In this era of low mortgage interest rates, it is possible you have a property mortgage that has a higher interest rate than today’s rates. The question you might ask is, can I save money by refinancing my property mortgage? In this article we discuss the pros and cons. Once you have the facts, it will be up to you to determine if it makes sense for your personal situation.

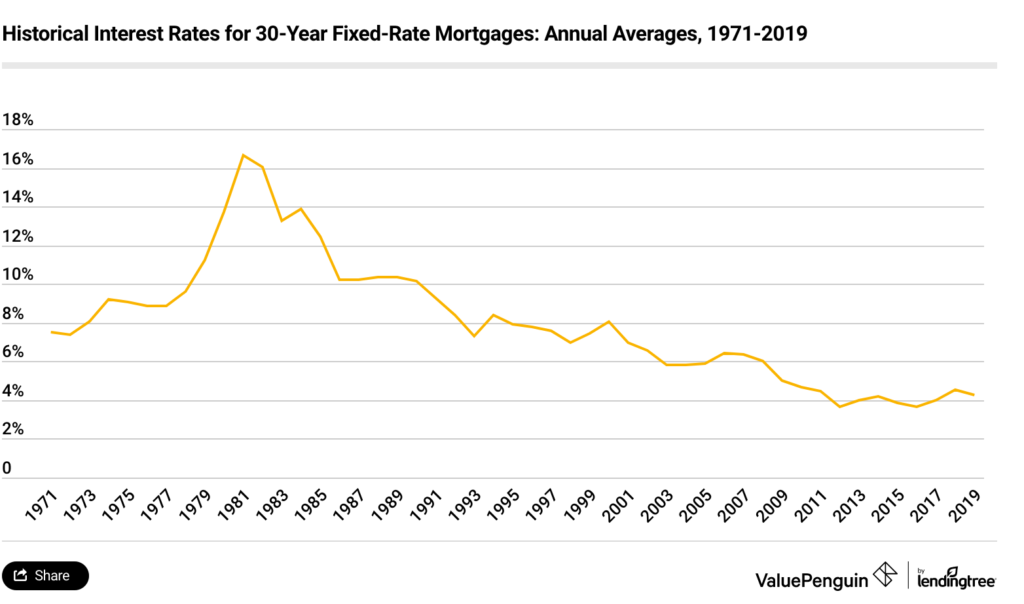

Historical Mortgage Rates

Over the past 30 years, mortgage rates have been following many other interest rate trends. Whether you consider government bond rates, corporate bonds rate, or mortgage rates, the trend has been lower. The chart from lendingtree.com below shows this trend.

If you have a mortgage from the past it is very likely that the interest rate on that mortgage is higher than ones offered today. The one exception to this is if you have an adjustable rate mortgage. Adjustable rate mortgages do what you think: either at 1,5,7 year intervals the mortgage rate is adjusted based upon prevailing rates.

We won’t consider adjustable rate mortgages in this article. If you have such a mortgage, you have won the mortgage contest. The reason is that you can take advantage of the lower mortgage rates without any extra expenses or fuss. Today, we will discuss the case where you have a fixed rate mortgage.

A Short Mortgage Primer

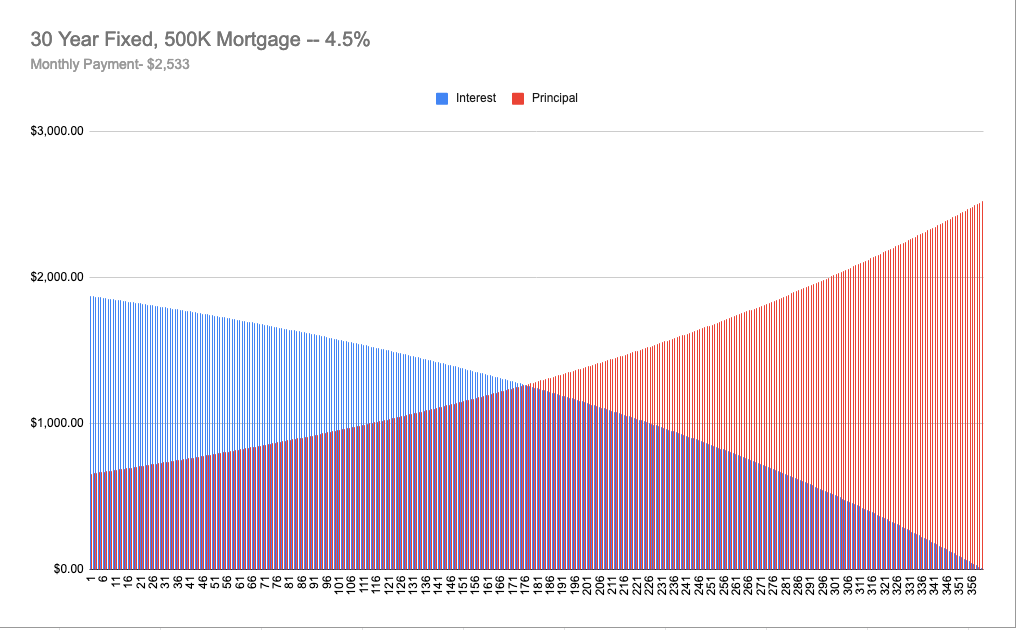

Before we consider the impact of a re-finance, let’s review how mortgage math works. Consider a 30 year fixed rate, $500K mortgage that was financed at a rate of 4.5%. This rate would be typical of a mortgage that was opened in the last 5 years. The mortgage would have a fixed payment of $2,533/month over the 30 years.

