In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using TurboTax software.

Do you have an LLC or company registration created for your rental property activity? If the answer is Yes, then you need to use IRS form Schedule C – Profit or Loss From Business instead of Schedule E.

It very well could also be that the rental activity is part of a larger business providing other services/products. We will not cover any other activity but the rental activity in this introductory walk through.

If you prefer a video walk through, check it out below.

In preparing this article, there are few assumptions made to simplify the walk through. It could be the case that your situation has different circumstances. If you need help, please ask in the comments below or contact us directly in the About Us Page.

| Assumptions Made For This Vacation Property * Property is owned/rented 100% throughout the filing year. * You have a company/LLC formed for your activity. * You materially participate in your rental activity. * The owner doesn’t employ any help. |

The following table of contents is a quick guide to the topics discussed in this walk through.

Table of Contents

First Question…Check Your Filing Status

Before you get started, please first check your filing status. Attached below is a document that summarizes the tests for Material Participation. In this walk through we assume that you are filing under Material Participation status.

Here is a quick version to use:

- You managed all the rental activity and did not pay anyone else management fees.

- The activity required 10 or more hours/week of your time.

- You made all the decisions in the maintenance/upkeep of the properties.

Tabulate Your Income/Expenses First

There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property – Schedule C . In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation of expenses and income.

This article is a good start to prepare your tax return for your vacation rental property.

Starting the Software

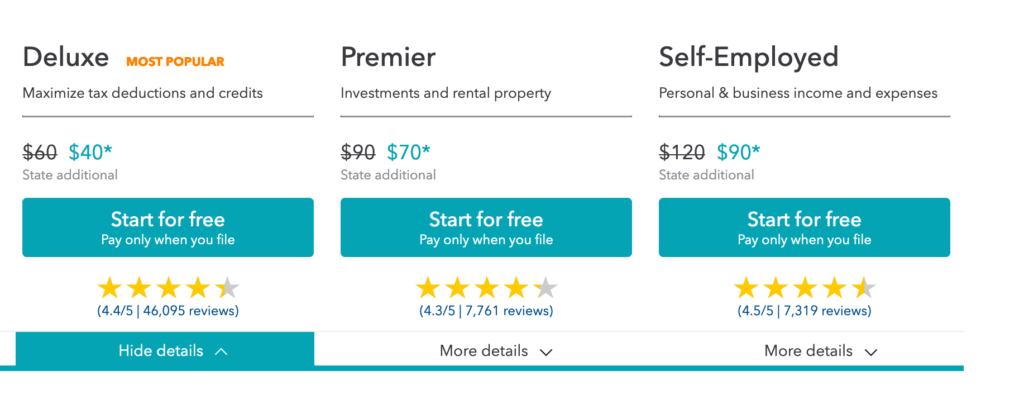

TurboTax has both PC/Mac software installations as well as cloud versions of the same software. In this demo, we are using the Deluxe version. The Deluxe version, while not specifically targeted to real estate investors, is perfectly adequate for the job in a basic situation.

If you are filing under a more complicated situation we recommend upgrading to the ‘Self-Employed’ version as pictured here:

The ‘Self-Employed’ software version would help you in the following situations:

- You are running a larger business where rental activity is only a part.

- You are paying employees on a payroll.

- You are paying many contractors on 1099-MISC or 1099-NEC.

If none of these apply, the deluxe version is adequate, it can be downloaded here. In this article and video, we will discuss the simpler case where none of the above three situations apply.

Where to Start…

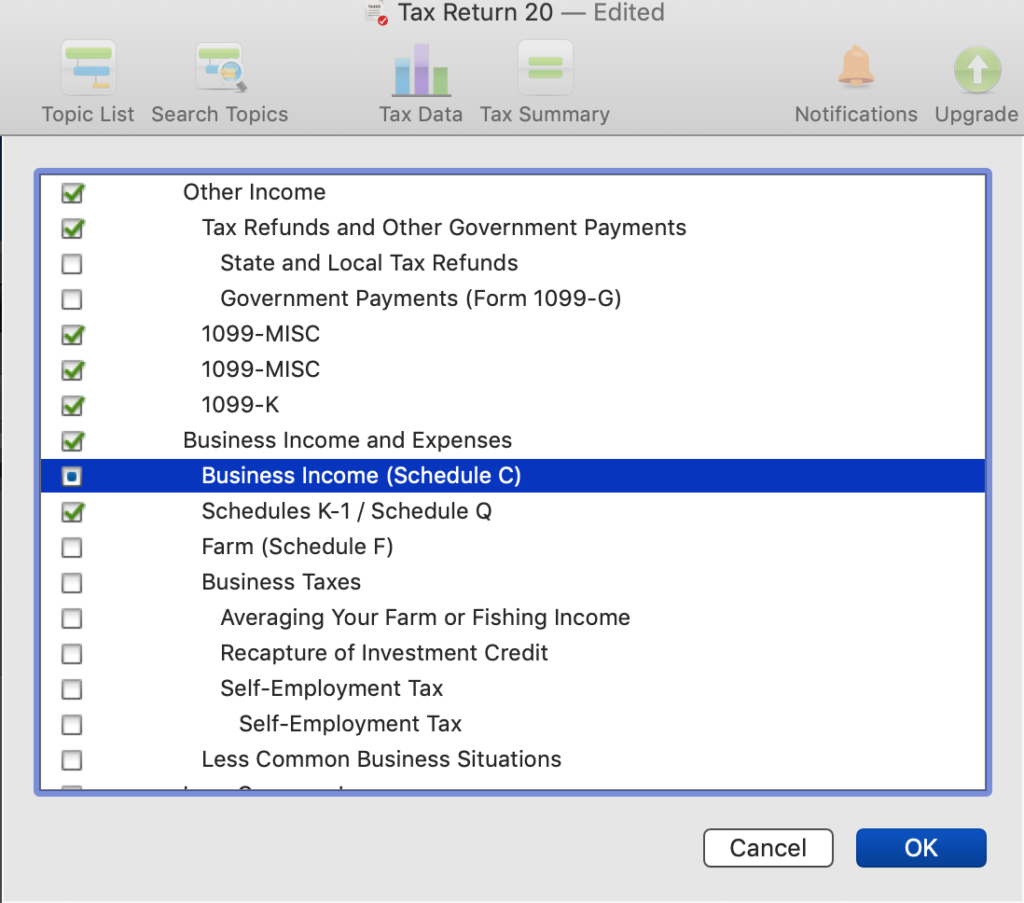

You will want to navigate to the ‘Business Income’ section of the software. At the top, click on ‘Topic List’ and select ‘Business Income (Schedule C)’, hit the ‘OK’ Button.

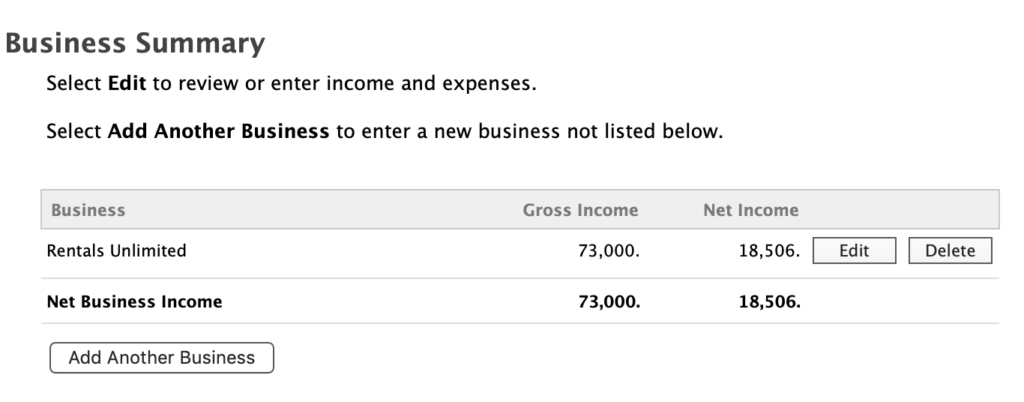

Once on the ‘Business Summary’ page, click ‘Add Business’ or ‘Edit’. You will get a description page for the business. For this walk through, we will discuss a business that makes a profit and also qualifies for the Qualified Business Income deduction.

