In this article we discuss how to file your U.S. Federal Income taxes for your property using H&R Block tax software. Specifically, a room that you rent in your own home.

In preparing this article, there are few assumptions made to simplify the walk through. It could be the case that your situation has different circumstances. If you need help, please ask in the comments below or contact us directly in the About Us Page.

| Assumptions Made For This Vacation Property * Property is owned 100% throughout the filing year. * You live in the main house as your primary home. * The rental is a room, not a separate apartment. * Rental days is more than 14 days during the year. * Rental room is 20% of house square footage. |

There is a companion article Financial Information Needed to File A Tax Return For Your Room Rental. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation of expenses and income.

Table of Contents

Video Walk Through

Renting A Room in Your House…

The rental scenario considered here is something like this. You own a home and rent a room out while you occupy the house. This type of rental accommodation is allowed virtually everywhere. The key detail is that you live in the home while renting the room out. This type of accommodation is how Airbnb got its start as a rental site.

Do You Need To File?

There is quite a bit of documentation required to file a room rental on your tax return. We go into the details in this article.

Note that you can rent any property you have for 14 days out of the year and not have to file the income/expenses on your tax return. If this is the case for you, there is no need to file it on the return. However, if you are consistently renting the property over many weeks/months year after year, then file it on your return.

What About Personal Use?

One of the first questions you may have is, can I still use the room myself when its not rented? Why, yes, of course. This is expected. From a filing point of view, you can specify how the room is used across the three uses: rented, personal use, and offered but not rented.

Where you need to careful when filing is to be sure to specify the correct rental participation status. It would not be expected that your rental use to be classified as a business activity. When we get into the details this will all become clear.

Starting the Software

H&R Block has both PC/Mac software installations as well as cloud versions of the same software. Any of these versions will do. In this demo, we are using the Deluxe version. The Deluxe version, while not specifically targeted to real estate investors, is perfectly adequate for the job.

Where to Start…

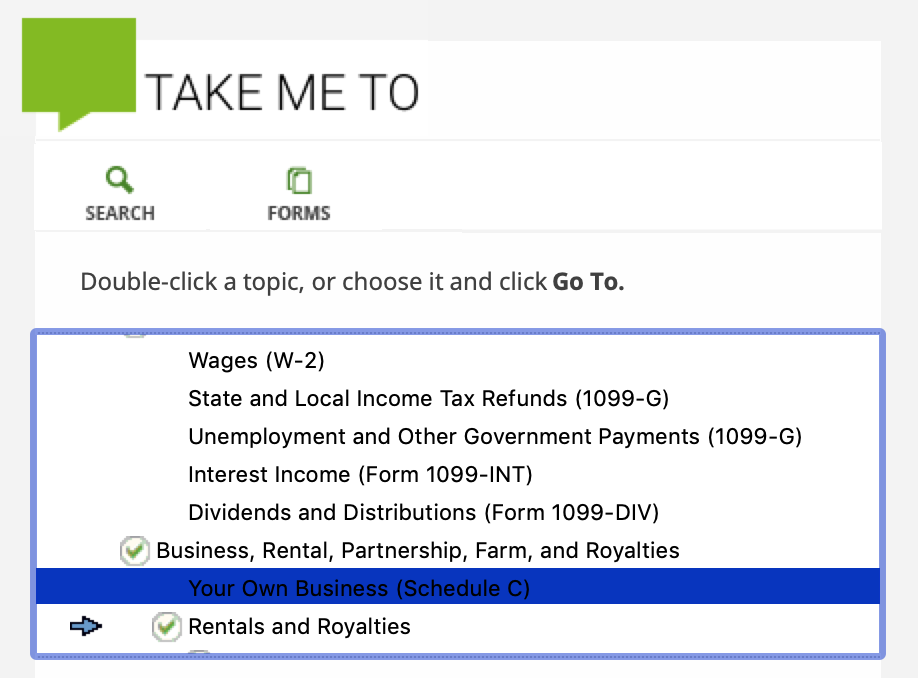

You will want to navigate to the ‘Rentals and Royalties’ section of the software. At the top, click on ‘Take Me To’ and select ‘Rental and Royalties’, hit the ‘Go To’ Button.

Once on the ‘Rental and Royalties’ page, click ‘Add Activity’. After selecting ‘Rentals’ in the first page, you will get a description page for the property.

