In this article we discuss how to file your U.S. Federal Income taxes for your property using Intuit TurboTax software. Specifically, a room that you rent in your own home.

In preparing this article, there are a few assumptions made to simplify the walk through. It could be the case that your situation has different circumstances. If you need help, please ask in the comments below or contact us directly in the About Us Page.

| Assumptions Made For This Vacation Property * Property is owned 100% throughout the filing year. * You live in the main house as your primary home. * The rental is a room, not a separate apartment. * Rental days is more than 14 days during the year. * Rental room is 20% of house square footage. |

Video walk through:

Please read the companion article Financial Information Needed to File A Tax Return For Your Room Rental. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation of expenses and income.

Table of Contents

Renting A Room in Your House…

The rental scenario considered here is something like this. You own a home and rent a room out while you occupy the house. Room rentals are allowed virtually everywhere. The key detail is that you live in the home while renting the room out. This type of accommodation is how Airbnb got its start as a rental site.

Do You Need To File?

There is quite a bit of documentation required to file a room rental on your tax return. We go into the details in this article.

Note that you can rent any property you have for 14 days out of the year and not have to file the income/expenses on your tax return. If this is the case for you, there is no need to file it on the return. However, if you are consistently renting the property over many weeks/months year after year, then file it on your return.

What About Personal Use?

One of the first questions you may have is, can I still use the room myself when its not rented? Why, yes, of course. This is expected. From a filing point of view, you specify how the room is used across the three uses: rented, personal use, and offered but not rented.

Where you need to careful when filing is to be sure to specify the correct rental participation status. Rental use would not be classified as a business activity. This is not common. When we get into the details this will all become clear.

Starting the Software

Intuit TurboTax has both PC/Mac software installations as well as cloud versions of the same software. Any of these versions will do. In this demo, we are using the Deluxe version. The Deluxe version, while not specifically targeted to real estate investors, is perfectly adequate for the job.

Where to Start…

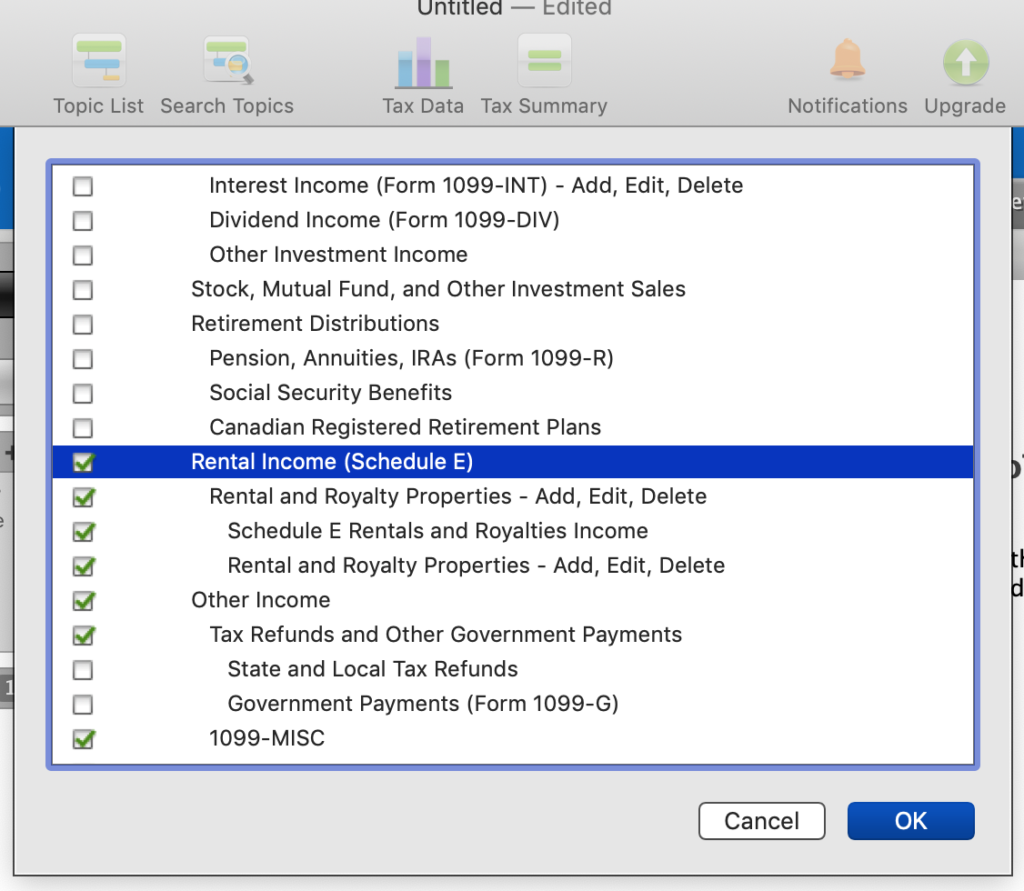

You will want to navigate to the ‘Rentals and Royalties’ section of the software. At the top, click on ‘Topic List’ and select ‘Rental Income’, hit the ‘OK’ Button.

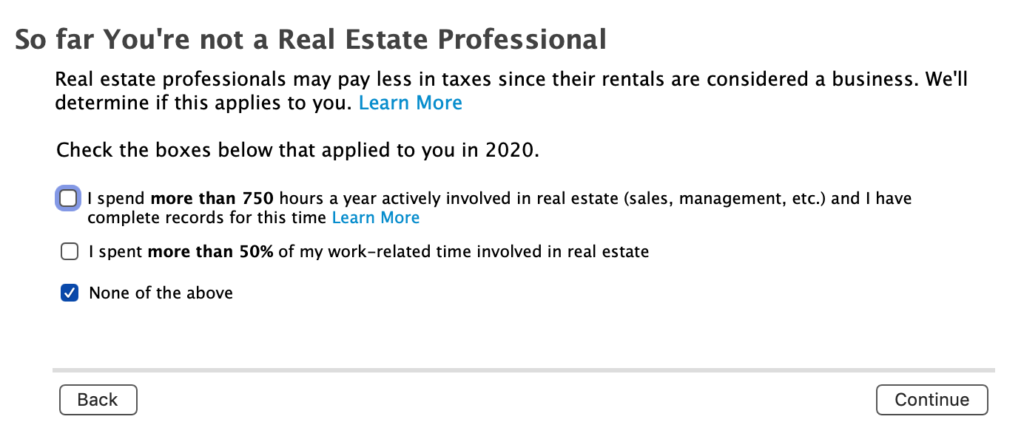

On the next screen you will get asked a question about your work. If you are a real estate professional and run your activity as a business, you would specify it here. This is uncommon, especially for room rentals. In this walk through, we assume you are not, so check ‘None of the above’.

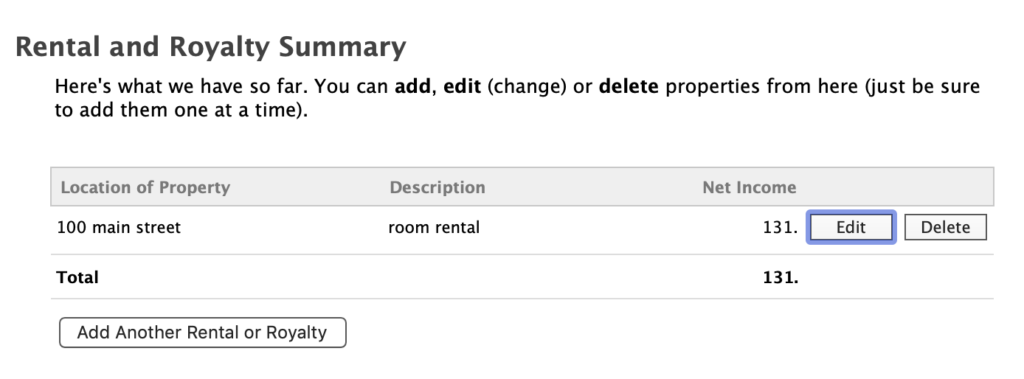

The next screen is the property entry screen. Click, ‘Add Another Rental’ or as pictured here, ‘Edit’ an existing rental.