Enter the business description.

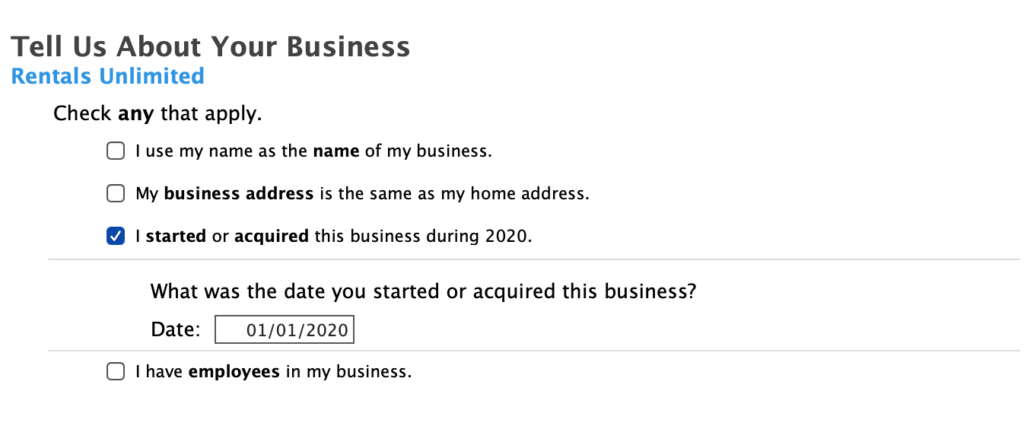

In the next screen enter when you started your business. We will use a 2020 date for this demo. We won’t click the employees checkbox since we assume you do not have any employees.

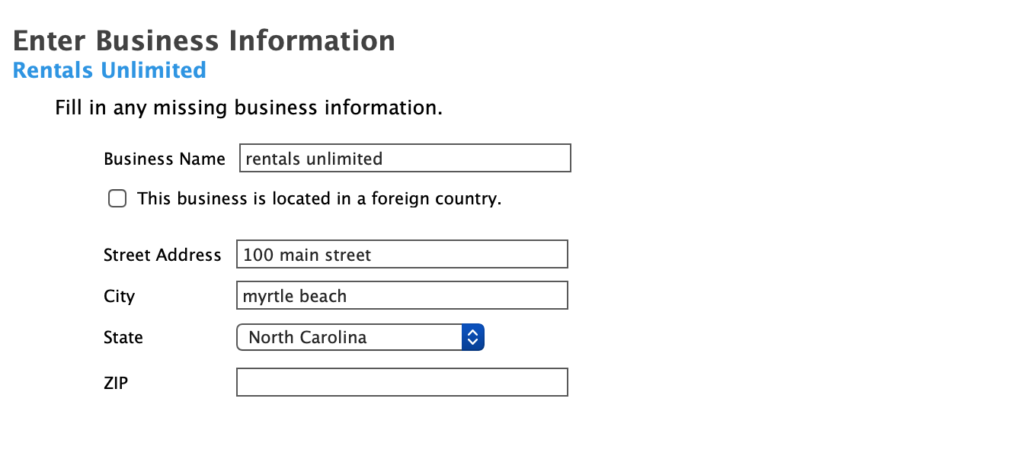

The EIN would be needed if your business has registered with a government, e.g., to pay employees. We assume not here, so leave it blank. In the next screen, enter the business name and location.

Business Details…

Next, you need to specify some business details. Skip the next screen when it asks for employees, by indicating ‘No’.

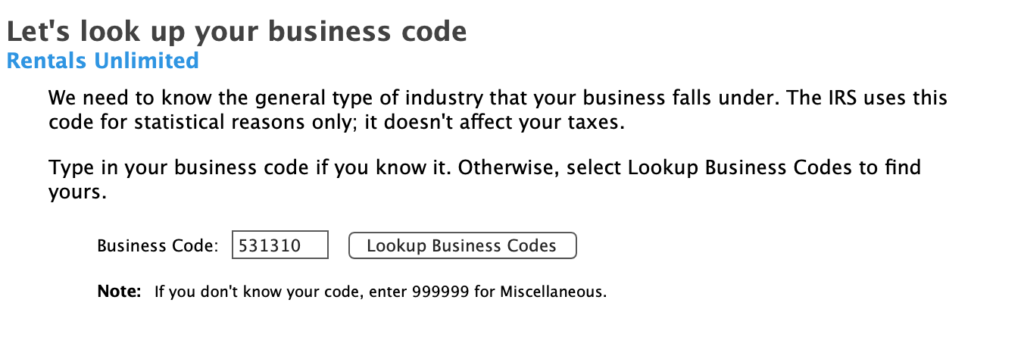

Select ‘Real Estate’ for category and 531310 as the business code in the next screen.

The next screen asks about ‘Cash Accounting Method’, select ‘Yes’. This means that you will declare income/expenses in the year when they occur.

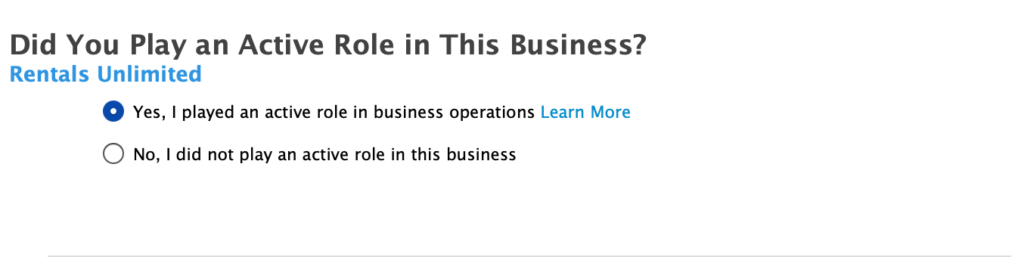

After that selection, select ‘Yes’ in the screen that asks about ‘Active Role in This Business’. This means that you managed all the activity and it is a large business activity during your work hours.

Entering Your Rental Income

In the next screen, we will go thru income/expenses at a detail level, select ‘Enter my business info myself’. In the following screen, you are asked if you need to issue 1099s. This could be true if you paid more than $600 to a contractor. If you say yes here you will need to file 1099s separately. Please see our other videos/articles that talk about how to do this.

The next two screens, covering uncommon situations as well as 1099-NEC income you may receive, say ‘No’. These are uncommon for rental activity.