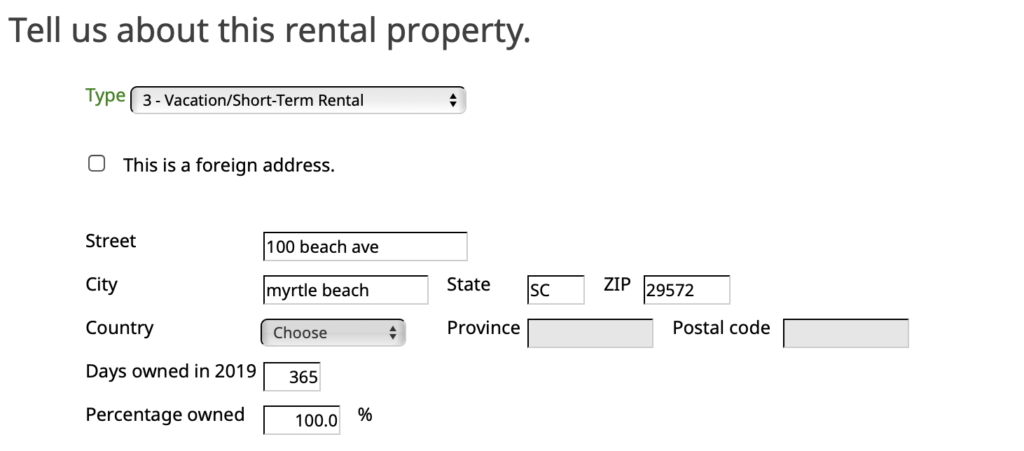

Enter the following information:

- Select ‘3-Vacation/Short Term Rental’ for property type.

- Enter the property address.

- For this demo, we assume that you owned the property the entire year and you own it 100%. Enter 365 for ‘Days Owned’ and 100% for ‘Percentage Owned’.

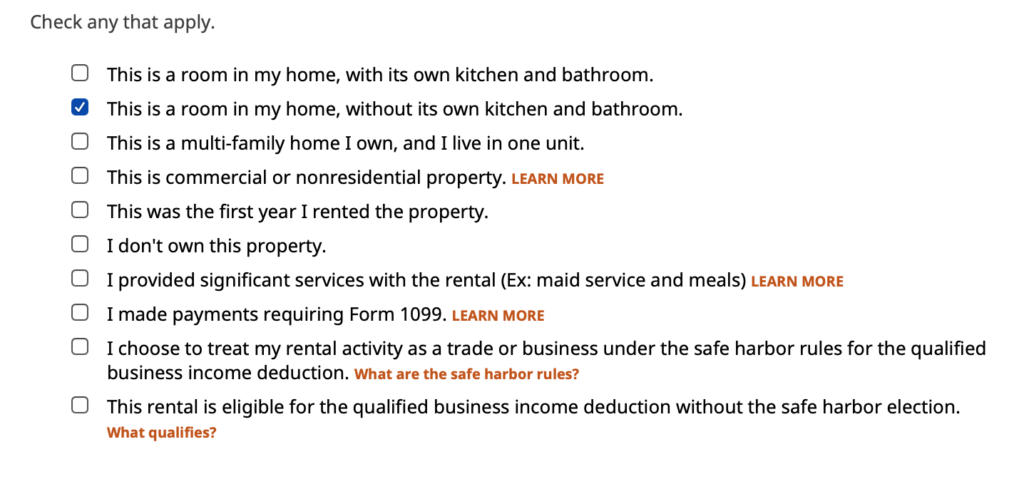

Below the description information are questions about special circumstances. There is an configuration that is important to check to specify your rental as below.

Check the box as shown above, ‘This is a room in my home, without its own kitchen and bathroom”.

Defining Property Use

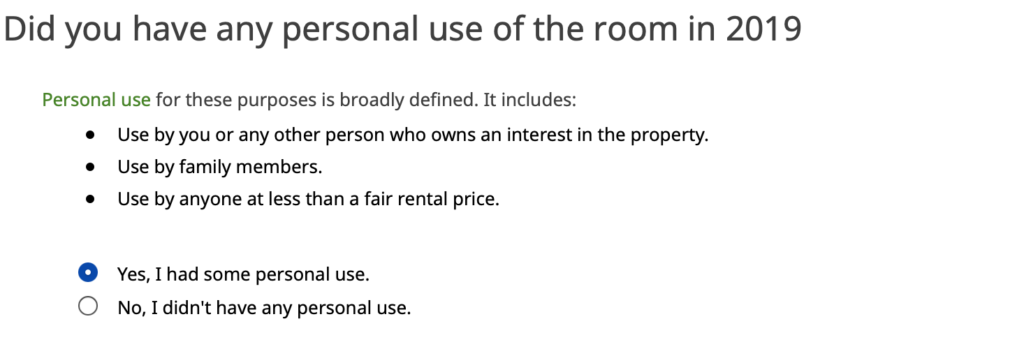

Next, you need to specify your personal use as well as days rented. If you used the property for personal use , select ‘Yes’. This is very common since the room is part of your home.

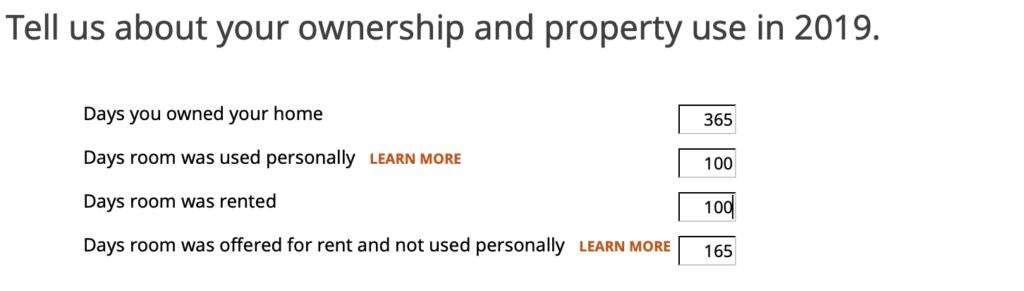

After that selection, specify how many days you rented the property during the year, personal use days and how many days the property was offered for rent. It could be the case that some months no one wants to rent the property, even if offered. Include these days along with the days when you offered but didn’t get any takers into the field ‘Days room was offered for rent and not used personally’.