Rental Property Summary

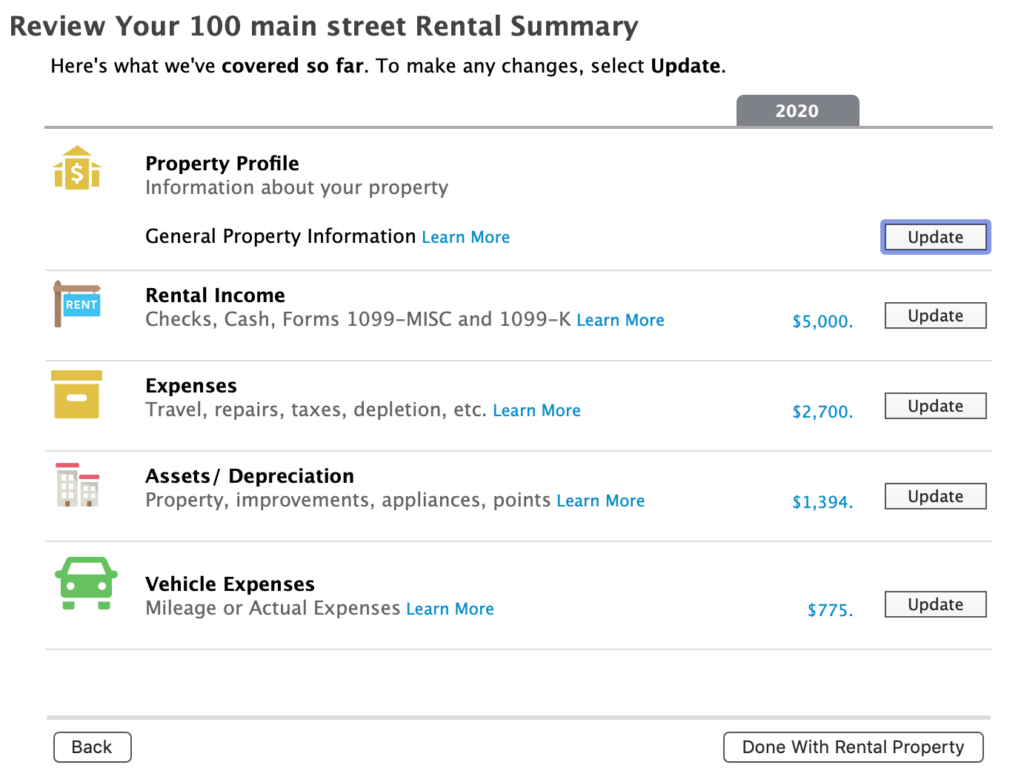

The Rental Summary screen will be displayed. Let’s go thru each section starting with ‘Property Profile’. We will walk through a property that was already created.

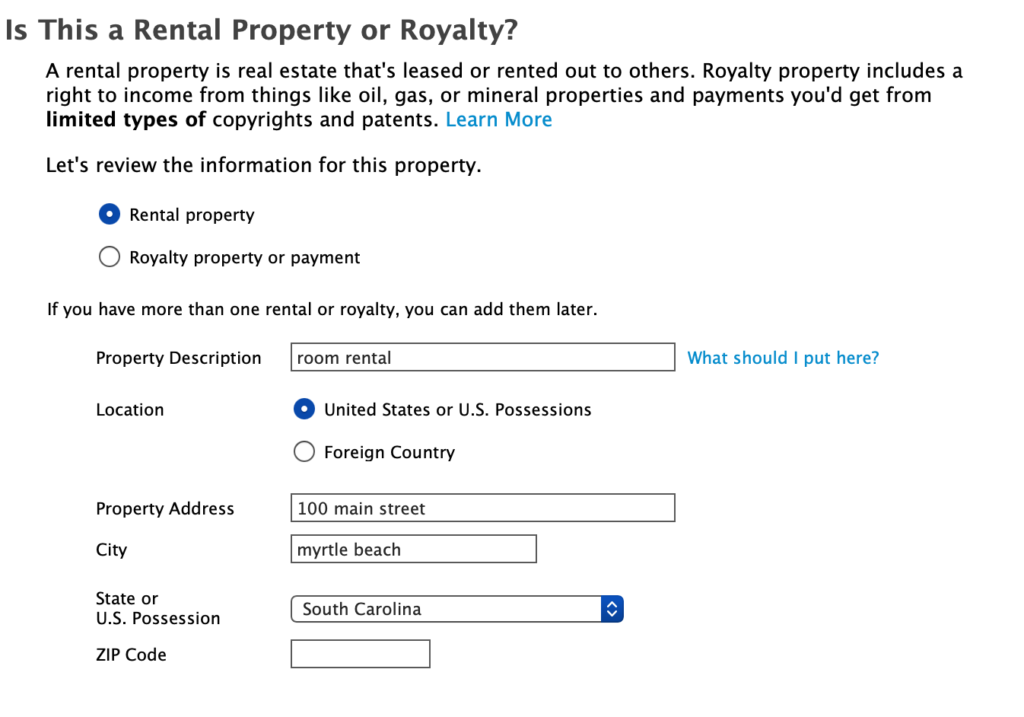

Enter the asked for description information. Select ‘Rental Property’ in the check list.

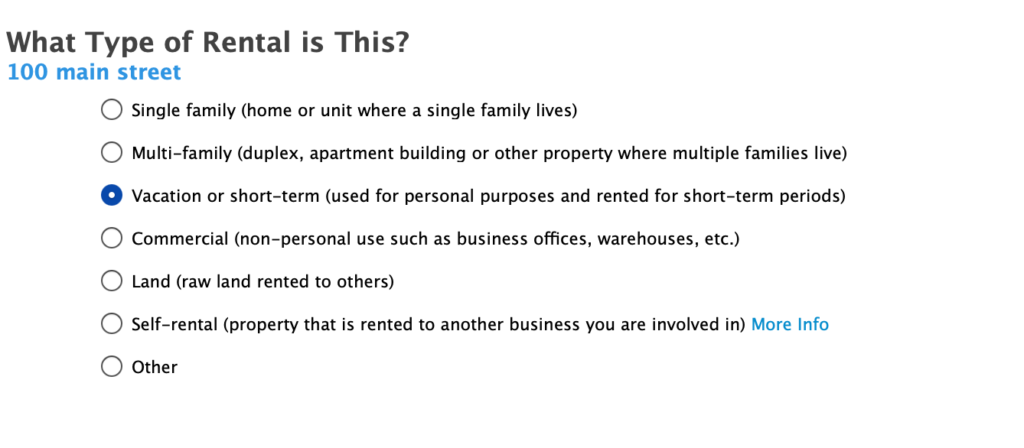

Next, select ‘Vacation/Short Term Rental’ for property type.

