In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using H&R Block tax software. If you prefer a video walk through, check it out below.

In preparing this article, there are few assumptions made to simplify the walk through. It could be the case that your situation has different circumstances. If you need help, please ask in the comments below or contact us directly in the About Us Page.

| Assumptions Made For This Vacation Property * Property is owned 100% throughout the filing year. * Property is rented 100%, no personal use. * The owner is not running the rental as a business. * The owner doesn’t employ any help. |

There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation of expenses and income.

This article is a good start to prepare your tax return for your vacation rental property.

Table of Contents

Starting the Software

H&R Block has both PC/Mac software installations as well as cloud versions of the same software. Any of these versions will do. In this demo, we are using the Deluxe version. The Deluxe version, while not specifically targeted to real estate investors, is perfectly adequate for the job.

Where to Start…

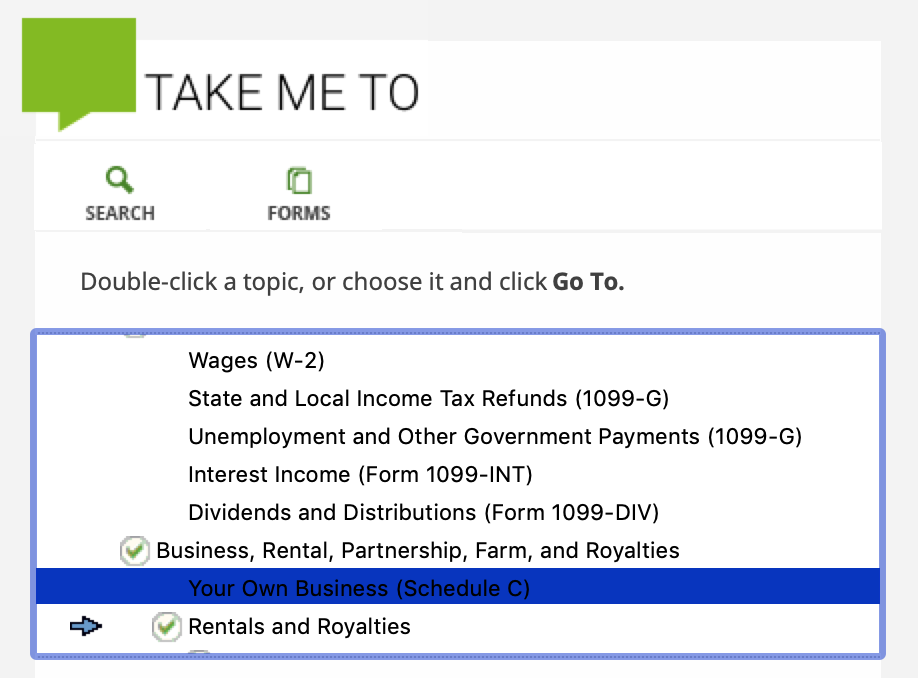

You will want to navigate to the ‘Rentals and Royalties’ section of the software. At the top, click on ‘Take Me To’ and select ‘Rental and Royalties’, hit the ‘Go To’ Button.

Once on the ‘Rental and Royalties’ page, click ‘Add Activity’. After selecting ‘Rentals’ in the first page, you will get a description page for the property.