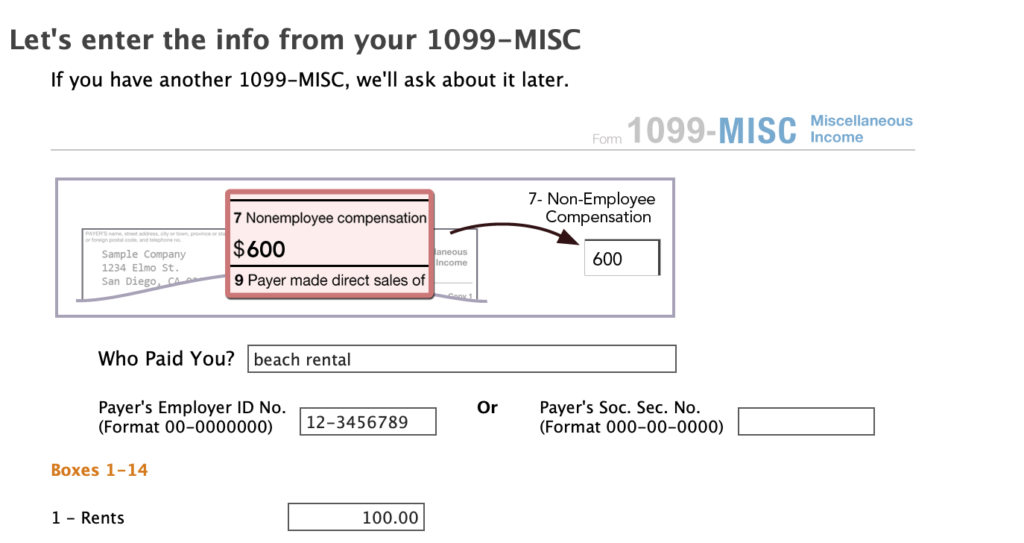

Next, specify rental income. Income is entered in two distinct places. First case, a third party such as a Rental Marketplace sent you a 1099-MISC. In the second case, you earn rental income from everywhere else that wasn’t reported using a 1099-MISC.

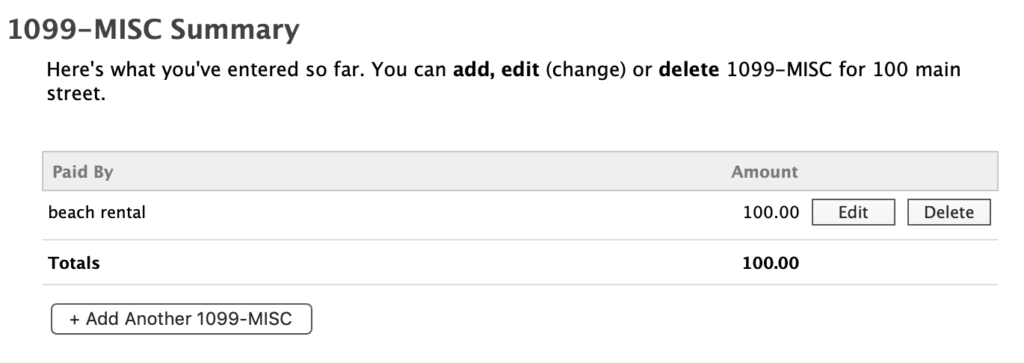

For each 1099-MISC, create an entry in the ‘Miscellaneous Income’ page.

Note that the income reported on these 1099s should come from third parties who book rentals and collect payments on your behalf. You must still manage the rental activity and not have another party do that task. Otherwise, you will not be able to file as business rental activity.

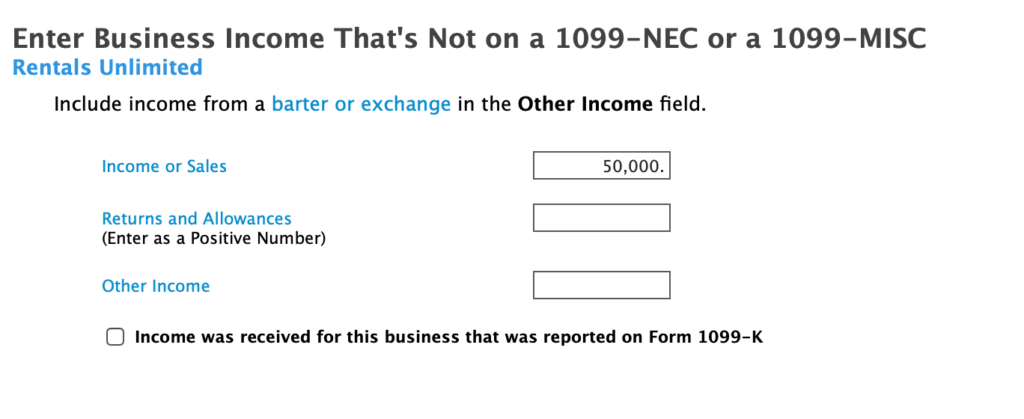

In the next page, enter all other income from every other source. Sum it all up and enter it into the ‘Income or Sales’ box. Note that total income includes all the money collected from guests, including rent, commissions paid and sales/use taxes.

In the next screen, specify ‘None Of The Above’ when asked about ‘Tell Me More About Your Business’. These don’t apply to rental activity.

Business Expense Navigation

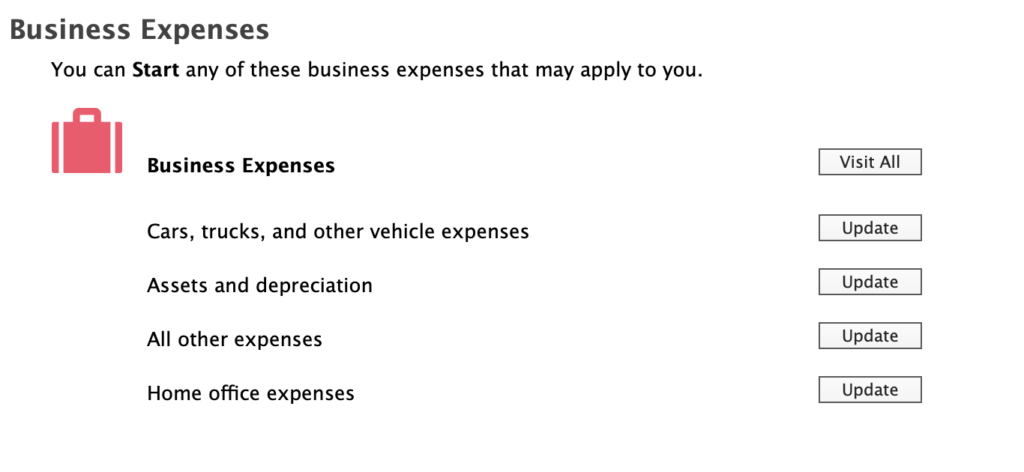

In the next summary screen, navigate to each expense category. Let’s start with the Home Office deduction.

Home Office Expenses

If you use an office for your rental activity you may claim a deduction. The most common case is that you have a room in your house that is used to conduct your business. We will cover the common case and use the simplified deduction available by measuring square footage of the office versus the home.