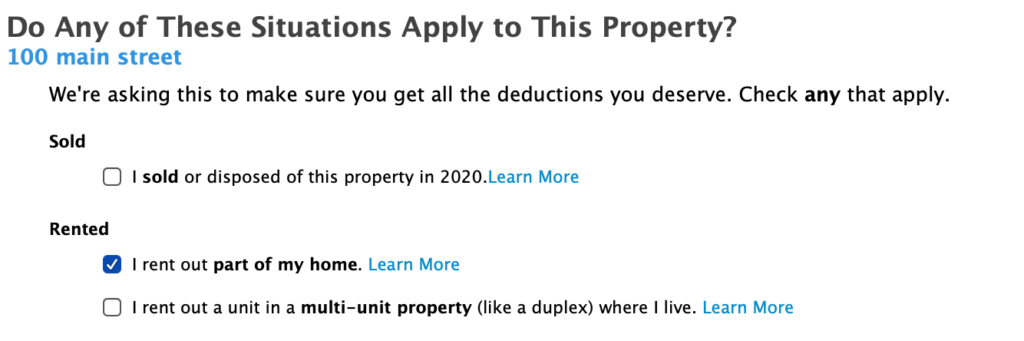

Below the description information are questions about special circumstances. There is an configuration that is important to check to specify your rental as below.

Check the box as shown above, ‘I rent out part of my home”.

Defining Rental Use

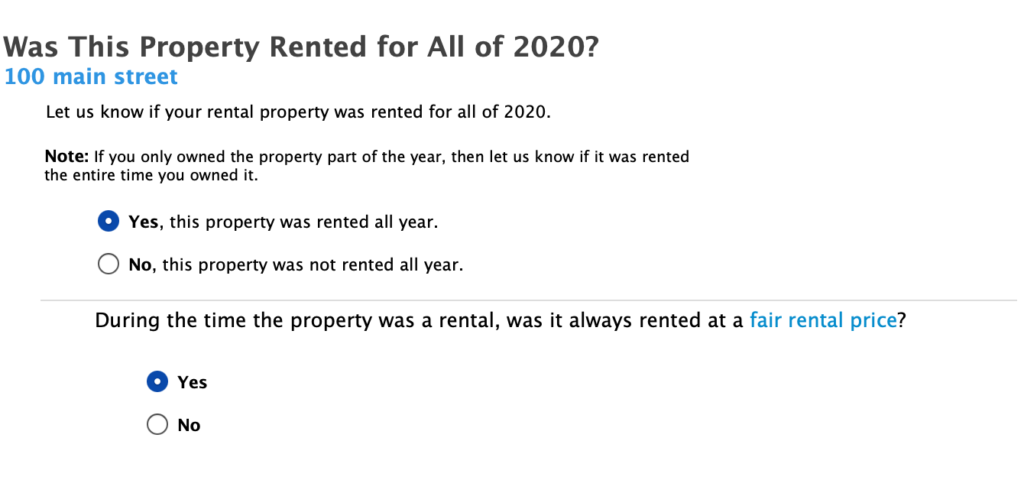

In the next screen, you are asked if you rented the room throughout the year and if you rented it for fair market value. This question should be interpreted as, ‘Did I rent it for full price when it was rented?’ The answer to this is obviously yes. If you did in fact rent it for less than fair value, this would count as personal use and not rental use.

Note that you are the one who largely determines what the fair market value for a rental is anyway.

If this is confusing, you are not alone. This screen is really geared to full property rentals and not room rentals. Select ‘Yes’ to both questions, we will cover personal/rental use in a later screen.

We will also say ‘No’ to the next screen (not pictured) which asks if you have a home office (unlikely).

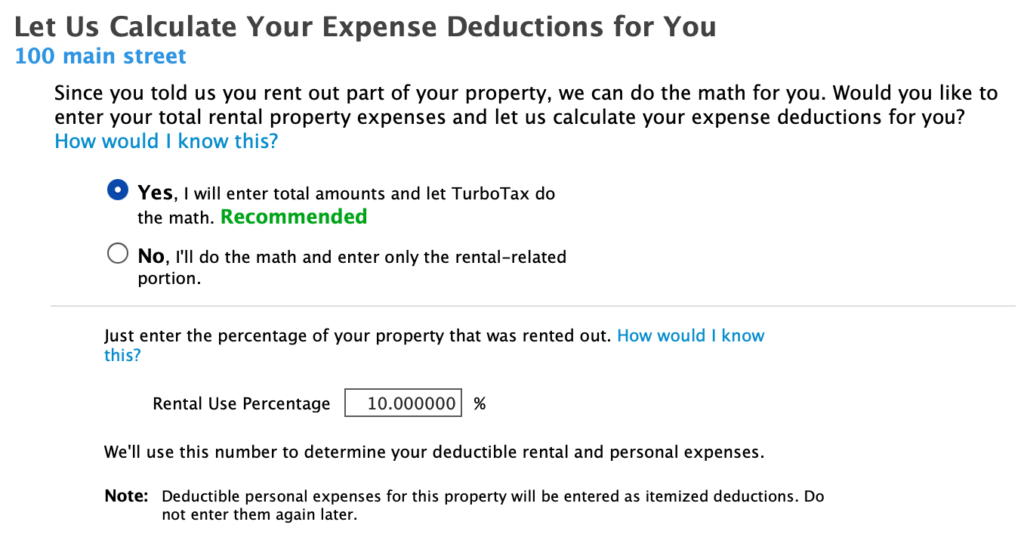

Expense Apportioning

The screen above specifies rental use, which can be used to apportion expenses. We suggest that you say ‘Yes’ and let TurboTax apportion expenses. This is the simplest way to account for all the expenses as well as the best for the highest claim amount. The reason is that a portion of expenses that are tied to the overall property (and not just the rental) can be claimed on the rental side.

But, you need to calculate what is called Rental Use. This is the percentage of the property that was used just for rental activity. This number removes not only personal use of the larger property, but also personal use of the rental unit itself. Here’s how to calculate it.

Rental Use = Ownership % X Rental %

Example:

- The Rental Room is 20% of the square footage of the home. Ownership Percentage is therefore also 20%.

- We will use an example for room usage: 100 days rented, 100 personal days , 166 days offered but not rented and not used personally. Rental Percentage is Days Rented / (Days Rented + Personal Days). This works out to be 50%.

- Rental Use => 50% X 20% = 10%.

The next screens ask a few questions. The answers given below are the most common. Answer as follows:

- Active Participation? Select ‘Yes’, I am an active participant at your property. This is the most common answer.

- No, I did not pay for work that required a Form 1099 (common).

- Next, select ‘Enter Rental Info Myself’. We select this option so that we can review expenses at a detail level.

- Lastly, it is unlikely that your property is in a ‘Designated Area’. Select ‘None of the above’.