In this example, we assume that you owned the property the entire year. Therefore, you want to make sure that the lower three boxes all add up to 365.

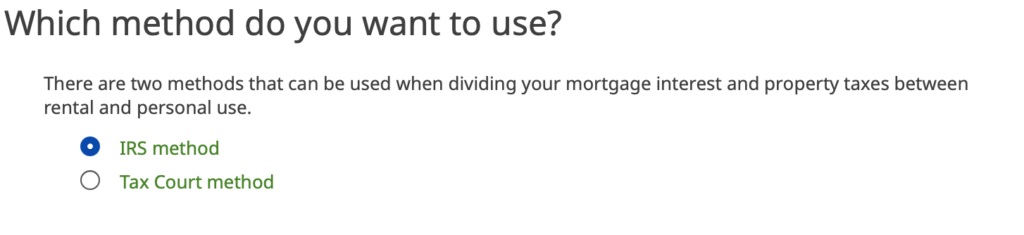

Specify Rental Apportioning Method

In the screen above specify the apportioning method that divides your property expenses. There are trade-offs between these two methods. Here is the main trade-offs:

- The IRS method maximizes deductions for the rental activity.

- The Tax Court method maximizes deductions for your itemized deductions on your personal side of the return.

Sine your rental activity and personal home are the same property, you have the opportunity to deduct your mortgage and property taxes for both situations.

If you need personal deductions to help you itemize, select the Tax Court method. If this doesn’t move the needle for you, you are better off getting the highest rental activity deductions by specifying the IRS Method. This is a simplification of all the trade-offs, but it gets to the heart of it.

Entering Your Rental Income

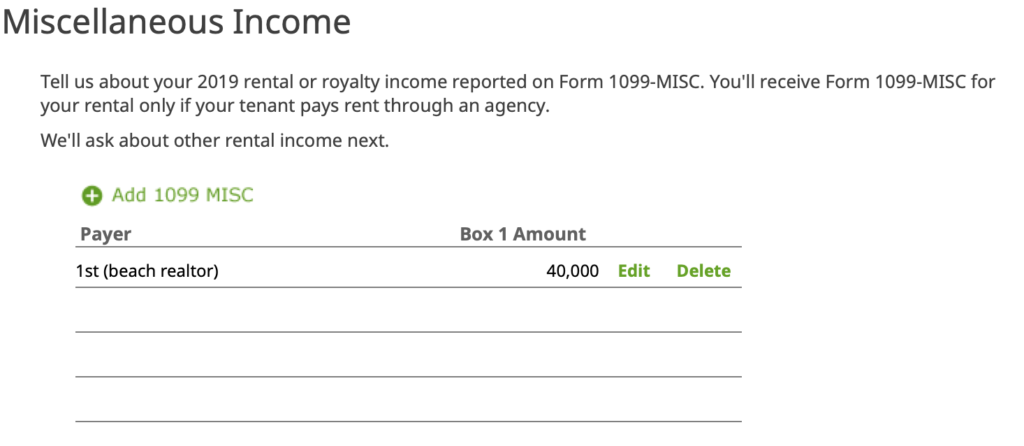

Income is entered in two distinct places. First case, a third party such as a Realtor or Management company sent you 1099-MISC. In the second case, you earn income from everywhere else that wasn’t reported using a 1099-MISC.

If an agency or other party sent a 1099-MISC, create an entry in the ‘Miscellaneous Income’ page. Create a separate entry for each one.

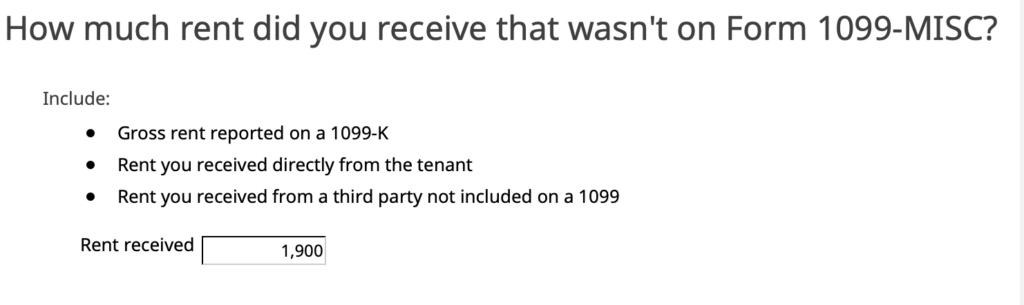

In the next page, enter all other income from every other source, including 1099-K. Sum it all up and enter it into the ‘Rent received’ box.