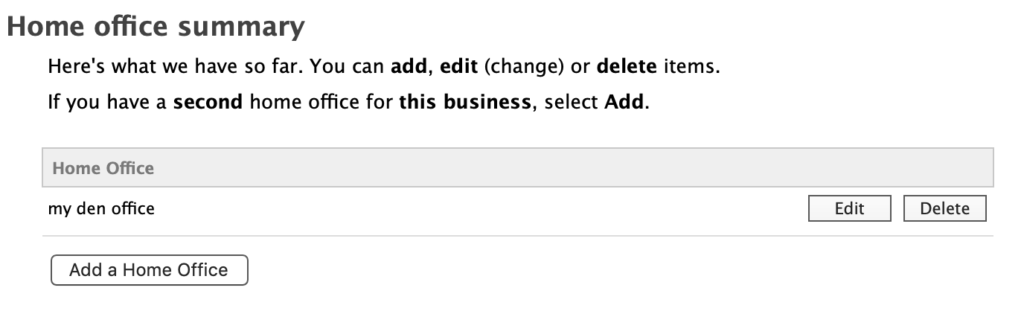

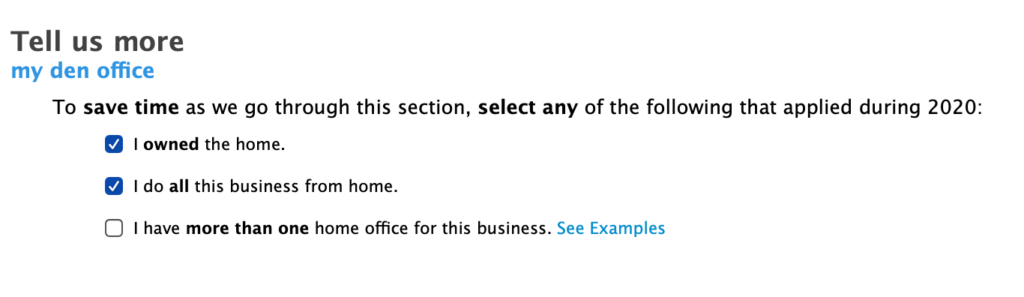

After specifying the office name, confirm these questions.

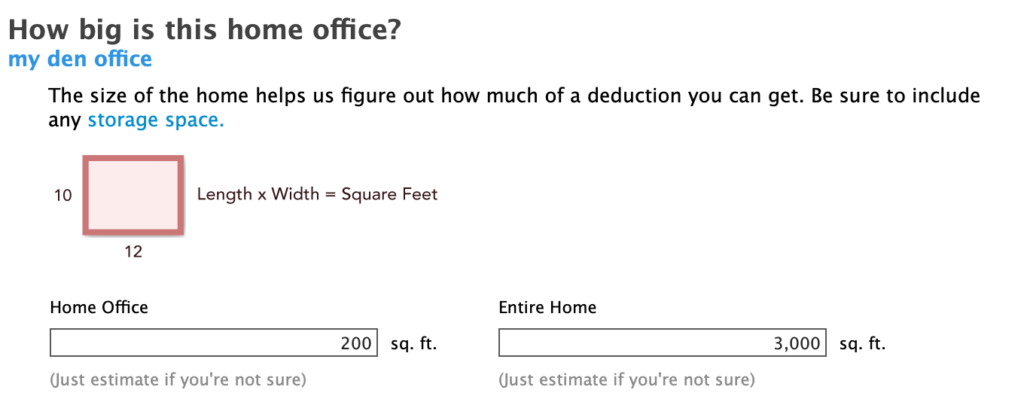

Enter square footage amounts for your home and office.

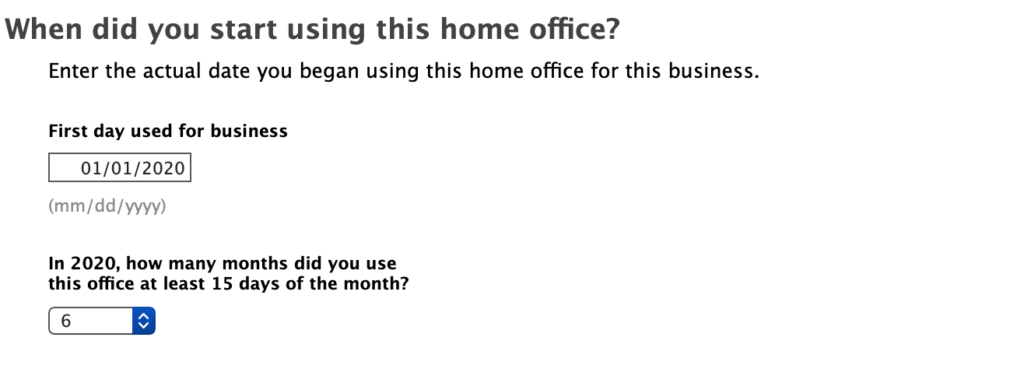

In the next screen enter when first start the use and how many months of the year you need the office. The deduction you claim will be prorated by the amount of the year the office was used.

In the next screen, ‘Business conducted in home office’, enter 100%. If you spent less than 100% of the time enter what amount applies in your situation.

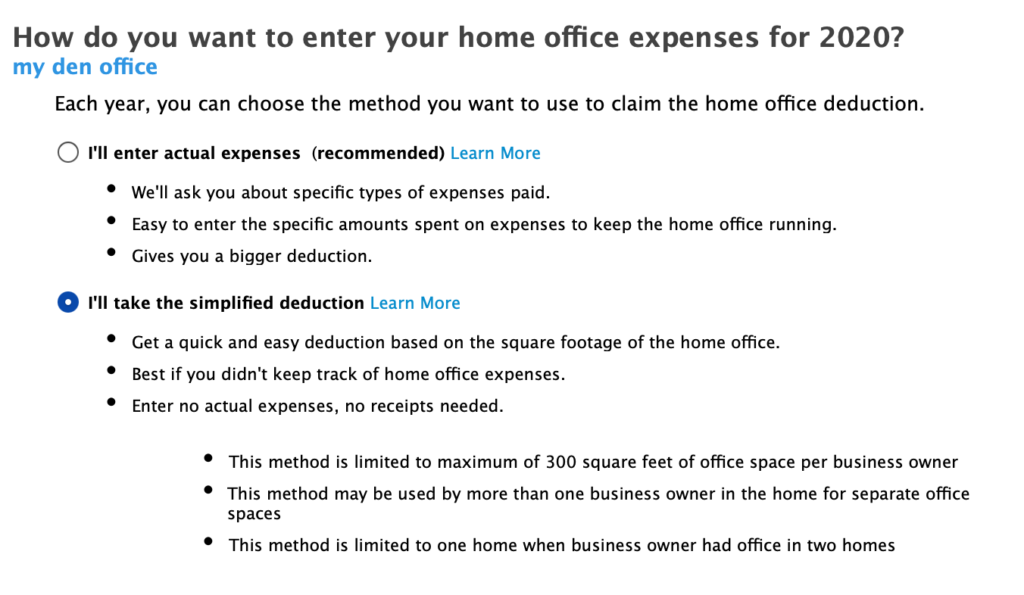

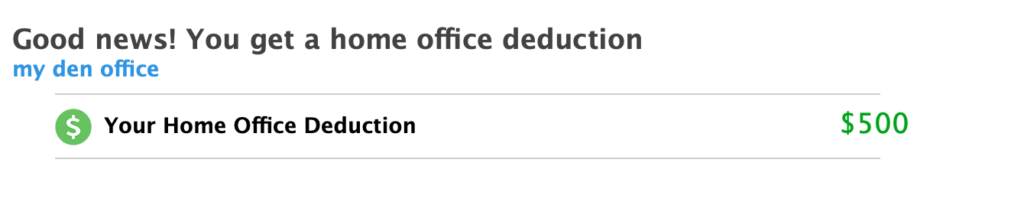

Select ‘Simplified Deduction’ in the next screen. We assume that you do not spend enough time or have enough rental business to justify an itemized expense entry.