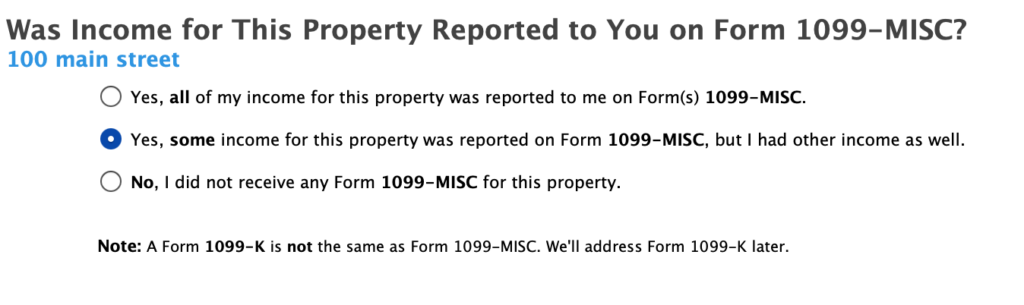

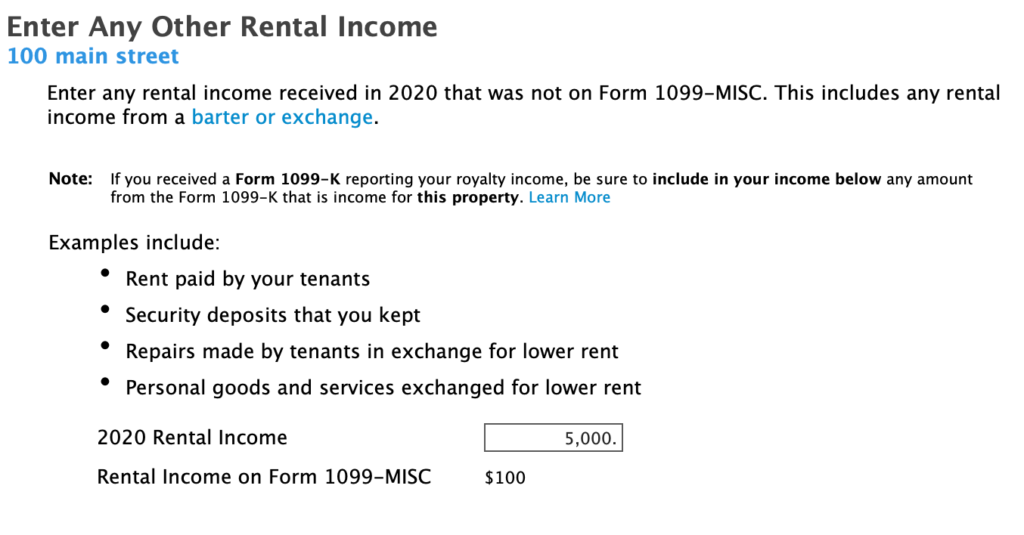

Entering Your Rental Income

Income is entered in two distinct places. First case, a third party such as a Realtor or Management company sent you 1099-MISC. In the second case, you earn ‘other income’ from everywhere else that wasn’t reported using a 1099-MISC. There is also a third form, 1099-K that a payment company might send you. However, 1099-K would be filed along with your ‘other income’.

Reported On 1099-MISC

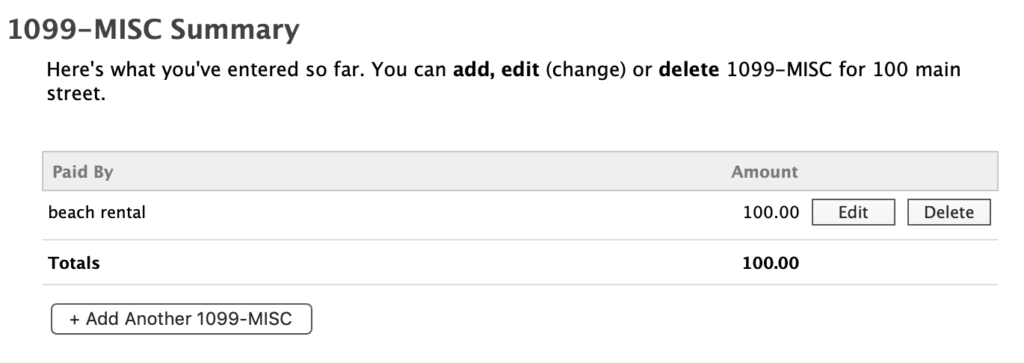

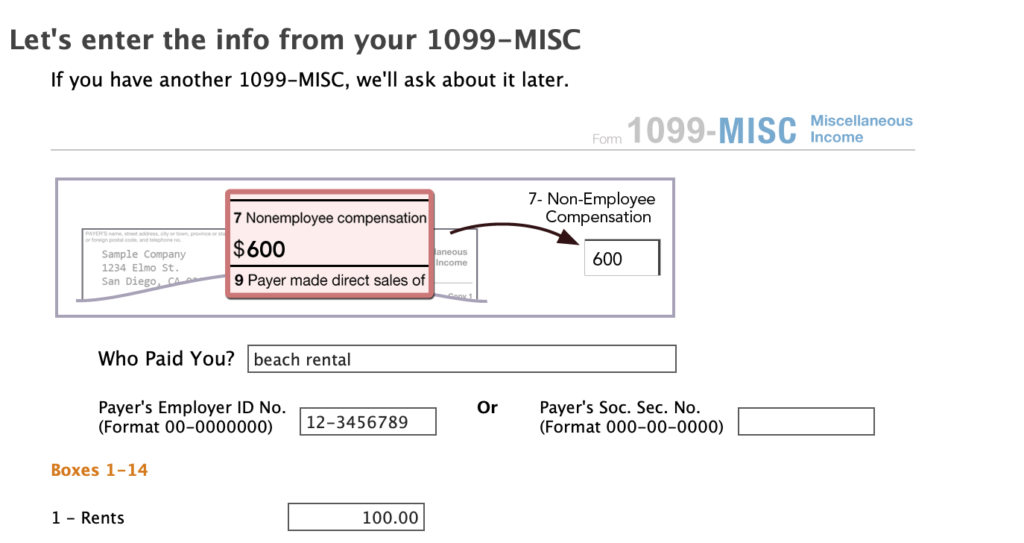

If an agency or other party sent a 1099-MISC, create an entry in the ‘Miscellaneous Income’ page. Create a separate entry for each one.

The important information to enter is the name (‘Who Paid You’), the Payer’s Employer ID and the amount of Rent. This information needs to match the information that was provided on each 1099-MISC.

Other Income Sources (Airbnb)

In the next page, enter all other income from every other source, including 1099-K. Include all your income, Airbnb, VRBO as well as personal rental income. Sum it all up and enter it into the ‘Rent received’ box.

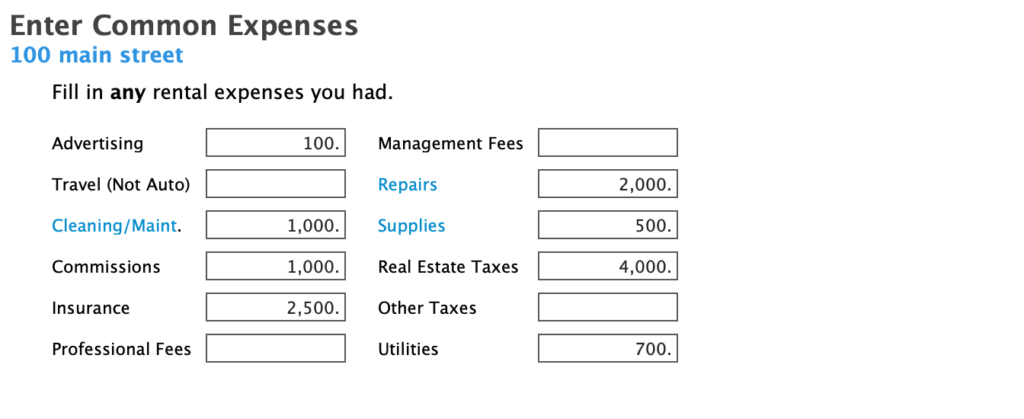

Enter Rental Expenses

For your rental activity, you can deduct expenses. The key detail is that you should enter total property expenses. The reason is that we previously decided that TurboTax will apportion expenses. Therefore, the expenses entered below are for the entire property during the year. Don’t worry about Advertising and Commissions, the software will not apportion those. These expenses will be claimed 100% since they apply to the rental only.

