In this article, we cover all you need to know about depreciation. Please use the table of contents below as it may be useful to jump to the specific situation you need to consider for…

In this article, we cover all you need to know about depreciation. Please use the table of contents below as it may be useful to jump to the specific situation you need to consider for…

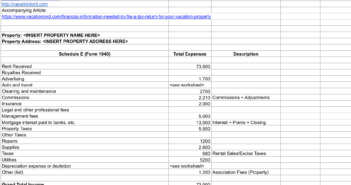

In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using H&R Block tax software. Do you run your rentals as a business and it is your full…

In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using H&R Block tax software. If you prefer a video walk through, check it out below. https://youtu.be/oTJKNsZ5e4Q In…

Ok, You just bought a vacation property that you want to rent. Great! If you are renting the property as a business you will need to file tax returns. File the property and its financials…

Rental Tax Collection and Remittance in the District of Columbia The city sales tax varies according to what service or goods are sold. Washington, D.C. charges the city Sales Tax for short term rentals. There…

Rental Tax Collection and Remittance in the State of Connecticut Connecticut charges an Occupancy Tax for short term rentals. There are no county or city taxes on short term rentals. The Occupancy tax rate is…

Sales/Lodging Tax Collection and Remittance in the State of Colorado Colorado charges the normal Sales Tax rates for short term rentals. The state, counties and local cities may all charge a sales tax. In addition…

Occupancy Tax Collection and Remittance in the State of California California calls its tax on entities that provide rentals in the state a Transient Occupancy Tax (TOT). The TOT is only assessed at the county/city…

Sales and Use Tax Collection and Remittance in the State of Arkansas Arkansas calls its tax on entities that do business in the state a Sales and Use Tax (S&U Tax). The S&U Tax applies…

Transient Lodging Tax Collection and Remittance in the State of Arizona Arizona calls its general tax on entities that do business in the state a Transaction Privilege Tax’ (TPT). Among the many categories of TPT…