Cars, Trucks and Other Vehicle Expenses

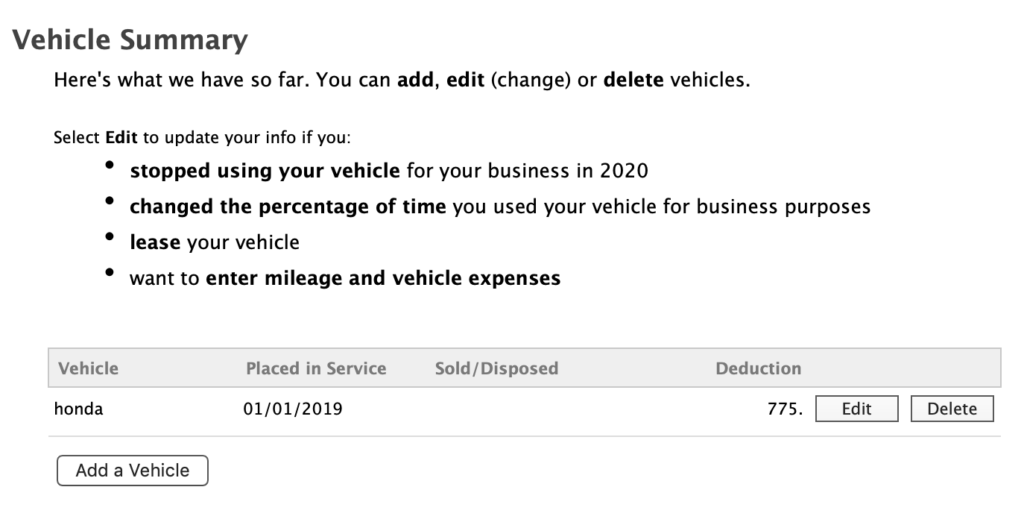

If you used a vehicle to travel to the rental property, you can claim a deduction. We will consider the simplest case, you used your personal vehicle part of the time and you are claiming the Standard Mileage deduction. Click next to enter the section vehicle use. Select ‘Add a Vehicle’.

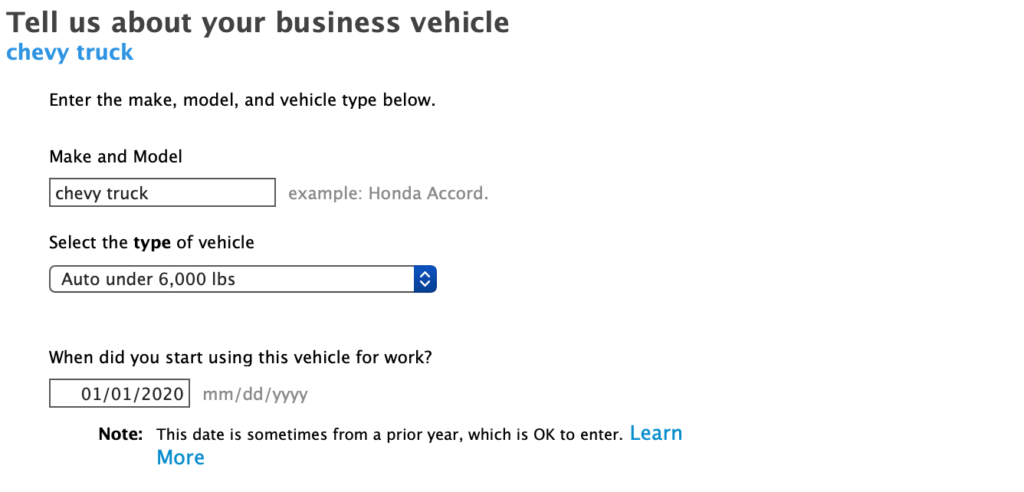

In the first screen ‘Tell us about your business vehicle.’, enter the details of the vehicle.

In the following screen, specify if you own or lease the vehicle. Following that say ‘Yes’, that you used the vehicle for personal use. Also, specify that you tracked and documented your mileage in the next screen. We recommend that you do track your mileage.

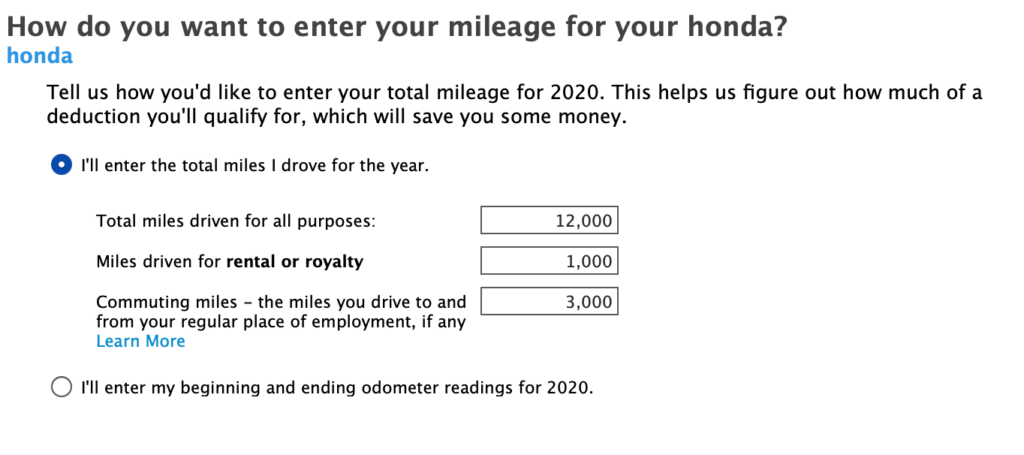

Next, enter the miles driven for the vehicle. The important entry here is ‘Miles driven for this business’ – this is the mileage you drove to the rental property and other trips on its behalf. In the next screen, select ‘Standard mileage’.

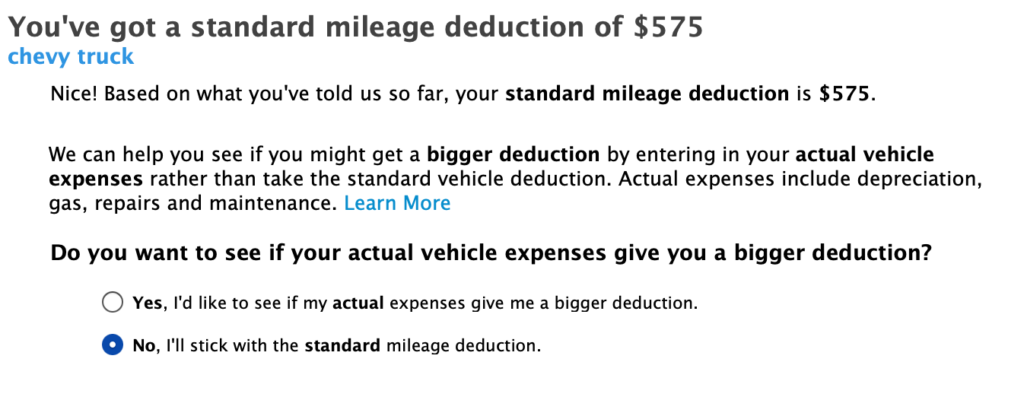

The next page specify how many vehicles you used, typically ‘0-4 vehicles’. When asked about deduction type, indicate ‘No I’ll stick with the standard mileage deduction’.

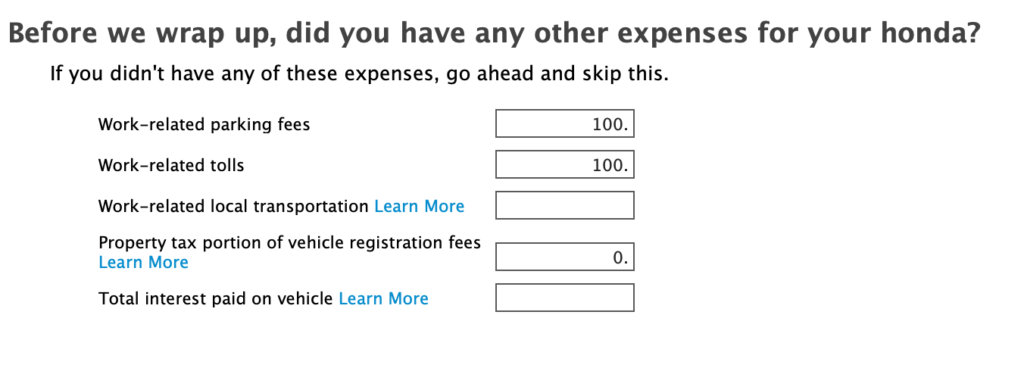

Enter any other expenses you incurred. These expenses will be added to your standard deduction.