Depreciate The Property

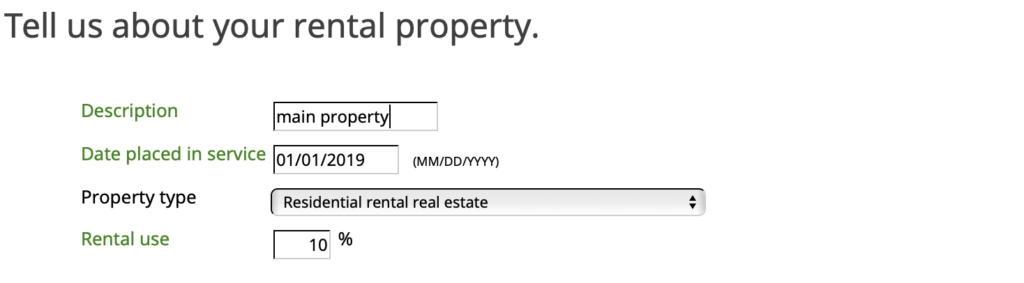

Large purchases of property that you buy along with the rental will be depreciated each year of service. For this video, we will start with the depreciation of the rental property itself.

The Rental Use percentage you need to calculate using the a combination of the room sq footage and the rental percentage. Here is the calculation with an example:

You rented out a room in your home for a total of 100 days during the year. The room is 300 square feet; your home is 1,500 square feet. Here’s how you would calculate this:

- Rental percentage = days rented / (days rented + personal use). In this example: 100 / 200 = 50%

- Area percentage = square footage of space rented / total square footage of property. In this example: 300 / 1,500 = 20%

- Rental use percentage = Rental percentage multiplied by Area percentage. In this example: 50% x 20% = 10%

At the depreciation page, enter ‘Add a Property’. In the entry screen fill out each field. Specify that the property type is ‘Residential rental real estate’.

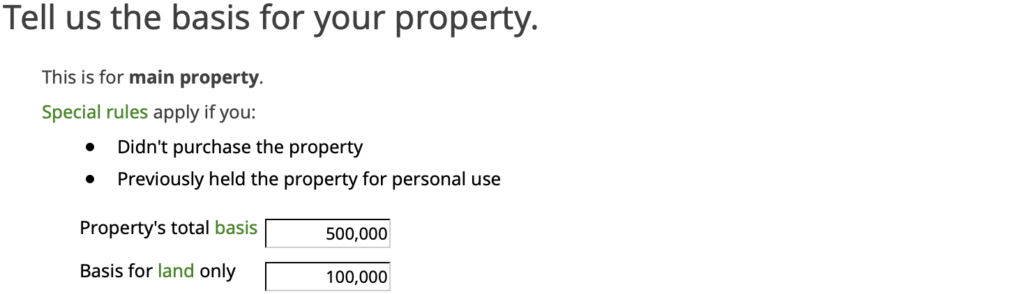

In the next screen enter the financials for the property. The actual depreciated value will be the difference between your purchase price and the land value entered.

Vehicle Expenses

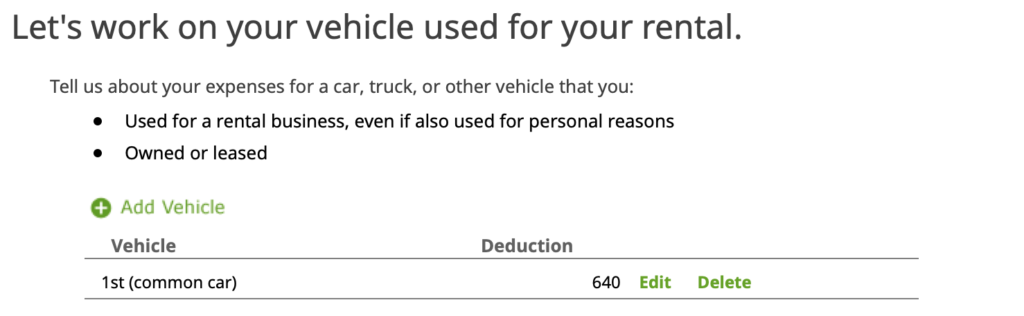

If you used a vehicle to travel to the rental property, you can claim a deduction. We will consider the simplest case, you used your personal vehicle part of the time and you are claiming the Standard Mileage deduction. Click next to enter the section vehicle use. Select ‘Add Vehicle’.

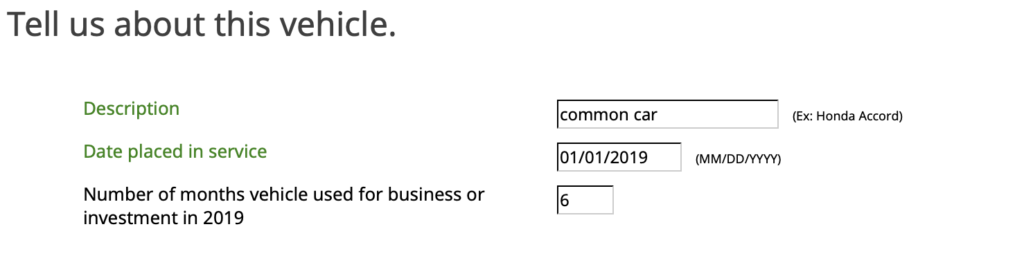

In the first screen ‘Tell us about this vehicle.’, enter the details of the vehicle.