The next page provides a place to enter your rental expenses. It helps to prepare this ahead of time so that the entry of the numbers is quick and easy. There is a companion article Financial Information Needed to File A Tax Return For Your Room Rental. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation.

Common Expenses

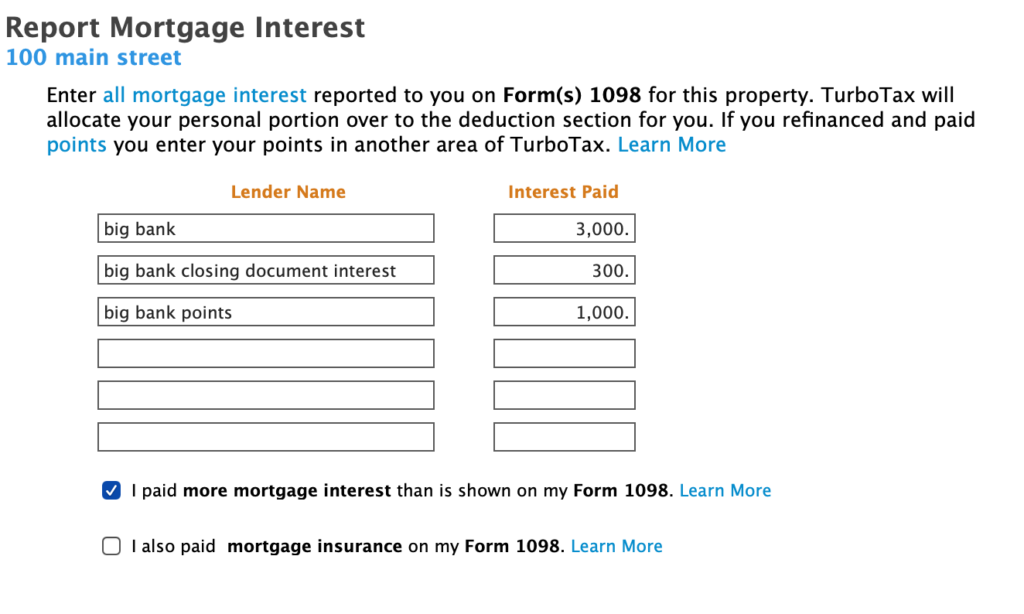

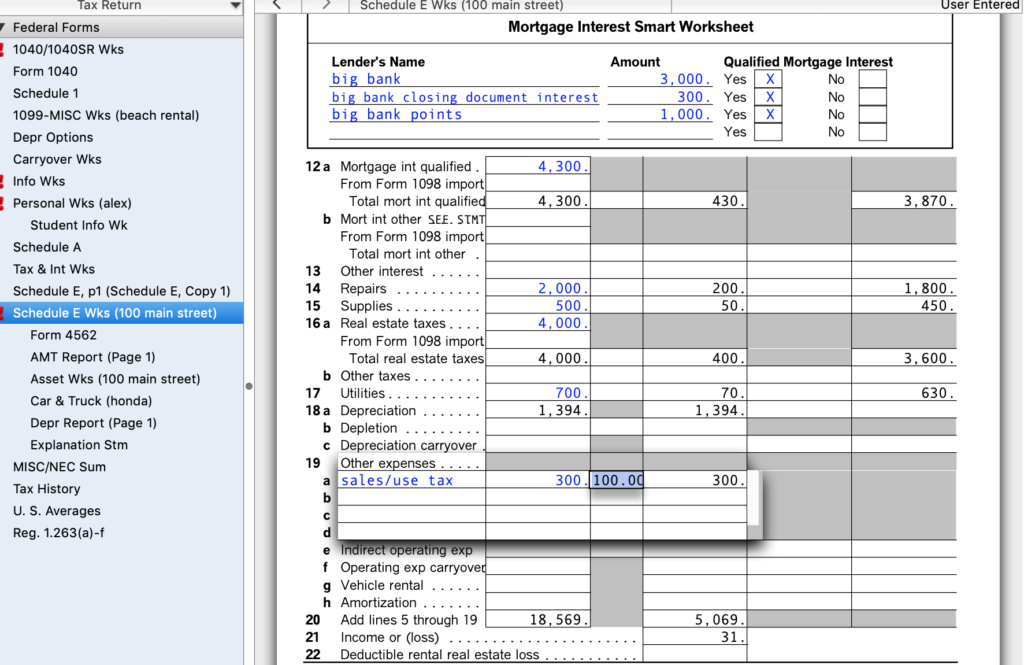

Report Mortgage Interest

Next report any expenses tied to a mortgage. The screen below covers most situations.

In the first year of ownership, it is possible you paid points or extra interest. Points are deductible immediately if they were paid on the originating mortgage. If you also have extra interest not on your bank 1098, be sure to check that box and enter the amount. Also, in the next screen enter a comment such as: ‘Closing Document Mortgage Interest’ and ‘Mortgage Points’.

Skip entry in the following screen, ‘Other Interest Paid’, since we covered extra interest just now.

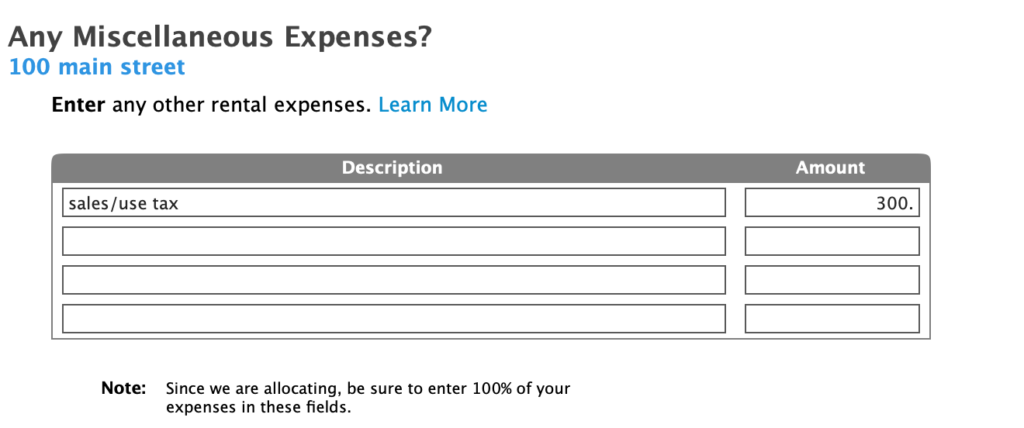

Miscellaneous Expenses

Next, enter ‘Miscellaneous Expenses’. These are expenses that are for the rental 100% only that were not captured elsewhere. TurboTax doesn’t handle this properly because the note below also indicates that they will be allocated. In this example, we added sales/use tax you paid for guests on your rentals.