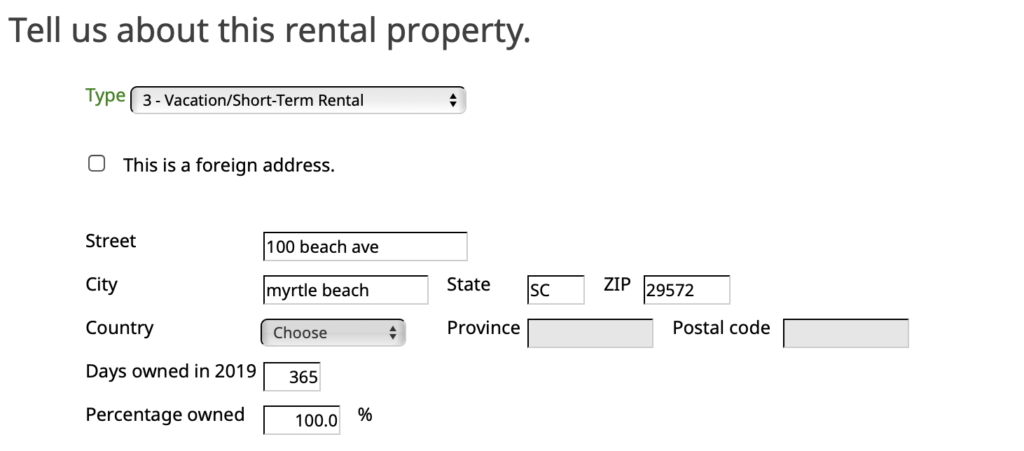

Enter the following information:

- Select ‘3-Vacation/Short Term Rental’ for property type.

- Enter the property address.

- For this demo, we assume that you owned the property the entire year and you own it 100%. Enter 365 for ‘Days Owned’ and 100% for ‘Percentage Owned’.

Below the description information are questions about special circumstances. We won’t cover these in this video, so leave all of those options unchecked.

Defining Property Use

Next, you need to specify your personal use as well as days rented. If you did not use the property for personal use (which is what we assume in this video), select ‘No’.

After that selection, specify how may days you rented the property during the year versus how days the property was offered for rent. It could be the case that some months no one wants to rent the property, even if offered. Include these days along with the days when you offered but didn’t get any takers into the field ‘Offered for rent but not rented’.

Entering Your Rental Income

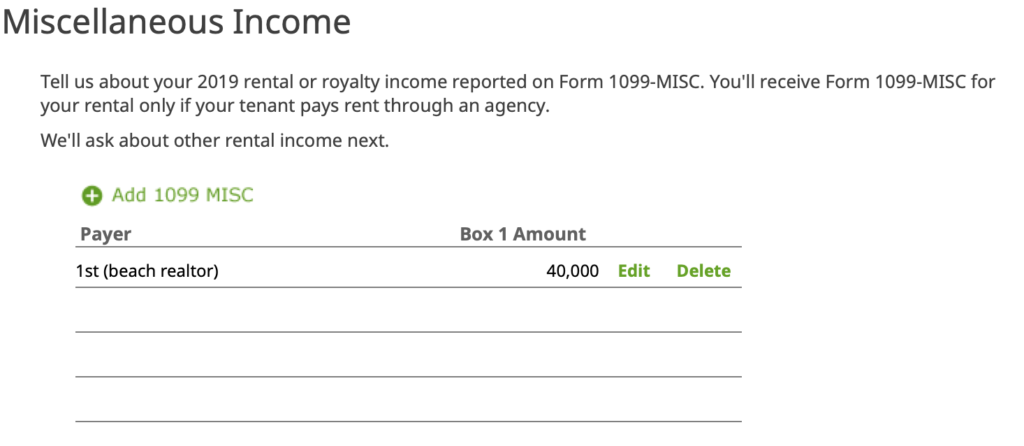

Income is entered in two distinct places. First case, a third party such as a Realtor or Management company sent you 1099-MISC. In the second case, you earn income from everywhere else that wasn’t reported using a 1099-MISC.

If an agency or other party sent a 1099-MISC, create an entry in the ‘Miscellaneous Income’ page. Create a separate entry for each one.

In the next page, enter all other income from every other source. Sum it all up and enter it into the ‘All other payments by or on behalf of the tenant’ box.

Depreciate The Property

Large purchases of property that you buy along with the rental will be depreciated each year of service. For this video, we will start with the depreciation of the rental property itself.

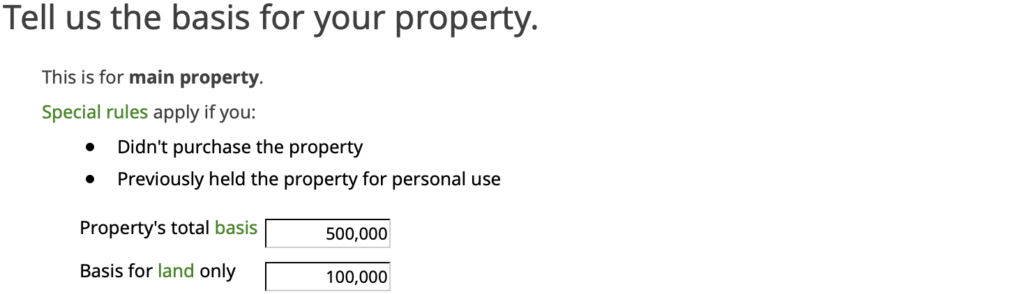

At the depreciation page, enter ‘Add a Property’. In the entry screen fill out each field. Specify that the property type is ‘Residential rental real estate’.