In the first year, you pay 4.5% interest on the initial amount of $500K in multiple payments. Added to that interest payments is a principal amount that drops the loan amount over time. Because your principal payments start at the very beginning, the amount of interest declines over each month. Even in that first year, you will pay slightly less than 4.5% total interest due to the principal payments.

The mortgage is calculated using standard amortization schedules. The mortgage is shown over time in the following chart.

Anatomy Of A Mortgage…

There are two key details to understand here:

- The interest payments are front loaded – meaning most of your interest payments occur in the early years.

- The principal payments are back loaded – meaning that most of your principal payments occur the back years.

This is important to understand when you refinance. The reason is that a refinance that starts the loan over will increase that interest ratio. Even though the new loan is a lower rate, that front loading of interest can detract from the savings. The following table describes how this works in a more direct way.

| Year | Total Interest | Total Principal | Time % | Interest % | Principal % |

| 1 | $22K | $8K | 3% | 5% | 2% |

| 5 | $108K | $44K | 17% | 26% | 9% |

| 10 | $204K | $100K | 33% | 50% | 20% |

The way to read this chart is as follows:

- In the first year, the mortgage is 3% done, but you have already paid 5% of the total interest.

- By year 5, the mortgage is 17% done, but you have paid 26% of the total interest.

- By year 10, the mortgage is 33% done, but you have paid 50% of the total interest.

How this effects your new mortgage is that is moves the break even further out. Or, is affects the minimum rate differential needed to make the refinance pay off.

Consider a Refinance After Year 5…

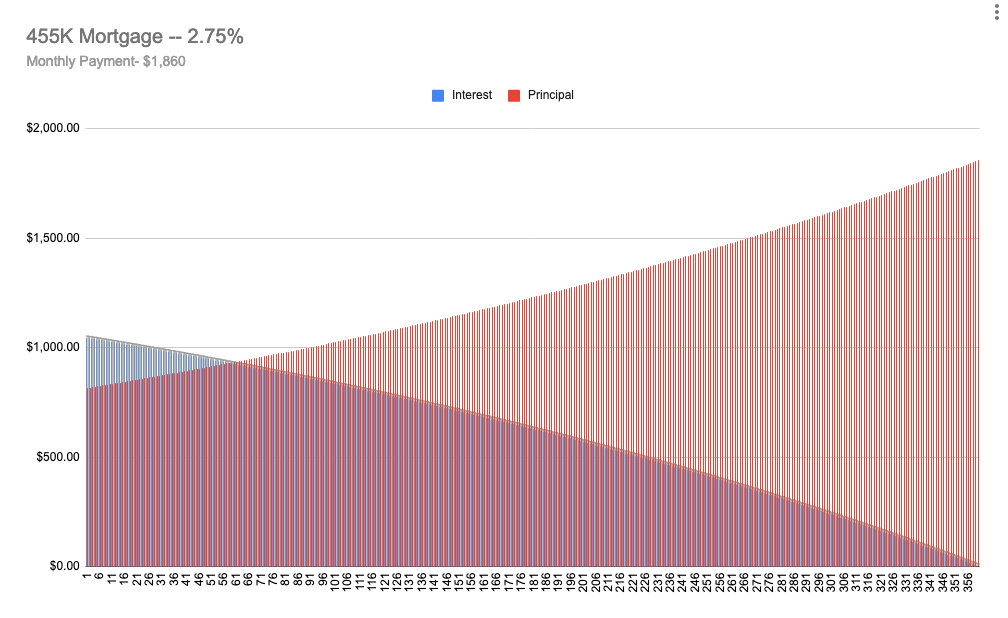

Let’s take that $500K mortgage above. Let’s say you want to refinance after year 5. For this example, we will use a new 30 year fixed rate mortgage at a 2.75% rate. What happens? The chart below shows that new mortgage chart.

Because you have paid the existing mortgage for 5 years, the refinance balance has moved down to $455K. Also, the mortgage payment has moved from $2533 per month to $1860 per month.