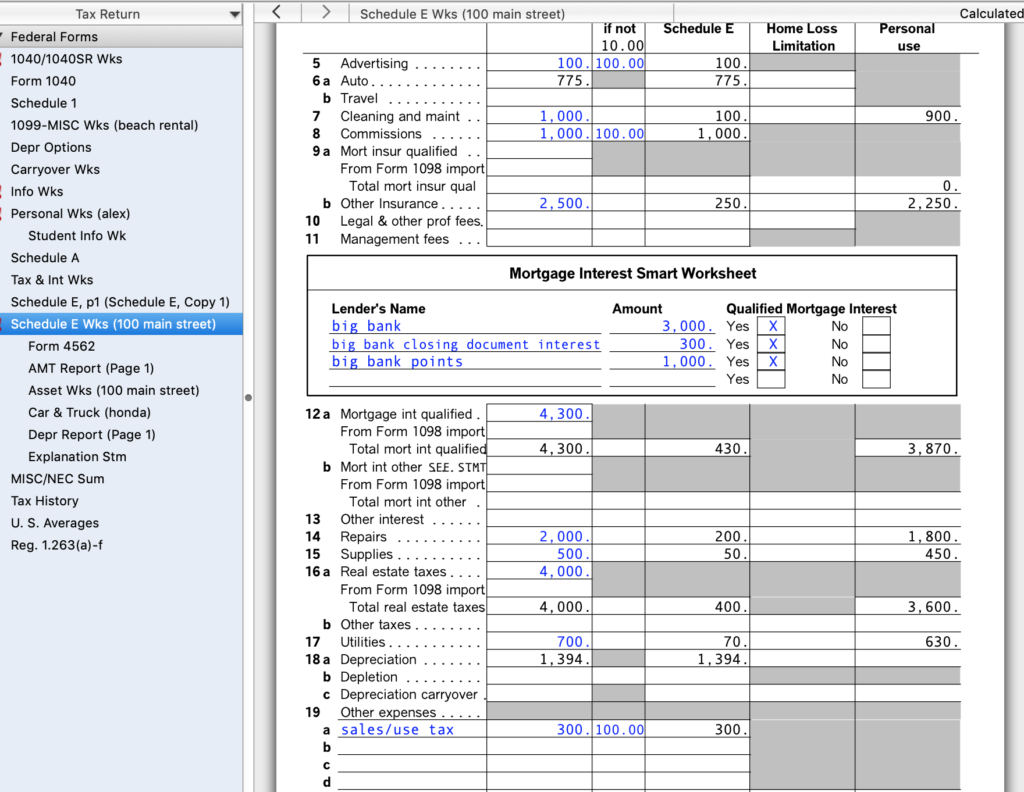

In order to fix the allocation, go to ‘Forms’ and select ‘Schedule E Wks’. Enter 100% in Column (b) for any ‘Other Expenses’ as indicated in the screen shot below:

If there were other expenses that were in fact allocated to the entire property, you can enter them in the Other Expenses screen. However, you would not need to fix the allocation for those. The software will apportion them to the rental based upon Rental Use you calculated previously.

Rental And Property Expenses

In the first section, enter property expenses. Property expenses are apportioned by the rental room percentage you just calculated. However, please note what we believe is an oversight on the form. The ‘Taxes (other than property tax)” box should be a rental expense and not a property expense. In this box you would specify taxes such as occupancy taxes or sales/use taxes on the rental activity. This clearly only applies to the room rental. If you have these expenses, hold on to them for now.

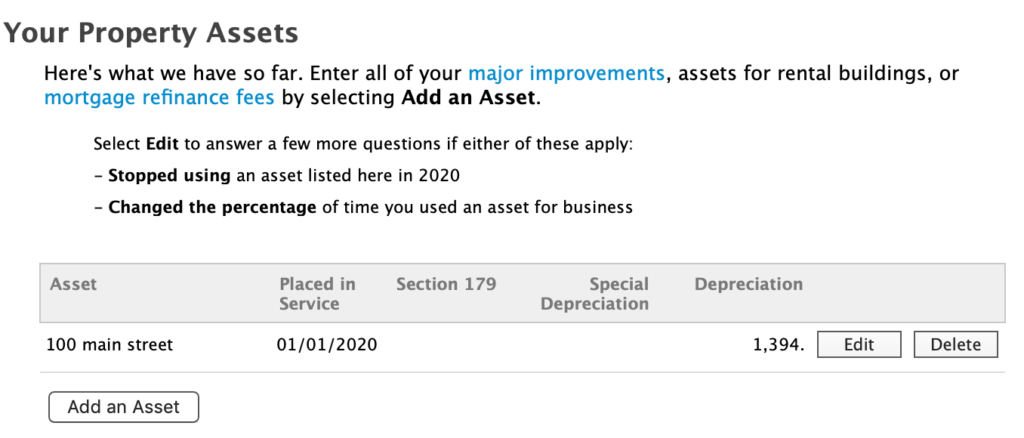

Assets/Depreciation

Depreciate your rental property plus and other real property. For this video, we will start with the depreciation of the rental property itself. Depreciation accounts for the decline in value of real property over its expected life. Enter ‘Asset/Depreciation’ and select ‘Go to Asset Summary’.

For the next two screens, specify ‘Rental Real Estate Property’ as the asset. Then, ‘Residential Real Estate’ as the category.

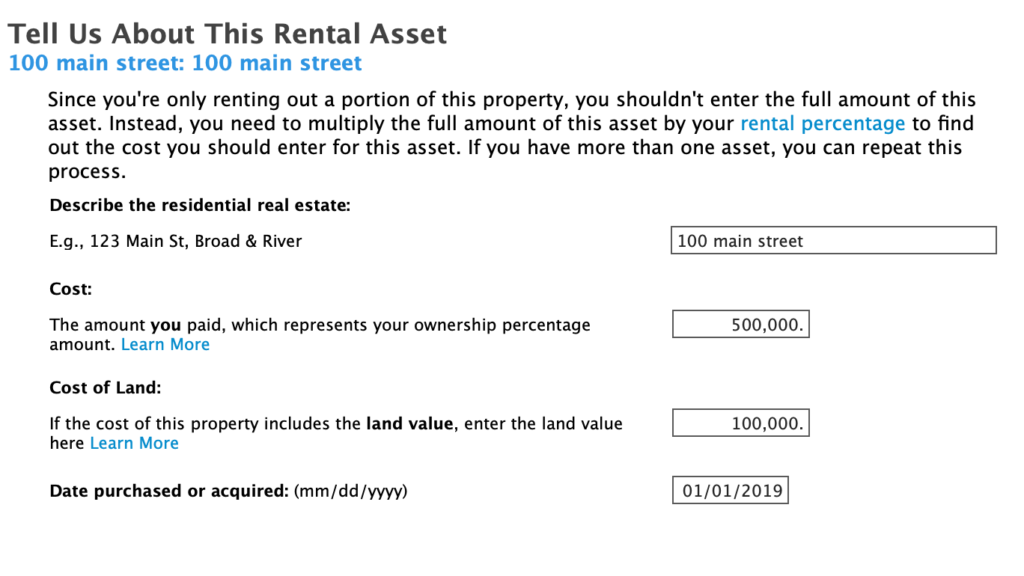

Asset Value

In the next screen enter the financials for the property. The actual depreciated value will be the difference between your purchase price and the land value entered.