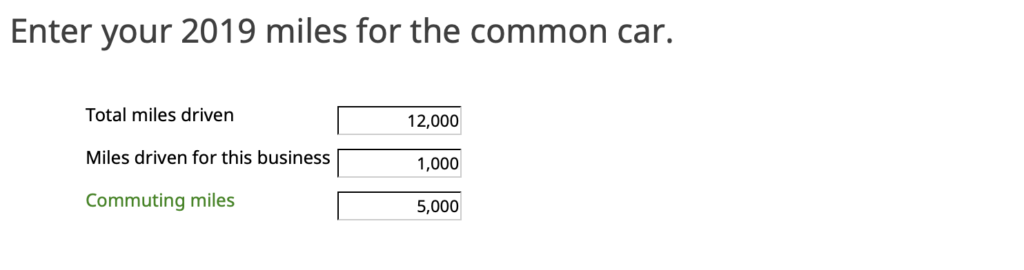

Next, enter the miles driven for the vehicle. The important entry here is ‘Miles driven for this business’ – this is the mileage you drove to the rental property and other trips on its behalf. In the next screen, select ‘Standard mileage’.

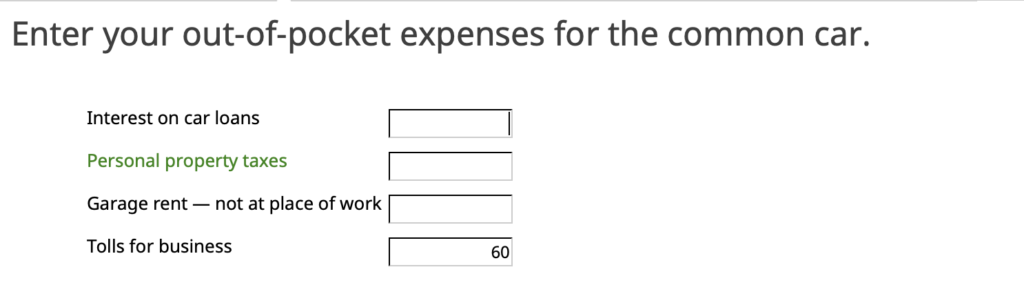

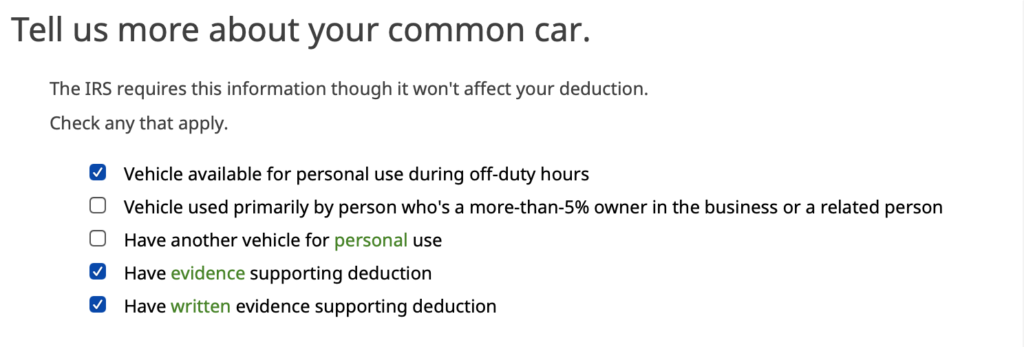

The next page enter ‘Out of pocket expenses’. The last two, ‘Garage Rent’ and ‘Tolls’ will not be captured in your Standard Mileage deduction. So, you will get a higher deduction if you can claim those expenses. The other two, ‘Interest on car loans’ and ‘Personal property taxes’ are only relevant if you are itemizing actual expenses (which we are not doing in this demo – using Standard mileage deduction).

In the last screen ‘Tell us More’, enter more information about the vehicle. We suggest checking the boxes indicated here. It is a good practice to keep evidence of your travel. Click the check-boxes indicating that you will provide evidence for your deduction.