In the next screen enter the financials for the property. The actual depreciated value will be the difference between your purchase price and the land value entered.

Vehicle Expenses

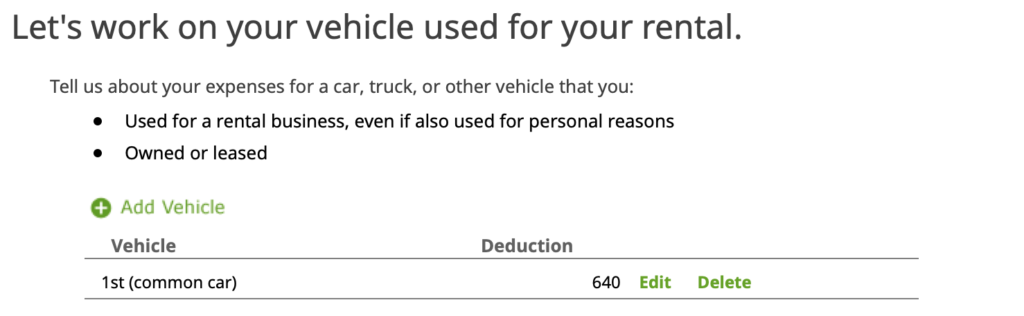

If you used a vehicle to travel to the rental property, you can claim a deduction. We will consider the simplest case, you used your personal vehicle part of the time and you are claiming the Standard Mileage deduction. Click next to enter the section vehicle use. Select ‘Add Vehicle’.

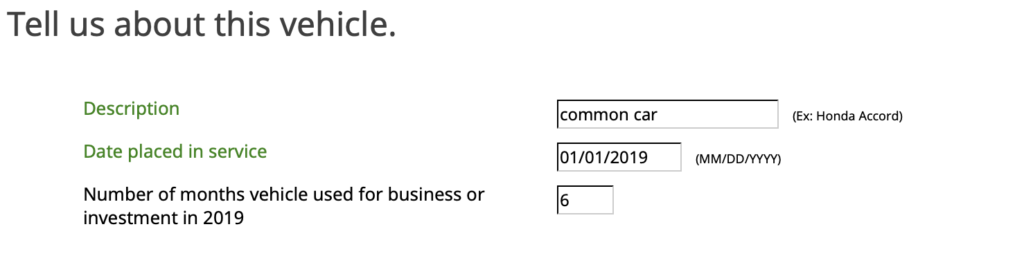

In the first screen ‘Tell us about this vehicle.’, enter the details of the vehicle.

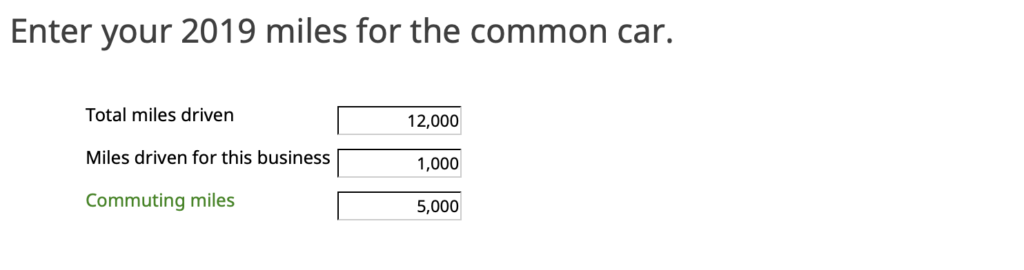

Next, enter the miles driven for the vehicle. The important entry here is ‘Miles driven for this business’ – this is the mileage you drove to the rental property and other trips on its behalf. In the next screen, select ‘Standard mileage’.

