assemble your income and expenses ahead of time.

Determine Ownership Percentage/Rental Use

Since the property you are renting is a room in a larger property, only a portion of the expenses that are tied to the whole property can be deducted. There are three calculations to determine what the exact portion is.

- Ownership Percentage – the percentage of the home used for room rental.

- Rental Percentage – the percentage of the time the room is rented (versus personal use).

- Rental Use – the percentage of an expense attributable using Ownership Percentage and Rental Percentage.

The table below has all the numbers need to calculate each value.

| Input Value | Amount |

|---|---|

| Total Home Square Footage | 2400 |

| Total Room Square Footage | 480 |

| Total Room Rental Days | 100 |

| Total Room Personal Days | 100 |

| Total Room Days Not Rented and Not Personal | 165 |

Financials From Your Closing Documents

The first place you look for expenses for your new property is in your closing documents. There are many expenses in your closing documents. These will not be provided by anyone else because the companies/entities involved do not know about them.

These expenses appear in your closing document. The reason why? The closing attorney needs to apportion expenses between the seller and the buyer.

The table below provides an example of the types of expenses that may be in your closing documents.

| Closing Cost | Sample Value |

|---|---|

| Property Taxes | $500 |

| Water Utility | $100 |

| Sewer Utility | $100 |

| Association Fees | $200 |

| Prepaid Mortgage Interest | $1,000 |

| Total Expenses | $1,900 |

Property Depreciation

Starting off, you will depreciate the property. Only physical property can be depreciated, not the land. A good rule of thumb to start (for a common residential property) is that the property structures are 75% of the property value. The land is 25% of the value. Another resource is the breakdown given from your property tax assessment. If you are unsure about this breakdown, seek out a CPA that is familiar with your local area.

The form requires an amount referred as Property Basis. Property Basis is total cost for the property which includes more than just the purchase price. Property Basis includes many closing costs such as Title Fees and Attorney Fees.

| Property Basis | $500,000 |

|---|---|

| Land Value | $100,000 |

| Structure Value (depreciate value) | $400,000 |

Vehicle Expenses

If you use a vehicle to travel to maintain your property, report those miles to obtain a travel deduction. The most common case is a personal vehicle that you use for your rental. In this situation, you will need to collect vehicle mileage/tolls. Then, file using the Standard Deduction. Calculate the deduction using a per-mile charge based upon mileage. Use the table below as your guide.

| Vehicle Expense | Sample Value |

|---|---|

| Total Miles Driven | 10,000 |

| Total Rental Miles | 600 |

| Total Personal Miles | 9,400 |

| Tolls | 60 |

| Garage Rent | 100 |

Property Income

Here’s the fun part! Earning income. Gather all the income you have from every source. The table below has sample information that may apply to your situation.

It is not common to pay taxes on your rentals. Third parties, such as marketplaces and realtors, will typically pay these taxes on your behalf. You may need to collect and remit taxes on your own rentals if your jurisdiction requires it.

Be sure to add all your commissions and any adjustments (rent refunds, extra guest payments, etc.).

| Income Source | Gross Payment | Taxes | Commissions/Fees | Adjustments | Take Home |

|---|---|---|---|---|---|

| Airbnb | 10,000 | 1,200 | -200 | 8,600 | |

| Venmo | 1,000 | 40 | 960 | ||

| Paypal | 2,000 | 80 | 60 | 1,860 | |

| Realtor/Manager | 10,000 | 1,000 | 9,000 | ||

| Marketplace Referral | 2,000 | 80 | 1,920 | ||

| Your Property Website | 5,000 | 400 | 150 | 4,450 | |

| Personal Check | 2,000 | 80 | 1,920 | ||

| Total | 32,000 | 680 | 2410 | -200 | 28,710 |

Utilities

Collect all your utilities bills for the year. The table below contains common utilities that you will want to summarize.

| Utility Cost | Sample Value |

|---|---|

| Cable TV | $1,000 |

| Water Utility | $1,000 |

| Sewer Utility | $1,000 |

| Internet Service | $1,000 |

| Total Utilities | $5,000 |

Direct Property Expenses

These are expenses that you incur in the property ownership. Collect all the expenses that quality for your property.

In this example, we include ‘Management Fees’ that are payments to property managers or marketplace referral apps. These payments would reflect fixed payments for property maintenance or fees to book/manage rentals. If you pay commissions by each rental, use the table above in the Income section.

| Property Expense | Sample Value |

|---|---|

| Mortgage Interest (Form 1098) | 10,000 |

| Mortgage Points | 2,000 |

| Property Taxes | 5,000 |

| Fire Insurance | 1,000 |

| Flood Insurance | 1,000 |

| Association Fees | 1,000 |

| Garbage Collection | 1,000 |

| Management Fees | 5,000 |

| Total Property Expense | 26,000 |

Property Maintenance Expenses

Next, collect all the expenses to maintain your property. For easy tabulation categorize into appropriate summaries: Cleaning and Maintenance, Repairs, and Supplies.

| Category | Expense | Sample Value |

|---|---|---|

| Cleaning and Maintenance | Changeover Cleaning | 900 |

| Power-wash Property | 500 | |

| Pest Control | 500 | |

| Weed Control | 500 | |

| HVAC inspection | 300 | |

| Repairs | Water Heater | 400 |

| Repair Deck | 500 | |

| Pave Driveway | 300 | |

| Supplies | Paper Products | 200 |

| Cleaning Products | 100 | |

| Linens | 300 | |

| Furnishings | 2,000 |

Advertising Expenses

Lastly, tabulate all the costs to market your property.

| Advertising Expense | Sample Value |

|---|---|

| Website Hosting | 300 |

| Online Ads | 600 |

| Offline Ads | 500 |

| Email Campaigns | 300 |

| Total | 1,700 |

Summing It All Up

After gathering your expenses, use the attached spreadsheet to put them all together. This spreadsheet organizes all your financial information into a U.S. Federal IRS Schedule E. If you are filing your rental as a business, this format will work well for that purpose as well.

This spreadsheet will work for Microsoft Excel, Google Sheets, and many other programs.

2 Comments

Pingback: File Your Vacation Property Taxes with H&R Block - Renting A Room - VacationLord

Pingback: File Your Vacation Property Taxes with Intuit TurboTax - Renting A Room - VacationLord