Enter Rental Expenses

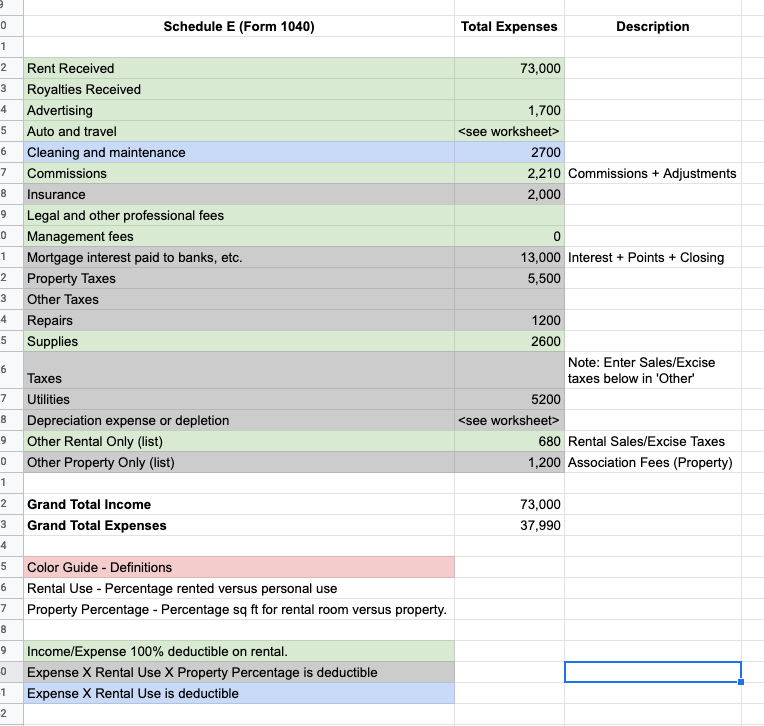

For your rental activity, you can deduct expenses. The image below summarizes how they are deductible. This is common sense: generally you can deduct expenses according to the portion of your home you are renting. Also, if an expense is 100% rental related, it can be claimed as such.

Tabulate Expenses: Rental or Property?

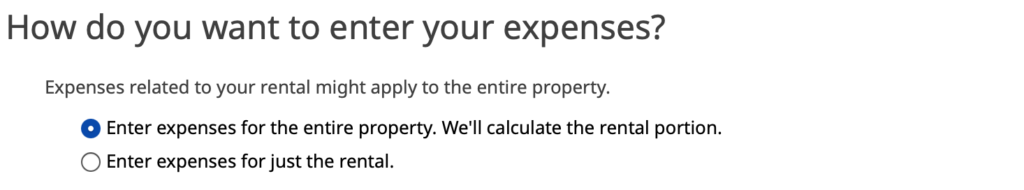

The next screen asks how you want to enter expenses. The choices are for the entire property or just for the rental. We recommend that you choose the first case, ‘entire property’. There are two reasons why you want to do this way.

- The property level expenses are very likely gathered at the property level and not the rental level. This makes gathering them easier. Also, rental only expenses are already specified at that level (e.g., commissions, advertising).

- A portion of every house expense gets attributed to the room rental, even when the room rental was not involved. This will enable you to claim a higher expense deduction amount overall.

Next, enter the rental percentage. This was calculated previously based upon square footage of the room versus the whole house/apartment/etc.

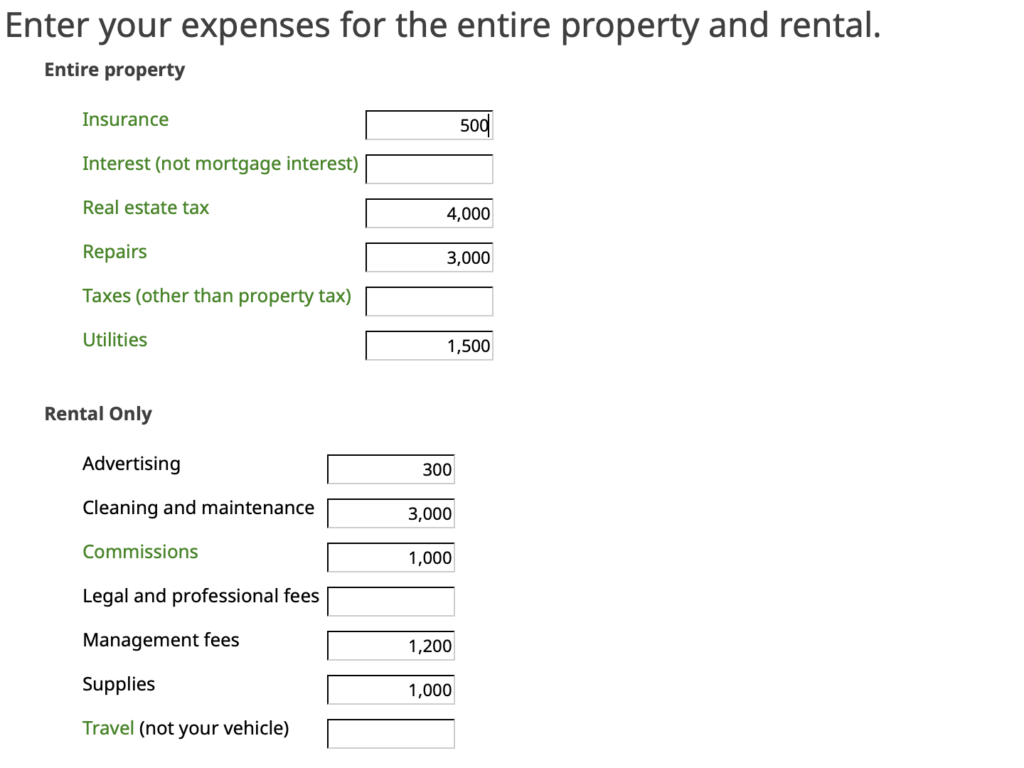

The next page provides a place to enter your rental expenses. It helps to prepare this ahead of time so that the entry of the numbers is quick and easy. There is a companion article Financial Information Needed to File A Tax Return For Your Room Rental. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation.