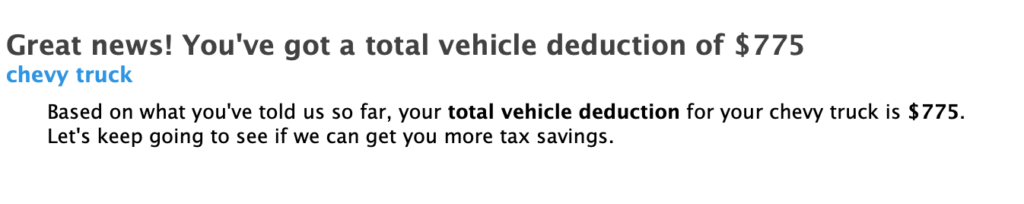

Click continue to get the deduction amount.

Assets and Depreciation

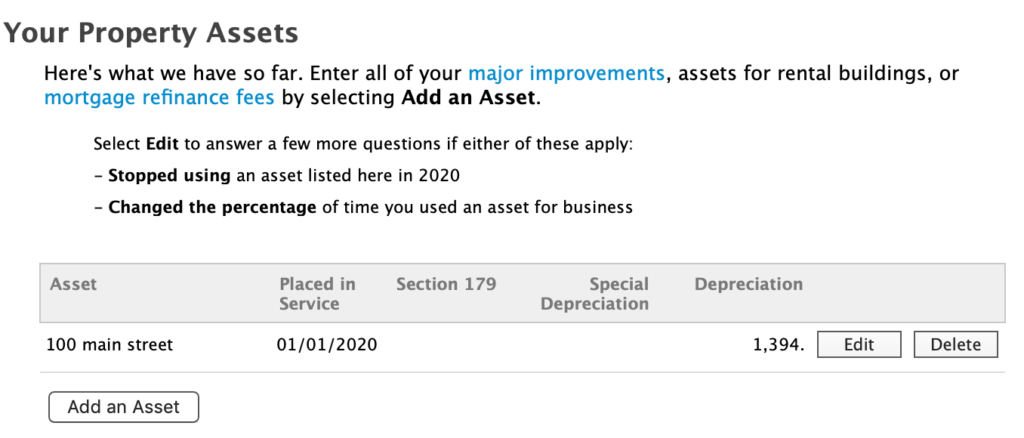

Large purchases of property that you buy along with the rental will be depreciated each year of service. For this video, we will start with the depreciation of the rental property itself. Click on ‘Go to Asset Summary’ in the first screen.

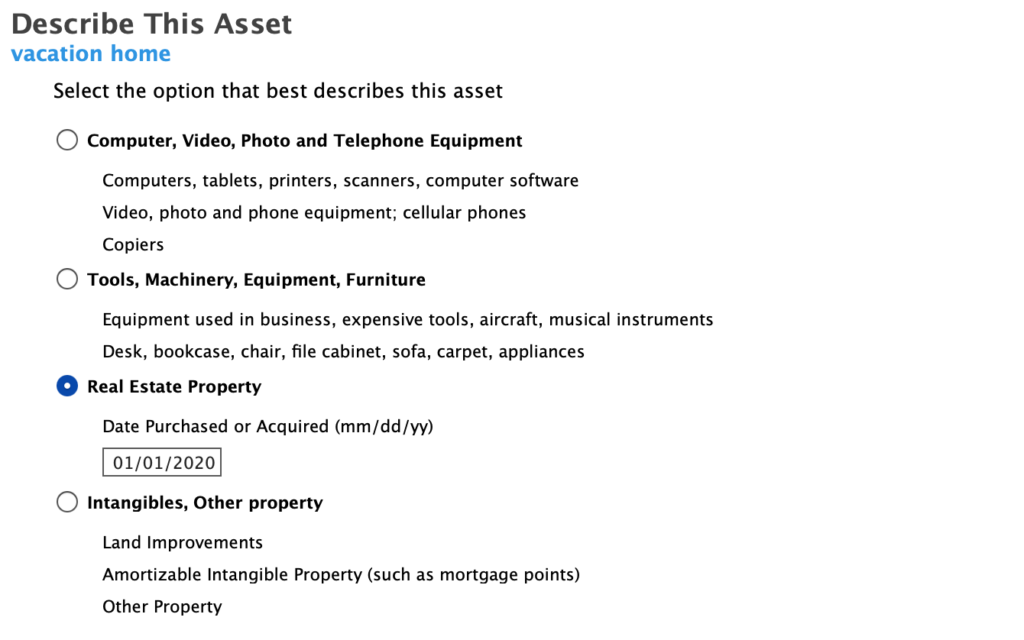

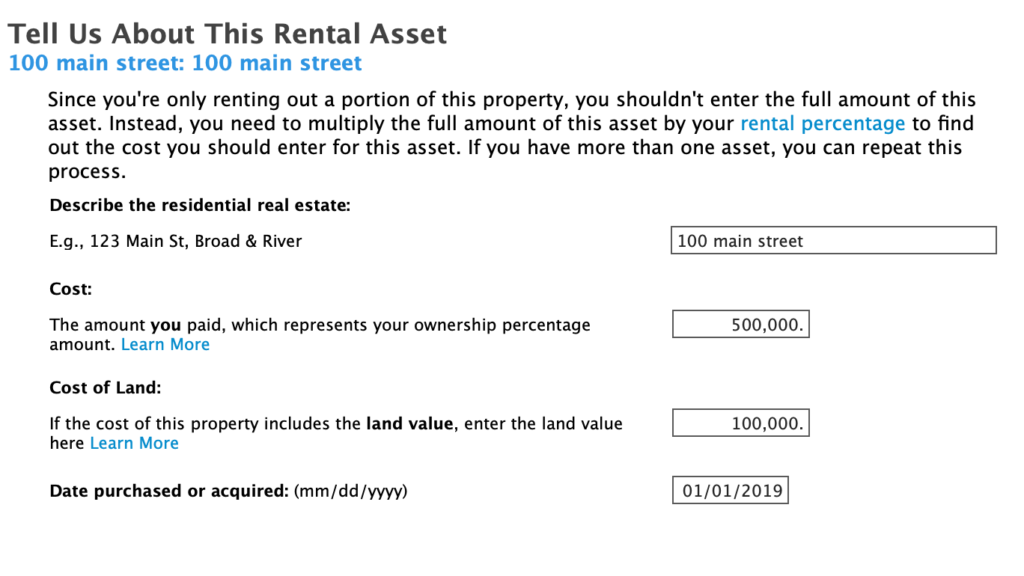

At the depreciation page, enter ‘Add an Asset’. In the entry screen fill out each field. Specify that the property type is ‘Real Estate Property’.

In the next screen specify the property as ‘Nonresidential real estate’. Following that, enter the cost details. The cost of the property is what you paid plus any closing costs such as attorneys fees and title insurance.