Anyway you want to look at it, this refinance works. The mortgage payment goes down. The total mortgage interest paid (including the 5 years already paid) will decrease. See Mortgage Options A and B in the below table for the summarized comparison.

| Mortgage Options | |||||||

|---|---|---|---|---|---|---|---|

| Type | Rate | Amount | Payment | Mortgage Interest | Add Interest Already Paid | Total Interest | |

| A | 30 Year Fixed | 4.5% | $500K | $2,533 | $412K | $412K | |

| B | 30 Year Fixed | 2.75% | $455K | $1,860 | $214K | $107K | $321K |

| C | 25 Year Fixed | 2.75% | $455K | $2,102 | $175K | $107K | $282K |

| D | 20 Year Fixed | 2.75% | $455K | $2,471 | $137K | $107K | $244K |

| E | 30 year Fixed | 3.75% | $455K | $2,110 | $304K | $107K | $411K |

Other Refinance Options…

The refinance referred to above reflects current rates to credit worthy buyers. What if we change the circumstances of the refinance loan? Under different conditions we can learn how minor changes to the loan can affect the overall cost.

Option D – Reduce Term

As we talked previously, restarting a 30 year loan can cause the new loan to front load more interest. What if we could reduce the term? If you reduce the term, you can reduce or eliminate this front loading. This is the case for Option D, using a standard 20 year loan. But first consider a loan that does not exist: a 25 year loan. A 25 year loan would work similarly if you could simply keep your current loan and lower the interest rate.

The total interest paid over the loan life would decrease by $40K. However, the payment amount will decrease by only $400, instead of $600 versus Option B. This non-existent mortgage quantifies the interest front loading that occurs.

If you instead opt for Option D – 20 year term, all the front loading is gone and you reduce total interest paid even more. The interest reduction is another $80K over the life of the loan. However, the mortgage payment is lower, but just by less than $100.

Option E – Reduce Payment

What is the maximum interest rate that you could obtain such that you would reduce your payment and not pay anymore interest over the long term? This is covered in Option E. The mortgage payment would still go lower because you have extended the term and lowered the rate.

Under this option, the maximum rate required to see interest paid savings is 3.75%.

- If your refinance rate is higher than 3.75%, your monthly payment will decrease. You will pay more interest over the loan term.

- If your refinance rate is lower than 3.75%, your monthly payment will decrease. You will pay less interest over the loan term.

The monthly payment is reduced from $2,533 to $2,110. This can help you increase your monthly cash flow.

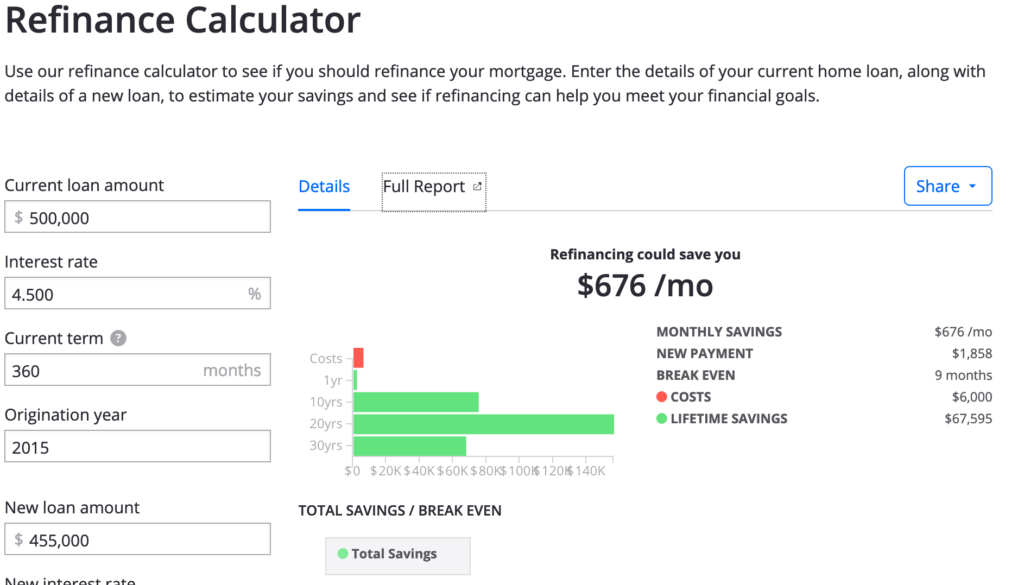

Refinance Calculator

Use the following calculator to determine the details of your own refinance situation. This calculator is from Zillow.com.

Zillow refinance calculator link.

Conclusion – What Do You Want?

When you refinance a mortgage, you need to decide what you want to do. Do you want a reduced payment? Do you want to pay the loan off sooner? Do you want to reduce total interest paid?

The easiest goal to achieve is reduce your monthly payment. This is because a lower interest combined with a fresh 30 year term will lower your payment. There may be a cost however: higher overall interest paid.

If your goal is to reduce the total interest paid over the life of the loan, look to a very low rate or reducing the loan term.

Lastly, paying off the mortgage sooner can be achieved by reducing the term. The trade off here is that the mortgage payments may be higher.

It’s all up to you.