In this article, we cover all you need to know about depreciation. Please use the table of contents below as it may be useful to jump to the specific situation you need to consider for your property.

Table of Contents

What is Depreciation?

First, let us talk about what depreciation is. Depreciation is a non-cash charge that you deduct as an annual expense on your physical property. From an accounting point of view, you are applying a charge against your earnings that estimates how much your property has declined in value.

You might be thinking that real estate doesn’t decline in value it only increases, right? Yes, it’s true that good real estate generally increases in value if only by inflation.

However, it is also true that the physical property you own (the house, the furniture, the pool, etc.) has a shelf life and periodically needs to be replaced. If you are investing in property, these costs needs to be accounted for in your planning over the long term.

How Does It Work For Me?

When you depreciate property each year, these expenses reduce your profits or increases your losses on your property. So, each year you are paying less taxes than you otherwise would without depreciation.

When the depreciation is recaptured by selling the property, the depreciation expenses are subtracted from your property basis. This cycle has the effect of reducing your taxes because some of your income gains are converted to long term capital gains.

Over the long term, depreciation has the effect of converting the regular income gains on your property into long term capital gains. Long term capital gains are taxed lower so your profit increases.

What Can Be Depreciated?

Depreciation is applied to physical property and not land. The IRS defines the following categories that apply in most situations.

Each property type has a different depreciation schedule. Residential real estate is depreciation over 28 years using straight line decline. Residential furniture is depreciated over 6 years using an accelerated declining balance.

When You Should Not Depreciate Property.

The depreciation schedules are designed to reflect the actual shelf life of the property. However, it is possible to expense your property 100% in the year you incur the expense. This would be possible under a few special situations. There are cases where the IRS allows a full expense deduction in only one year.

Section 179

The Section 179 deduction, named after the corresponding section of the tax code, lets you immediately deduct property placed in service in the current year rather than depreciating that over time.

This applies to everything, except the property itself and major additions/renovations to it. Examples of acceptable property include furniture and maintenance equipment.

Note that the Section 179 deduction is still considered depreciation and will be accounted as such when recapturing occurs. Recapturing would occur when you sell the property.

Supplies Expense Deduction

The IRS allows you to claim property you buy for $2,500 or less per item as an expense, instead of depreciating over time. This is called the de minimis safe harbor election.

Unlike the Section 179 deduction, this deduction does not need to be tracked in the depreciation schedules. It is considered a common property expense, such as supplies.

There is a form called ‘De Minimis Safe Harbor Election’ that you need to file with the IRS for the deduction at the federal level. Common tax software will do this for you easily.

Repairs Expense Deduction

The IRS allows you to claim small property improvements as an expense, instead of depreciating over time. However, all repairs, maintenance, and improvements to the building must total less than both of these:

- 2% of the original cost of the rental

- $10,000

This is called the small taxpayer safe harbor election. You’re eligible if your building’s un-adjusted basis is $1 million or less.

Unlike the Section 179 deduction, this deduction does not need to be tracked in the depreciation schedules. It is considered a common property expense, such as supplies.

There is a form called ‘Small Taxpayer Safe Harbor’ that you need to file with the IRS for the deduction at the federal level. Common tax software will do this for you easily. For more detailed information about this topic, see: How to Deduct Improvement Costs Immediately On Your Taxes Instead of Depreciating.

How To Depreciate Your House

This is short walk through on how to depreciate your rental house, condo, or apartment. The appropriate IRS forms provide the necessary calculations, but for this exercise we rely on tax software to do the work for us. First enter the details about the property as below.

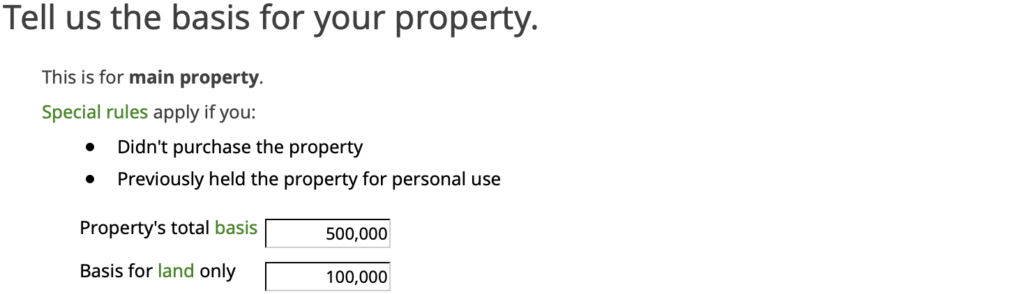

The key entry here is the ‘Property Type’. You want to select ‘Residential rental real estate’. This selection will configure the schedule for your property using straight line balance, 27.5 year depreciation. Next, enter the key financials.

The first number to enter here, ‘Property’s total basis’ is what you paid for the property. Be sure to include all your closing costs (such as surveys, attorney fees, and title insurance). Don’t include closing costs that are property expenses (such as utilities and association fees).

The next number is ‘Basis for land only’. A good rule of thumb here is that the land is about 20% of the property value. This may vary in our local area. Please consult a CPA if you need guidance.

When you complete the form, the result is what you see above. The first year deduction for the 500K property is 13,939.

How To Depreciate Your Furniture

This is short walk through on how to depreciate your furniture. The appropriate IRS forms provide the necessary calculations, but for this exercise we rely on tax software to do the work for us. First enter the details about the property as below.

The key entry here is the ‘Property Type’. You want to select ‘Residential rental applicances’. This selection will configure the schedule for your property using 200% accelerated declining balance, 6 year depreciation. Next, enter the key financials.

Enter the property cost in the field ‘Basis’. After calculating, this is the result that you get.

The first year deduction for the 45K property is 9,000.

More Information

For more information on Depreciation, consult the following IRS publications.

Form 4562 - Depreciation and Amortization Instructions for Form 4562 - Instructions for Form 4562