Rental And Property Expenses

In the first section, enter property expenses. These will be apportioned by the rental room percentage you just calculated. However, please note what we believe is an oversight on the form. The ‘Taxes (other than property tax)” box should be a rental expense and not a property expense. In this box you would specify taxes such as occupancy taxes or sales/use taxes on the rental activity. This clearly only applies to the room rental. If you have these expenses, hold on to them for now.

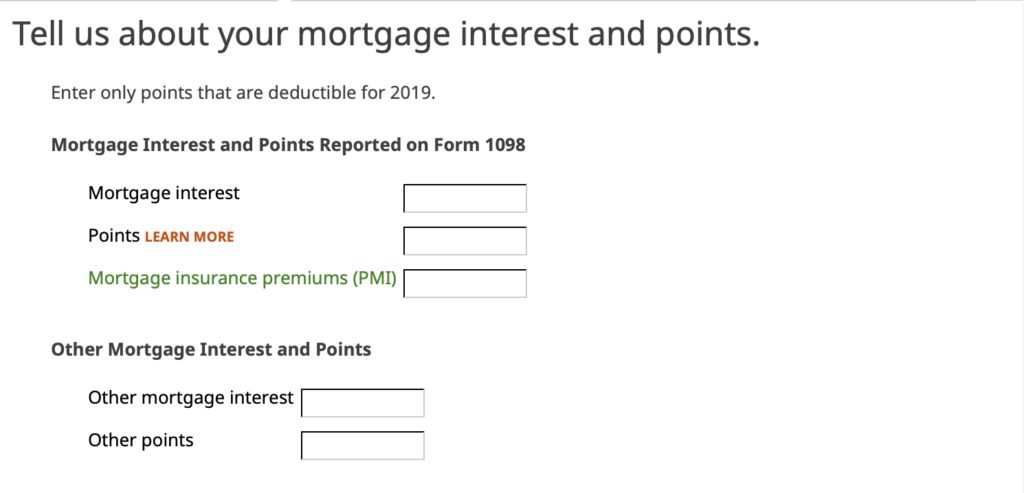

Mortgage Interest

Click to the next page to enter ‘Mortgage Interest and Points’. There are two entries here. The first set of boxes are used for the Form 1098 that your mortgage holder sent you. Be sure to enter the information as it appears in that document.

The second set of boxes is other Mortgage Interest and Points not in the Form 1098. You would enter financials in these boxes if there were other payments not specified in the Form 1098. If you prepaid these amounts during your closing enter them here. This is very common.

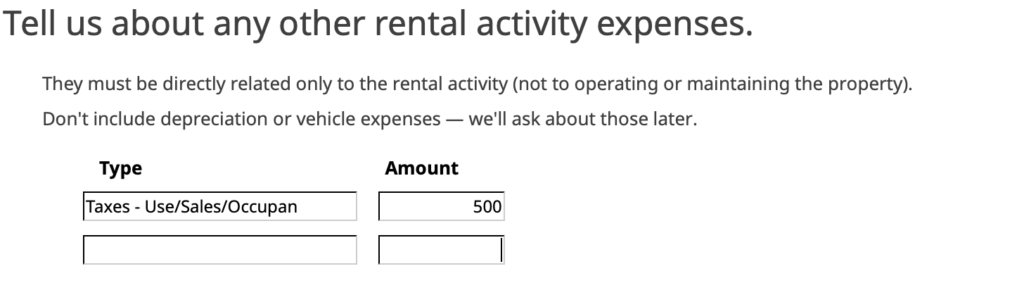

Other Rental Expenses

In the next screen, enter any other expenses that are not captured elsewhere. These must be specific to the room rental activity only. In the example above, we entered the taxes that we mentioned previously as being specific to the rental.

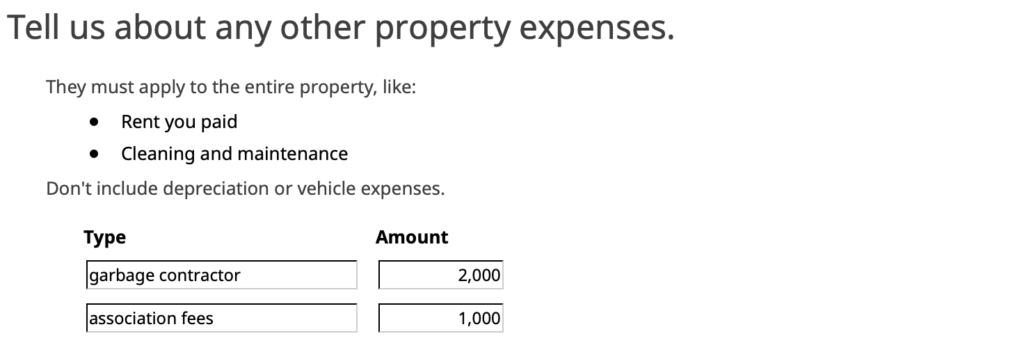

Other Property Expenses

There is also an opportunity to enter expenses for the property as well, in the following screen above. The example provided here is condo association fees and garbage contractor fees.