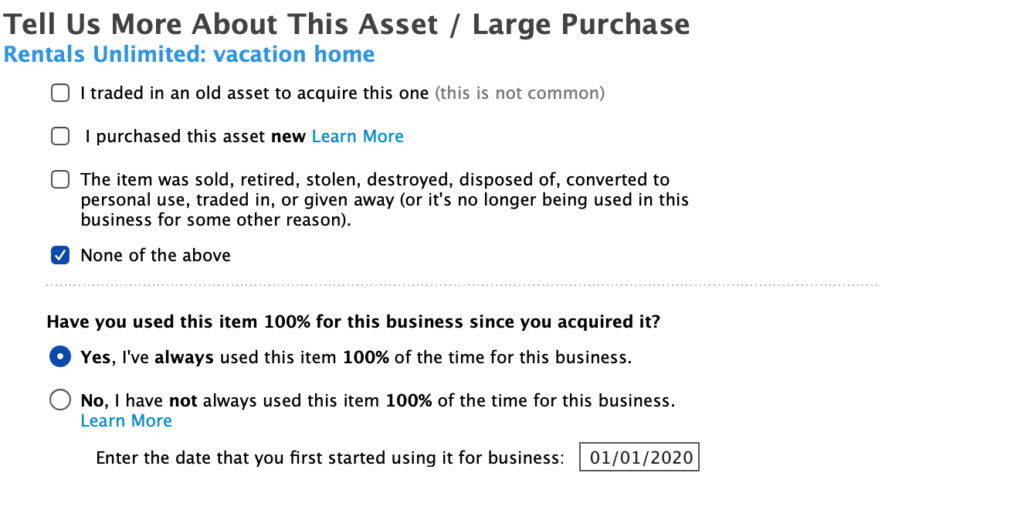

In the next screen specify that you used the property 100% for business.

All Other Expenses

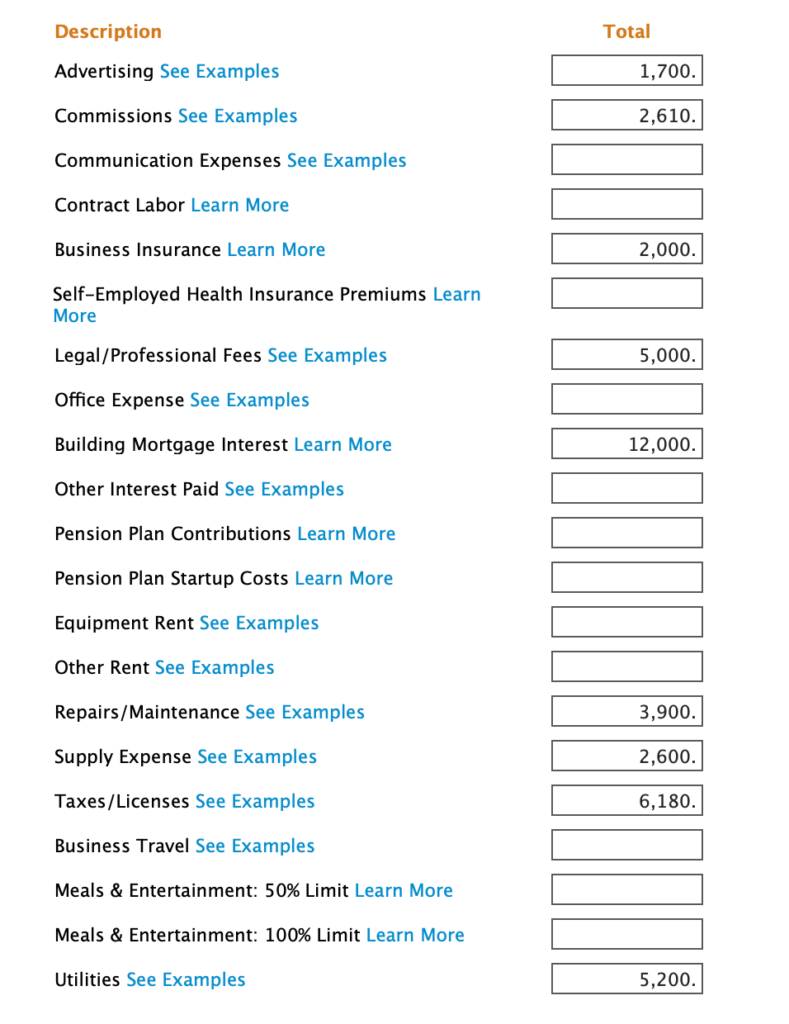

The next page provides a place to enter your rental expenses. It helps to prepare this ahead of time so that the entry of the numbers is quick and easy. There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property – Schedule C. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation.

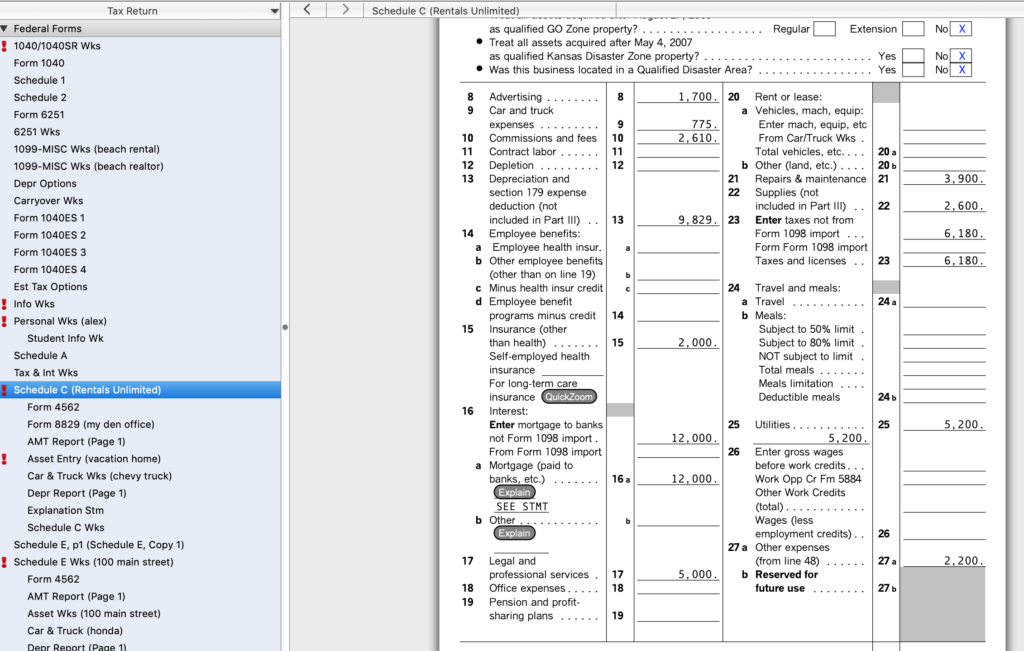

In the screen below entries were made that are most relevant for you rental activity. The entries are very common.

Skip the next screen that asks for Long Term Care Insurance expenses.