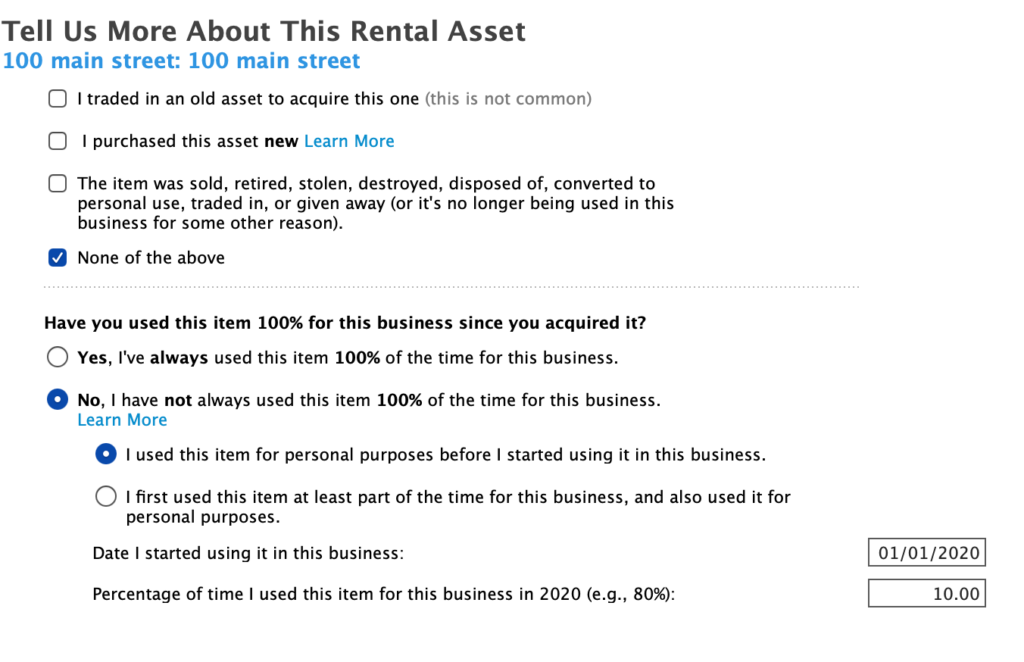

Asset Rental Use

The following screen concerns rental use. We suggest the following values which apply to most situations. Use the 10% value for ‘business use’ that we calculated previously during expense allocation. You want to be sure to select ‘No, I have not used this item 100%’. You rent only a portion of the property. Set it to ‘No’.

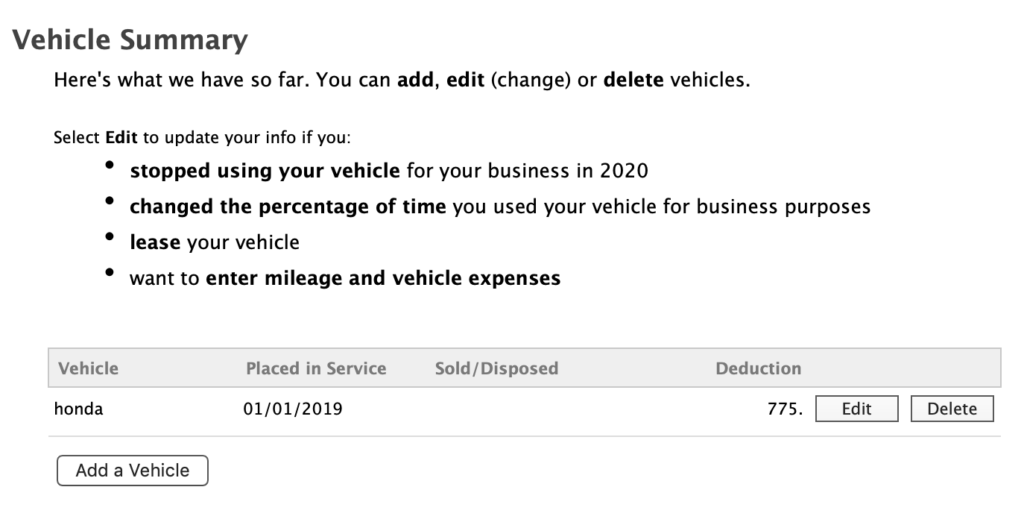

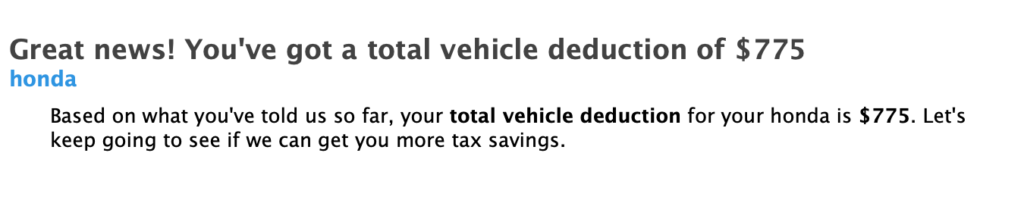

Click for the next screen to get a depreciated value of 1,394. Click done to continue on to Vehicle Expenses.

Vehicle Expenses

If you used a vehicle to travel to the rental property, you can claim a deduction. We will consider the simplest case, you used your personal vehicle part of the time and you are claiming the Standard Mileage deduction. Click next to enter the section vehicle use. Select ‘Add Vehicle’.

In the first screen ‘Tell us about your vehicle.’, enter the details of the vehicle. Next, specify if you own or least the vehicle.

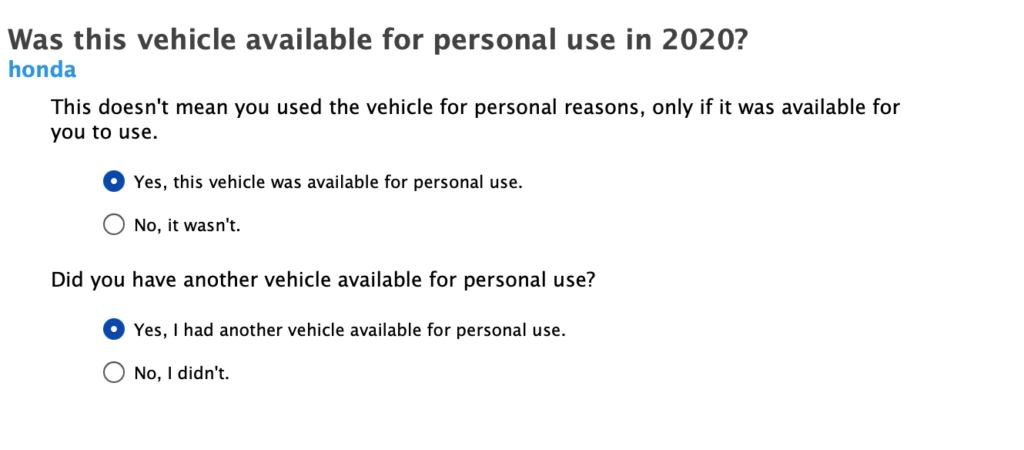

After that specify if you are using a personal vehicle. the most common situation is that you are using a personal vehicle, so select ‘Yes’.

Next, we suggest that you document your work miles and say ‘Yes’. Now tabulate your mileage.