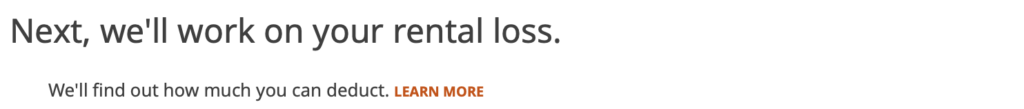

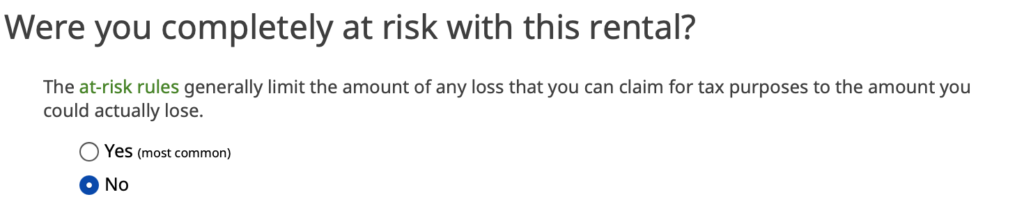

Determine Rental Loss Qualification

The last section of questions is about working on you rental loss. This is an advanced topic that requires its own explanation. We won’t cover this in the introductory video. In this walk through, we have a profit on our rental activity anyway.

The next screen asks about at-risk limitations. What this is asking is if you bought the property using your own money. This is typically yes, so click ‘Yes’.

Summary

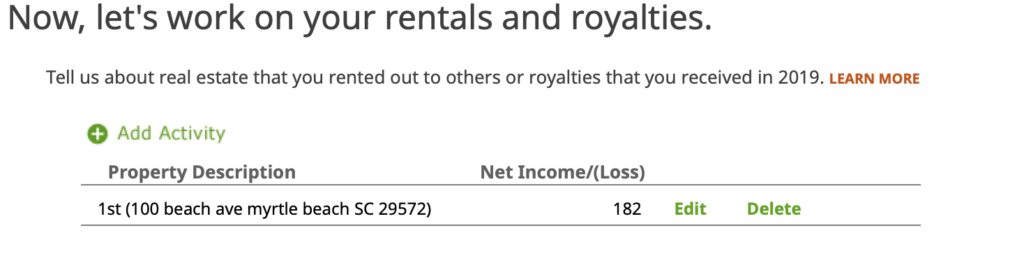

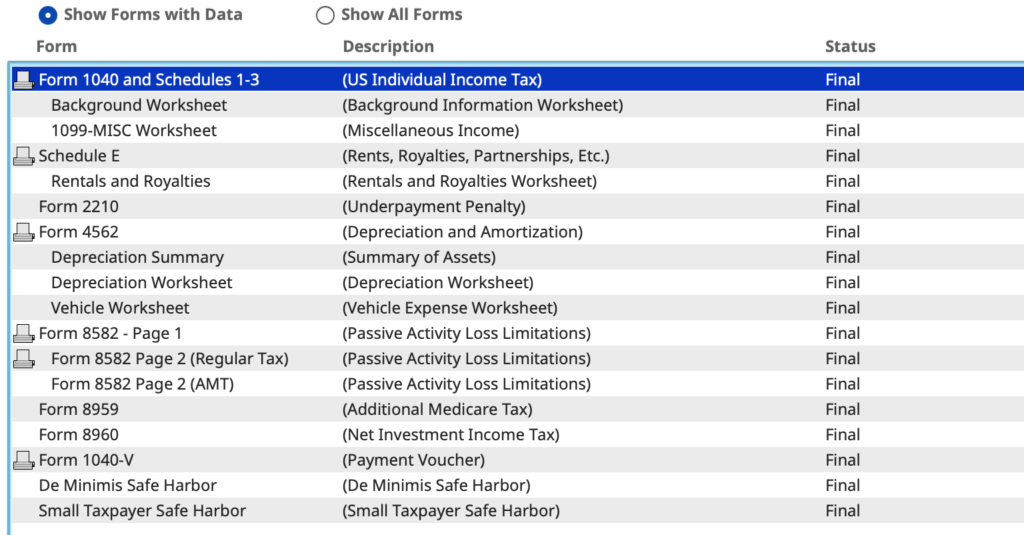

You have just completed the entry in your tax return for a vacation rental property. After complete, review the filled out form by going to ‘Forms’ at the top of the page and selecting ‘Rentals and Royalties Worksheet’.

Review the worksheet, look at each expense. Confirm that everything looks good and all your entries showed up correctly.

For this activity we had a profit as seen here.