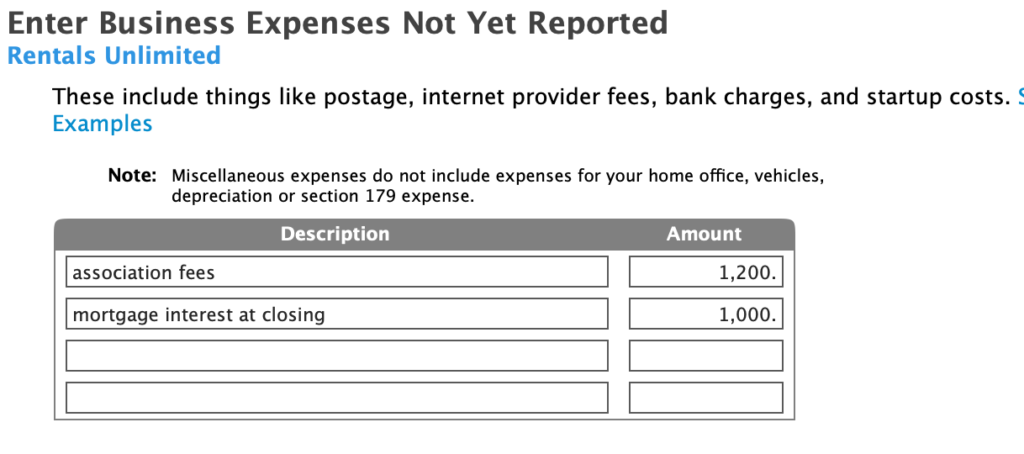

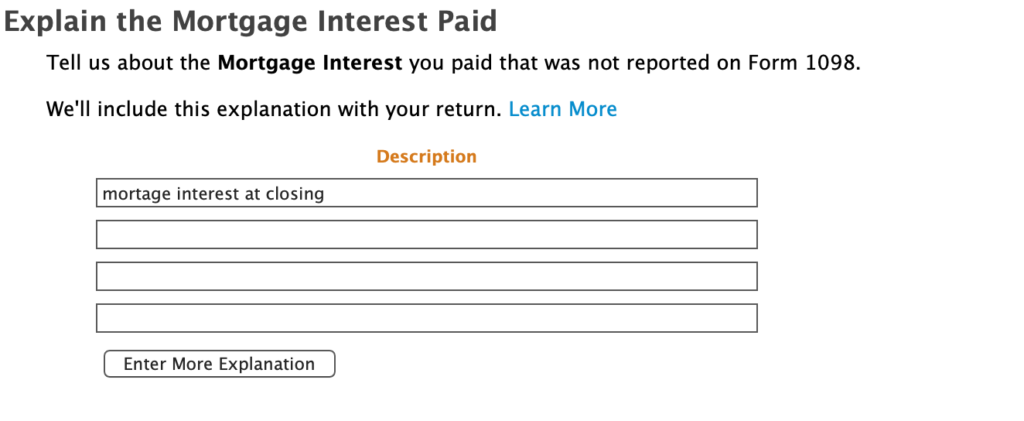

Next, enter other expenses. There were a few common ones entered. If you paid extra mortgage interest (not specified on a Form 1098 previously on the initial expense page), specify it here.

Then, make a note about mortgage interest.

Expense are all done!

Qualified Business Income Deduction

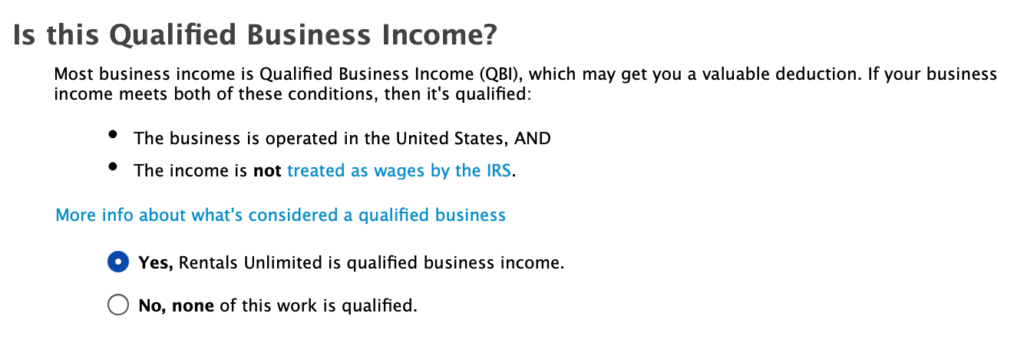

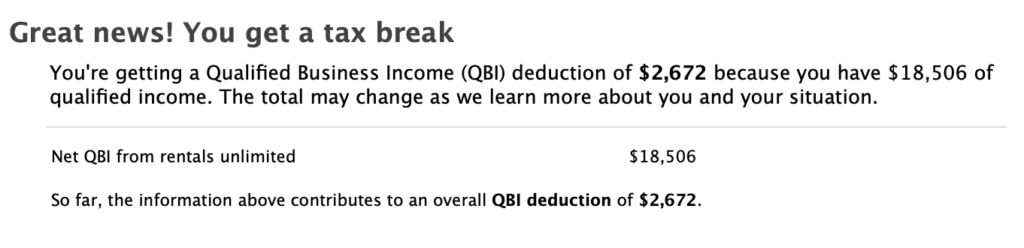

If you are conducting your rental activity as a business, you can qualify for the QBID, which excludes 20% of income from your taxable income. If you made it this far and have confirmed that you are materially participating in your rental activity, claim the QBID. Also, it goes without saying that you also need to be making a profit. The next screens talk about how to do this.

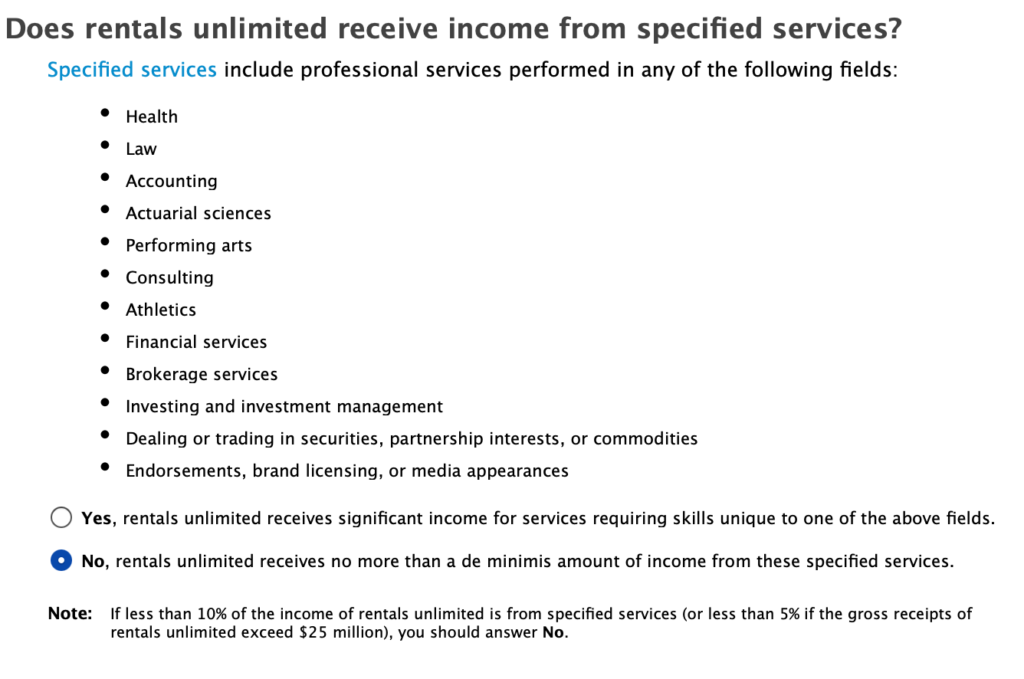

Skip the next screen that talks about uncommon situations. Following that you are asked about specified services you receive income from. This is not relevant, so say ‘No.’

In the following screen you are asked about if you receive income from specified services business with common ownership (SSTB). We assume ‘No’. Finally, your deduction!

Summary

You have just completed the entry in your tax return for a vacation rental property. After complete, review the filled out form by going to ‘Forms’ at the top of the page and selecting ‘Schedule C’.