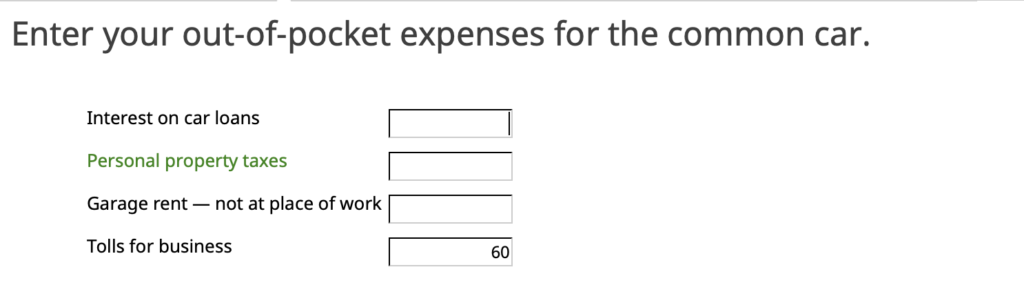

The next page enter ‘Out of pocket expenses’. The last two, ‘Garage Rent’ and ‘Tolls’ will not be captured in your Standard Mileage deduction. So, you will get a higher deduction if you can claim those expenses. The other two, ‘Interest on car loans’ and ‘Personal property taxes’ are only relevant if you are itemizing actual expenses (which we are not doing in this demo – using Standard mileage deduction).

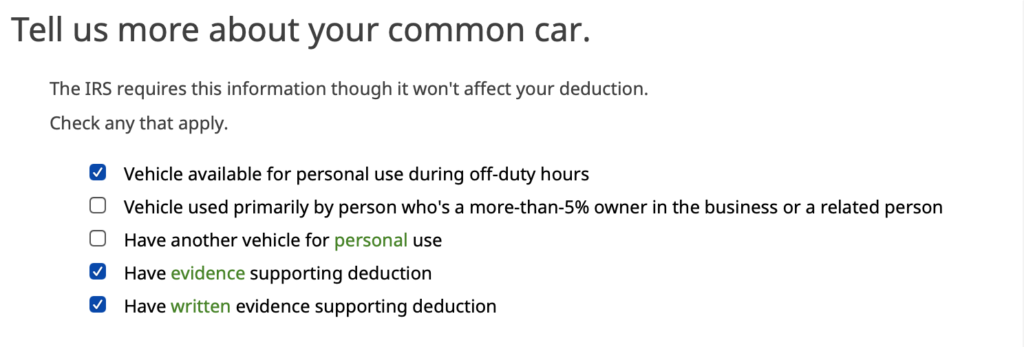

In the last screen ‘Tell us More’, enter more information about the vehicle. We suggest checking the boxes indicated here. It is a good practice to keep evidence of your travel. Click the check-boxes indicating that you will provide evidence for your deduction.

Enter Rental Expenses

The next page provides a place to enter your rental expenses. It helps to prepare this ahead of time so that the entry of the numbers is quick and easy. There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation.