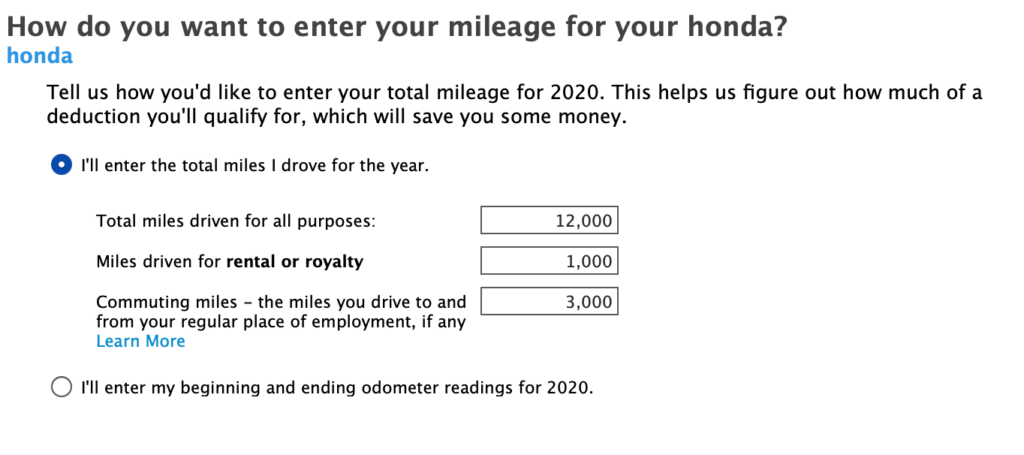

The important entry here is ‘Miles driven for rental’.

This is the mileage you drove to the rental property and other trips on its behalf. For the following screen, enter the number of vehicles used (most common: 0-4).

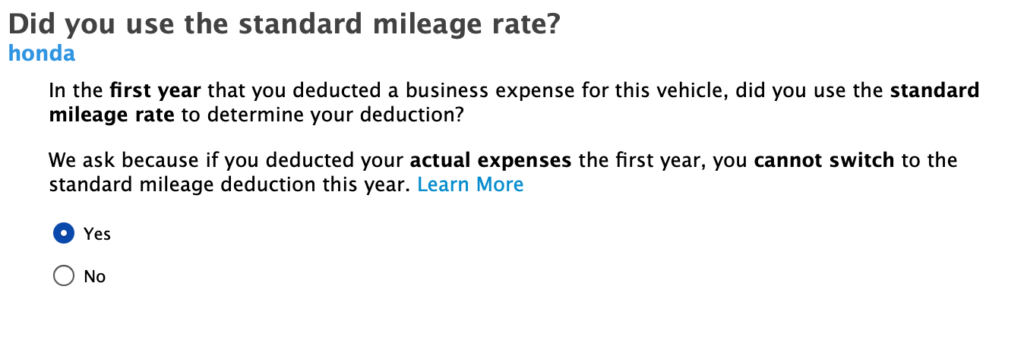

In the next screen, select ‘Standard mileage’. We recommend this option to simply reporting and get the best deduction. IF asked if you want to stick with this deduction, say ‘Yes’.

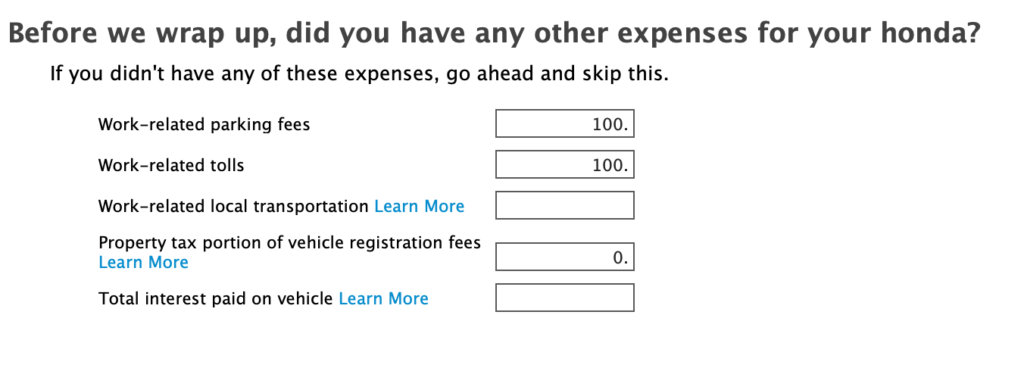

Out of Pocket Expenses

The next page enter ‘Out of pocket expenses’.

The last screen will tell you your vehicle rental deduction. Click ‘Done With Rental Property’ to finish up.

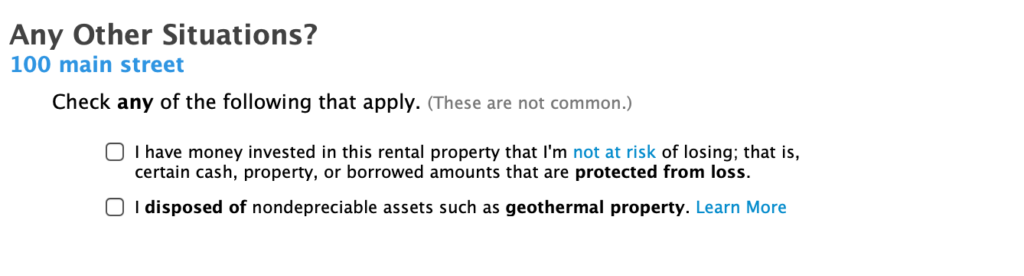

Final Questions…

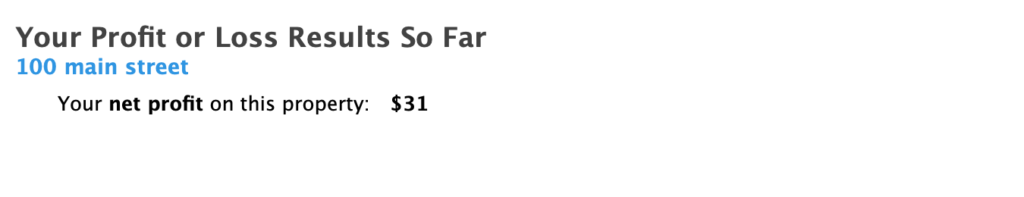

The first screen asks about at-risk limitations. What this is asking is if you bought the property using your own money. This is typically true, so leave the checkbox blank. Next, see if you have a profit or loss!

Congratulations, you earned a profit! Your situation may vary 😉

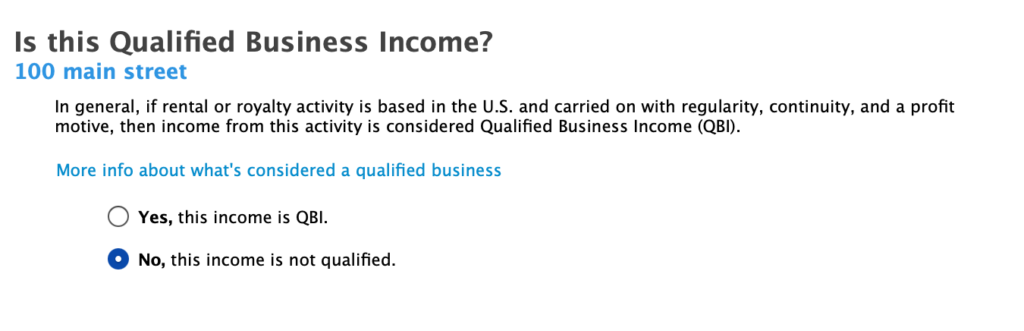

The profit will be reported on your 1040 schedule on ‘Line 8 – Other Income’. The interview asks if you qualify for the QBI deduction. Say, No here. You would need to be conducting your rental as a business which is not the case in virtually all room rental situations.

Summary

You have just completed the entry in your tax return for a room rental property. After complete, review the filled out form by going to ‘Forms’ at the top of the page and selecting ‘Rentals and Royalties Worksheet’.

Review the worksheet, look at each expense. Confirm that everything looks good and all your entries showed up correctly.