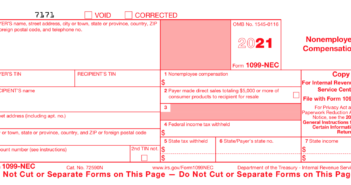

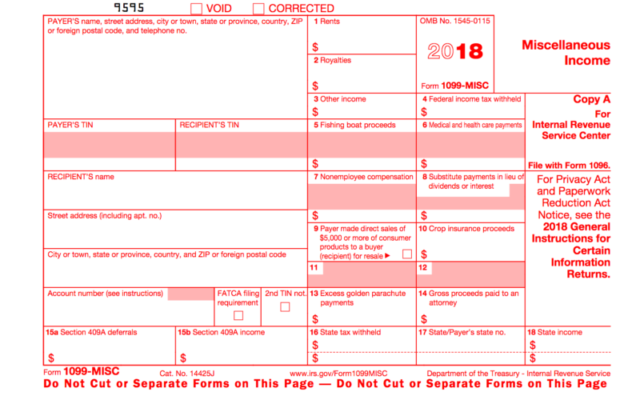

In this article we discuss all you need to know about filing tax forms on behalf of contractors you pay that provide services to your vacation rental business. There is a table of contents below…

In this article we discuss all you need to know about filing tax forms on behalf of contractors you pay that provide services to your vacation rental business. There is a table of contents below…

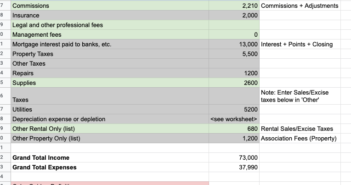

In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using TurboTax software. Do you have an LLC or company registration created for your rental property activity? If…

In this article we discuss how to file your U.S. Federal Income taxes for your property using Intuit TurboTax software. Specifically, a room that you rent in your own home. In preparing this article, there…

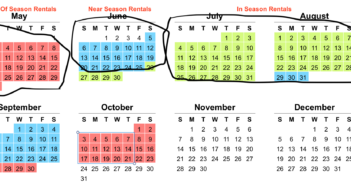

Rental Tax Collection and Remittance in the State of Florida Florida is a state with a vibrant, large tourism economy. Unlike most other states, Florida heavily relies on tourist dollars to pay its bills. Before…

In this article we are going to discuss all the configuration options you should setup before you put your property on Airbnb. This will help you to manage your property better and avoid common booking…

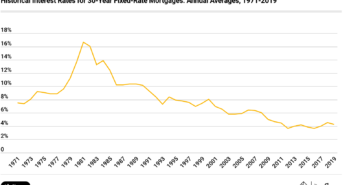

In this era of low mortgage interest rates, it is possible you have a property mortgage that has a higher interest rate than today’s rates. The question you might ask is, can I save money…

In this article we discuss how to file your U.S. Federal Income taxes for your property using H&R Block tax software. Specifically, a room that you rent in your own home. In preparing this article,…

Ok, You just decided to rent a room in your personal property. Great! If you are renting the property as a side income you will need to file tax returns. File the property and its…

When you file your tax return for your vacation rental activity, you might have questions about how to file, what your filing status is and what forms to use. The IRS provides many different paths…

In this article we discuss all you need to know about filing tax forms on behalf of contractors you pay that provide services to your vacation rental business. There is a table of contents below…