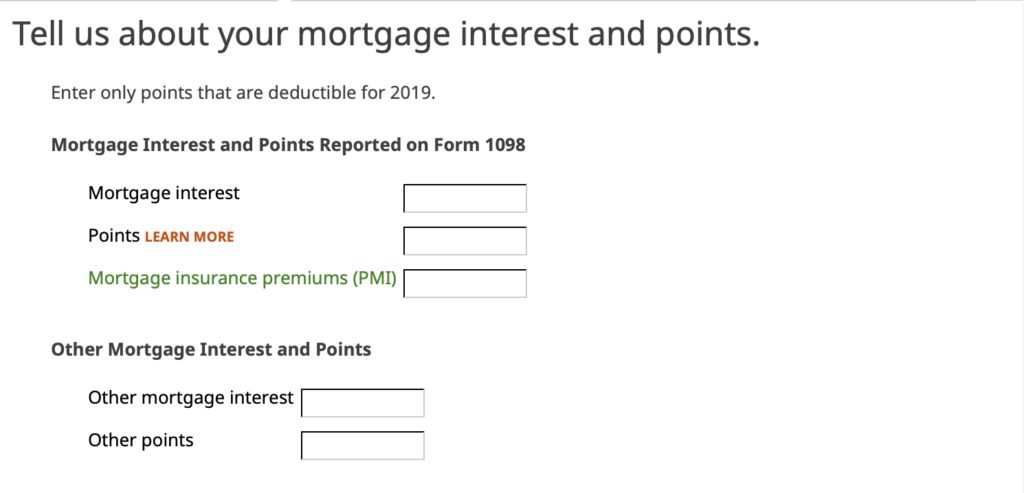

Click to the next page to enter ‘Mortgage Interest and Points’. There are two entries here. The first set of boxes are used for the Form 1098 that your mortgage holder sent you. Be sure to enter the information as it appears in that document.

The second set of boxes is other Mortgage Interest and Points not in the Form 1098. You would enter financials in these boxes if there were other payments not specified in the Form 1098. If you prepaid these amounts during your closing enter them here. This is very common.

In the last screen, enter any other expenses that are not captured elsewhere. The example provided here is Condo Association Fees.

Determine Rental Loss Qualification

The last section of questions is about determining your participation status, which will then be used to determine how to handle losses. It is common to have an accounting loss on your property (even if you are cash flow positive) primarily due to the non-cash depreciation charges you entered earlier.

For this demo we are assuming the most common case: you manage your rental property but you are not a business.

In the first page, it asks ‘Was your average lease seven days or less’. Based upon your answer the next screen will ask another question:

Yes: “Did you materially participate in this rental activity?” ==> Answer No.

No: “Do you qualify as a real estate professional?” ==> Answer No.

In the next screen, enter ‘Yes’ for the question: ‘Did you actively participate in a rental?’. This would be true if you managed the property yourself and were not a passive investor in a property that someone else manages. This is the main assumption for your tax filing. If this is not true, you probably cannot use Schedule E for your property.

For the following question be sure the click on ‘Have passive losses from this rental activity that you’re carrying forward’ if you in fact had losses from the previous year.

Summary

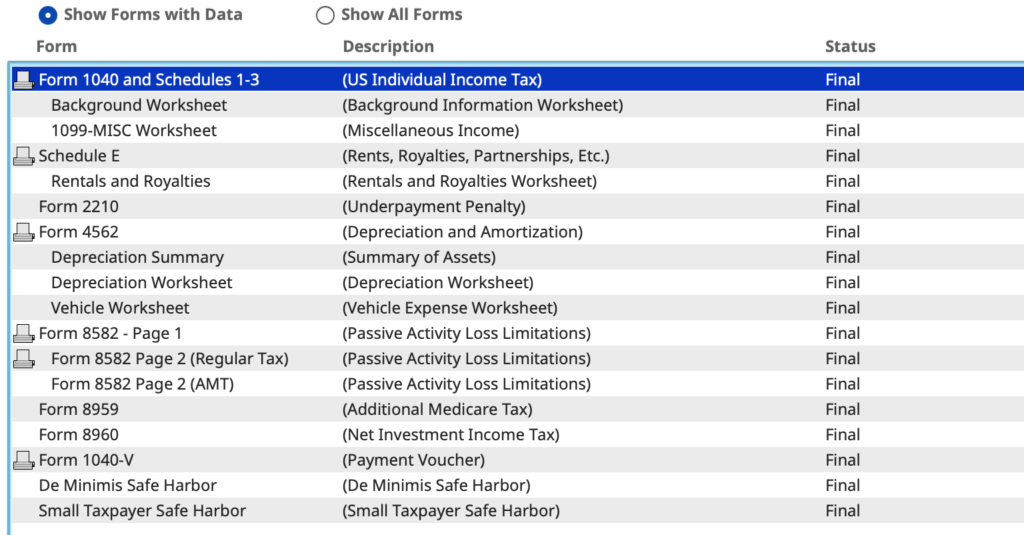

You have just completed the entry in your tax return for a vacation rental property. After complete, review the filled out form by going to ‘Forms’ at the top of the page and selecting ‘Rentals and Royalties Worksheet’.